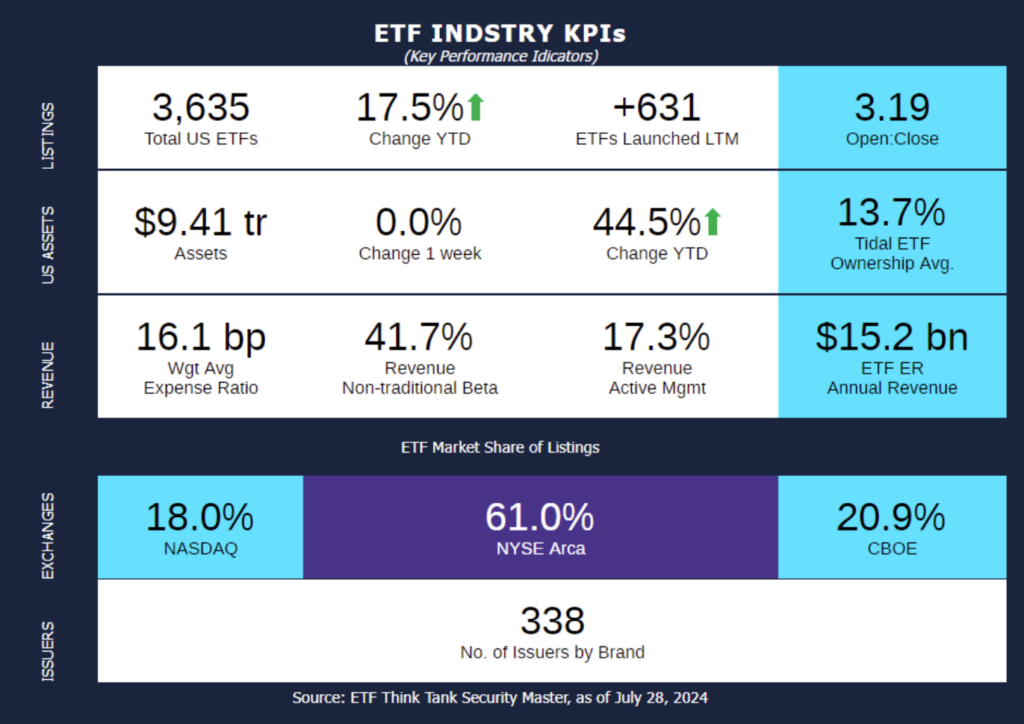

Week of July 22, 2024 KPI Summary

In the last full week of July, the ETF industry experienced 17 ETF launches, 1 closure, and 1 ticker change.

- The 1 Year ETF Open-to-Close ratio has surged to 3.19, marking a significant increase from 1.84 during the same period last year, representing a year-over-year growth of 73%.

- The total number of ETFs listed in the US has reached a new high of 3,635, reflecting continued growth and expansion in the ETF market.

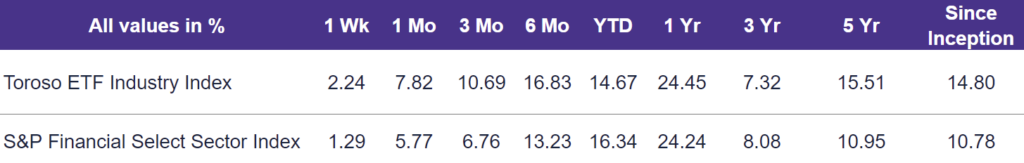

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 2.24% last week, outperforming the S&P Financial Select Sector Index, which rose by 1.29%.

Top ETF launches from the past week include:

- Ethereum ETFs Floodgates Open: This week saw the launch of spot Ethereum ETFs, with ~$2.8 billion in trading volume over the first three days. In comparison, Bitcoin ETF debuts attracted significantly more interest, with ~$4.6 billion in volume on their first day alone. Eight issuers have entered the Ethereum ETF market, with Grayscale, BlackRock, and Bitwise dominating inflows, while the other five issuers face challenges in gaining market share. The goal of spot Ethereum ETFs is to provide investors with direct exposure to the price movements of Ethereum without requiring investors to hold the cryptocurrency directly.

- Goldman Sachs Expands Municipal Bond ETF Suite: Goldman Sachs released 4 new municipal income ETFs to expand their fixed income division:

- Goldman Sachs Dynamic CA Municipal Income ETF (GCAL): Invests in California Muni bonds with flexible duration (2-8 Years) and credit quality (Up to 30% of assets in Non-Investment Grade Muni’s). Exempt from federal & California income taxes.

- Goldman Sachs Dynamic New York Municipal Income ETF (GMNY): Invests in New York Muni bonds with flexible duration (2-8 Years) and credit quality (Up to 30% of assets in Non-Investment Grade Muni’s). Exempt from federal & New York income taxes.

- Goldman Sachs Municipal Income ETF (GMUB): Invests in a diversified portfolio of investment-grade municipal bonds and may allocate up to 15% of net assets to non-investment grade municipal bonds, with a duration range of 3 to 6 years. Exempt from federal income tax.

