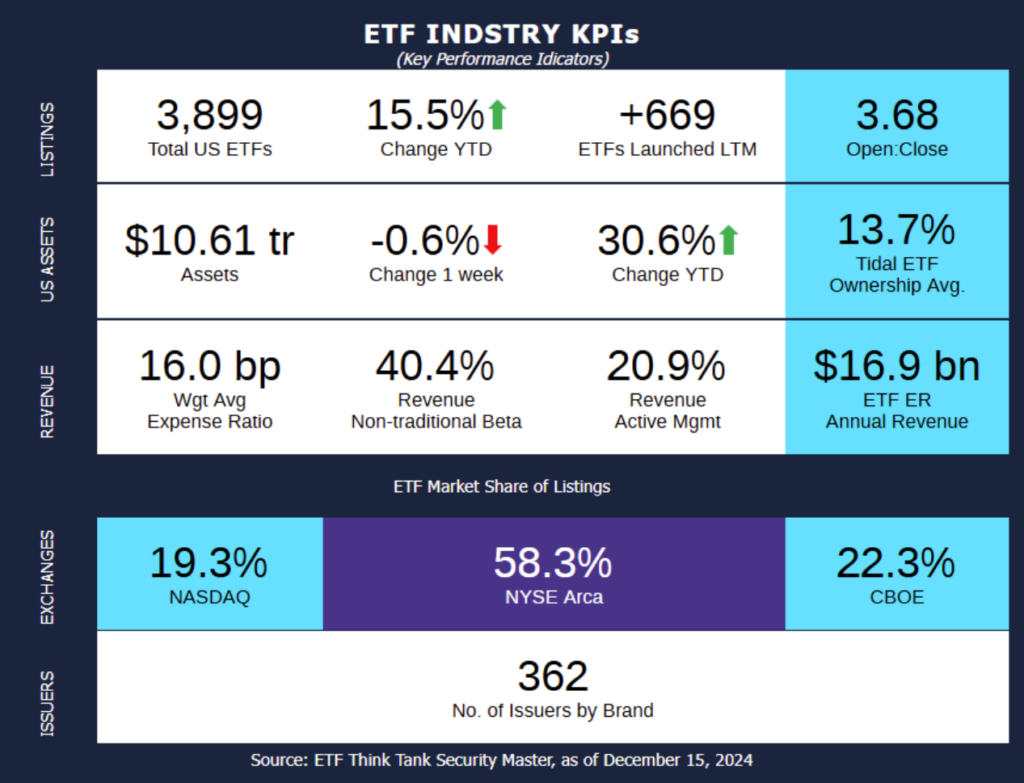

Week of December 9, 2024 KPI Summary

The ETF industry had an active week, highlighted by 24 Launches, 2 Mutual fund conversions, 2 ETF Ticker Changes, and 9 Closures.

- The current 1 Year ETF Open-to-Close ratio sits at 3.68.

- The total number of US ETFs jumped to 3,899.

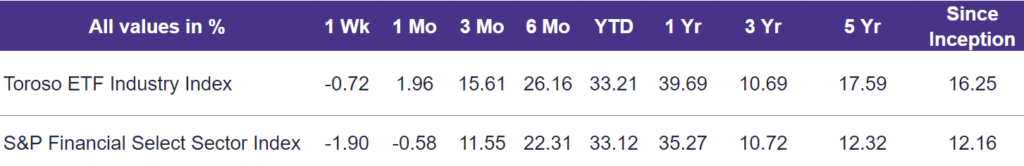

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, fell 0.72% last week, outperforming the S&P Financial Select Sector Index, which fell by 1.90%.

ETF activity from the past week includes:

Morgan Stanley Completes Two Mutual Fund Conversions: The $2.6 billion Morgan Stanley Pathway Large Cap Equity Fund and the $470 million Morgan Stanley Pathway Small-Mid Cap Equity Fund have been transformed into ETFs. Morgan Stanley sited the traditional ETF structure, including trading flexibility, greater enhanced tax efficiency, were some of the reasons for the conversion.

NEOS Investment Expands Their Active Income Suite: NEOS Investments unveils the NEOS Enhanced Income 20+ Year Treasury Bond ETF (TLTI), blending long-duration Treasury exposure with its signature options strategy to deliver diversified, tax-efficient income for investors. By combining direct investments in 20+ year Treasury bonds with strategically managed put spreads on the S&P 500, TLTI seeks to enhance monthly income while mitigating risk.

ETRACS Delists 7 Funds: ETRACS, a UBS brand, has delisted seven of its exchange-traded notes, ranging from the 2x Leveraged US ESG note to the US Critical Technologies note.

