THE ETF ECOSYSTEM

An ecosystem is more than a rainforest or a coral reef; an ecosystem comes to life anytime components interact with one another and with their environment. The ETF industry is a complex ecosystem of financial innovators and service providers who profit from the success of ETFs.

As with any ecosystem, it’s illuminating to delve into EFT industry forecasts and trends to see where we’ve been and what lies ahead. Five years ago, a McKinsey study1 predicted that the ETF industry would grow to $4.7 trillion by early 2017. They were in the ballpark, since total global ETF assets surpassed $3.8 trillion in April2, including U.S. assets topping $2.7 trillion. In that same timeframe, slightly more than 1,000 U.S. ETFs opened and less than 500 closed3.

Notably, the major issuers have remained steady over the past half-decade, with BlackRock, SSgA, Vanguard, and Invesco occupying the top four slots. Yet there was much more movement in positions five through ten. When we drilled down, it became clear that some issuers’ outflows were performance related, while others reflected the trend away from ETNs and ideas du jour, such as dividends, bank loans, agriculture, and currency hedging.

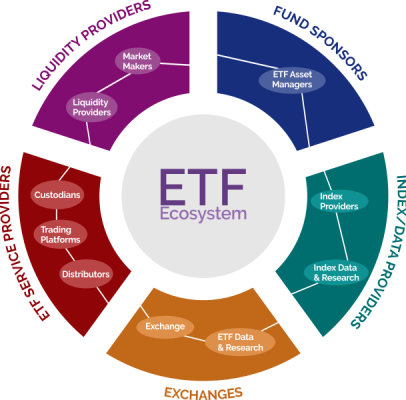

Our research into the history of ETF issuers is only one slice of the ETF ecosystem. In order to develop and maintain the Toroso ETF Industry Index, we similarly drill down into virtually every publicly traded company that derives revenues from the ETF industry. This intricate ecosystem encompasses service providers, liquidity providers, fund sponsors, index and data providers, and exchanges.

With more than 80 issuers and more than 1744 U.S. ETFs in the field4, it’s beneficial to have a fresh set of eyes look at your portfolio. We’d welcome the opportunity to utilize our ETF expertise to review your portfolio, and to share our insights about the trajectory of the various constituents that make up the ETF ecosystem.