It’s Thanksgiving week, so we thought we’d take a quick moment to think about things we are grateful for.

Topping our list is the ETF industry itself.

From a product standpoint, we’ve all seen the topline figures reaffirm relevance, usefulness, and continued growth of ETFs:

- We’re flirting with a record product launch pace in 2023 – ETFs now exceed 3,300 in the U.S. market, and we are still welcoming first-of-a-kind strategies 30 years in.

- ETF closures have been equally healthy, confirming that while the ETF market is welcoming, only meaningful solutions survive, noise does not. The launch-to-closure ratio sits around 2 today.

- Conversions from other wrappers into ETFs are an increasing part of that growth story, validating this structure as best in class.

- Asset creations are nearing $400 billion year to date, pointing to consistent and growing adoption, especially in challenging markets.

The data and market trends confirm the value proposition of the ETF structure – what we like to call structural alpha relative to other investment vehicles. By all measures, the ETF wrapper is having a banner year of success, and we are thankful for that.

ETFs as an industry tell an equally remarkable story. Look at our ETF Industry Index (TETF), which tracks all parts of the ETF ecosystem, from product sponsors to distributors to exchanges to data providers.

Back in 2017 when we created the TETF Index, we did it out of conviction that this corner of asset management was special, anchored on a product structure that simplifies, improves and broadens market access through lower cost, better tax efficiency, transparency and liquidity.

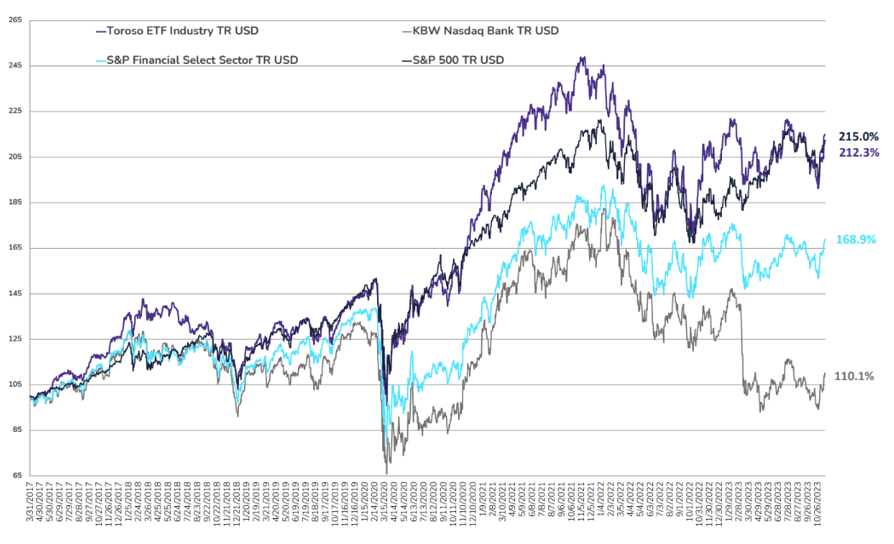

Since inception, the TETF Index has, in fact, outpaced the S&P 500’s Financial Sector by a wide margin; it has far outpaced banks (as measured by the KBW Nasdaq index); and it has kept up – or outpaced – the broader S&P 500 index throughout its run. This is an industry in growth mode, and we are grateful for being a part of it.

TETF Index Vs. Everyone Else

More importantly, it all comes down to people. We are grateful for the many people who make the ETF ecosystem a happy, collaborative place to be.

Yes, it may be cheesy, but it’s Thanksgiving, so here we go: Thanks to the cool, creative, entrepreneurial people who give this industry its one-of-a-kind collaborative, constructive and mission-driven flavor. You know who you are.

Maybe it’s the problem-solving mindset that pushes us – collectively and collaboratively – to work smarter at creating, innovating, and ultimately improving investor outcomes through ETFs. Maybe it’s the shared purpose of broadening and improving market access that unites and motivates us to keep disrupting.

Whatever fuels us as an industry, there’s no question that the ETF ecosystem is built on partnerships and on trust. We could not be more grateful for that partnership and for the trust we’ve shared with you at the ETF Think Tank and at Tidal. We know it takes a village to create, run, and transact in an ETF, and we are so thankful for being in this business with every one of you.

Happy Thanksgiving!

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).