ETF Launches

AB International Buffer ETF (ticker: BUFI)

AB Moderate Buffer ETF (ticker: BUFM)

Invesco MSCI North America Climate ETF (ticker: KLMN)

Simplify Downside Interest Rate Hedge Strategy ETF (ticker: RFIX)

YieldMax MARA Option Income Strategy ETF (ticker: MARO)

Leverage Shares 2X Long NVDA Daily ETF (ticker: NVDG)

Leverage Shares 2X Long TSLA Daily ETF (ticker: TSLG)

Bahl & Gaynor Dividend ETF (ticker: BGDV)

Bahl & Gaynor Small Cap Dividend ETF (ticker: SCDV)

Efficient Market Portfolio Plus ETF (ticker: EMPB)

Harbor Osmosis International Resource Efficient ETF (ticker: EFFI)

iShares MSCI Global Quality Factor ETF (ticker: AQLT)

Parnassus Core Select ETF (ticker: PRCS)

Parnassus Value Select ETF (ticker: PRVS)

Teucrium 2x Daily Corn ETF (ticker: CXRN)

Teucrium 2x Daily Wheat ETF (ticker: WXET)

Direxion Daily BRKB Bear 1X Shares ETF (ticker: BRKD)

Direxion Daily BRKB Bull 2X Shares ETF (ticker: BRKU)

Direxion Daily PLTR Bear 1X Shares ETF (ticker: PLTD)

Direxion Daily PLTR Bull 2X Shares ETF (ticker: PLTU)

GraniteShares 2x Long SMCI Daily ETF (ticker: SMCL)

NEOS Enhanced Income 20+ Year Treasury Bond ETF (ticker: TLTI)

Nuveen AA-BBB CLO ETF (ticker: NCLO)

Stone Ridge Durable Income ETF (ticker: LFDR)

ETF Closures

BNY Mellon Responsible Horizons Corporate Bond ETF (ticker: RHCB)

ETRACS 2x Leveraged IFED Invest with the Fed TR ETN (ticker: FEDL)

ETRACS 2x Leveraged MSCI US ESG Focus TR ETN (ticker: ESUS)

ETRACS Alerian Midstream Energy ETN (ticker: AMNA)

ETRACS Alerian Midstream Energy Total Return ETN (ticker: AMTR)

ETRACS Alerian Midstream Energy High Dividend ETN (ticker: AMND)

ETRACS Bloomberg Commodity Total Return ETN Series B (ticker: DJCB)

ETRACS Whitney US Critical Techs ETN (ticker: WUCT)

iShares iBonds December 2024 Term Muni Bond (ticker: IBMM)

Fund/Ticker Changes

American Century Sustainable Growth ETF (ticker: ESGY)

became American Century Large Cap Growth ETF (ticker: ACGR)

American Century Sustainable Equity ETF (ticker: ESGA)

became American Century Large Cap Equity ETF (ticker: ACLC)

Morgan Stanley Pathway Large Cap Equity Fund (ticker: TLGUX)

became Morgan Stanley Pathway Large Cap Equity ETF (ticker: MSLC)

Morgan Stanley Pathway Small-Mid Cap Equity Fund (ticker: TSGUX)

became Morgan Stanley Pathway Small-Mid Cap Equity ETF (ticker: MSSM)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of December 13, 2024)

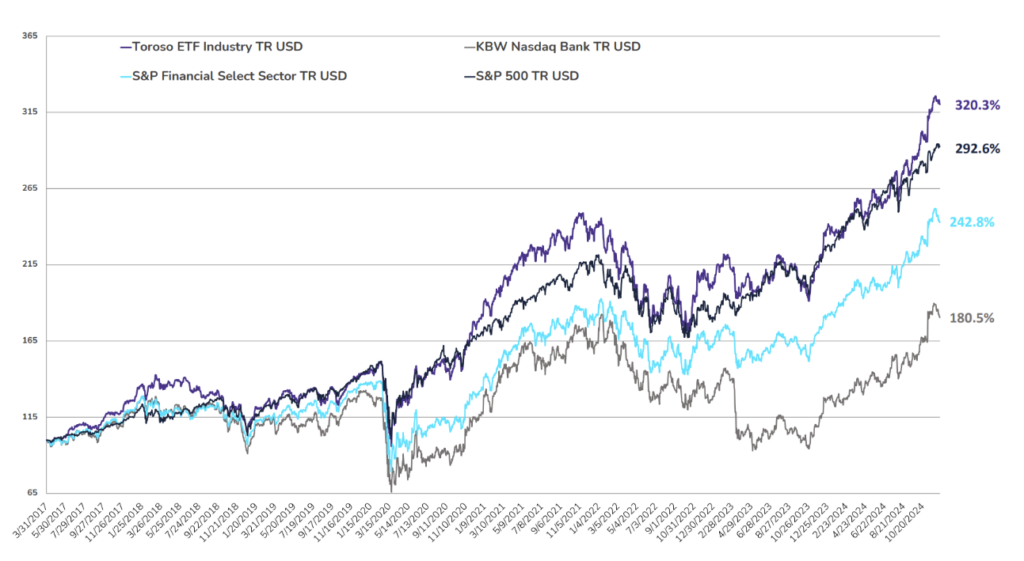

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through December 13, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.