- Goldman Sachs Ultra Short Municipal Income ETF (GUMI): This fund seeks to provide high current income with low principal volatility, focuses on shorter-dated maturities across both fixed rate and floating rate structures within the Muni investment-grade spectrum. Exempt from federal income tax.

- These municipal bond ETFs offer attractive tax-advantaged income and diversification benefits for fixed income portfolios. Goldman Sachs Asset Management now oversees 42 US ETF strategies, with over $35 billion in AUM.

- Buffer ETF Listings Keep Pace with Growing Demand: First Trust adds to the growing buffer ETF landscape with two new releases:

- FT Vest U.S. Equity Max Buffer ETF – July (JULM): JULM aims to track the SPDR S&P 500 ETF’s returns up to an 8.45% cap while providing a 100% buffer against losses over a one-year period from July 25, 2024, to July 18, 2025.

- FT Vest Nasdaq-100 Conservative Buffer ETF – July (QCJL): QCJL aims to track the Invesco QQQ Trust’s returns up to a 14.01% cap while cushioning investors against the first 20% of losses over a one-year period from July 22, 2024, to July 18, 2025.

- Earlier this month, 13 new buffer ETFs were launched, including Innovator ETFs’ 9 offerings and iShares’ inaugural buffer ETF, demonstrating growing investor demand for this type of investment product. A buffer ETF is designed to allow investors to gain from potential market upsides while capping downside risk within a specific “buffer zone,” with periodic resets to adjust protection levels based on market conditions or set dates.

ETF Launches

21shares Core Ethereum ETF (ticker: CETH)

Bitwise Ethereum ETF (ticker: ETHW)

Fidelity Ethereum Fund (ticker: FETH)

iShares Ethereum Trust ETF (ticker: ETHA)

VanEck Ethereum ETF (ticker: ETHV)

Franklin Ethereum ETF (ticker: EZET)

Grayscale Ethereum Mini Trust (ticker: ETH)

Invesco Galaxy Ethereum ETF (ticker: QETH)

FT Vest Nasdaq-100 Conservative Buffer ETF – July (ticker: QCJL)

FT Vest U.S. Equity Max Buffer ETF – July (ticker: JULM)

Goldman Sachs Dynamic California Municipal Income ETF (ticker: GCAL)

Goldman Sachs Dynamic New York Municipal Income ETF (ticker: GMNY)

Goldman Sachs Municipal Income ETF (ticker: GMUB)

Goldman Sachs Ultra Short Municipal Income ETF (ticker: GUMI)

Kurv Technology Titans Select ETF (ticker: KQQQ)

Unity Wealth Partners Dynamic Capital Appreciation & Options ETF (ticker: DCAP)

YieldMax Short NVDA Option Income Strategy ETF (ticker: DIPS)

ETF Closures

Goldman Sachs Defensive Equity ETF (ticker: GDEF)

Fund/Ticker Changes

Defiance Next Gen Connectivity ETF (ticker: FIVG)

became Defiance Connective Technologies ETF (ticker: SIXG)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of July 26, 2024)

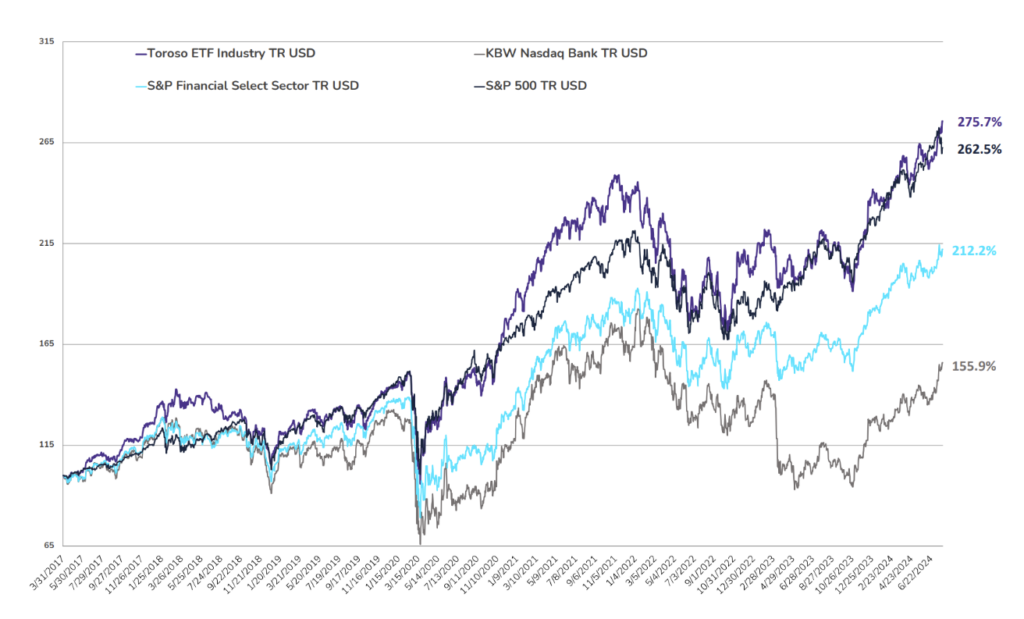

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through July 26, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.