Broad Market

These are exciting times for investors and financial advisors, but the stakes are high! Sure, a bit of coin can make a difference, but let’s stay focused on the core mandate of managing risk and achieving investor goals. Volatility never feels good, but anyone not expecting it in 2024 will surely be disappointed. Buckle up! Hope to see you on Thursday (See important section in the summary).

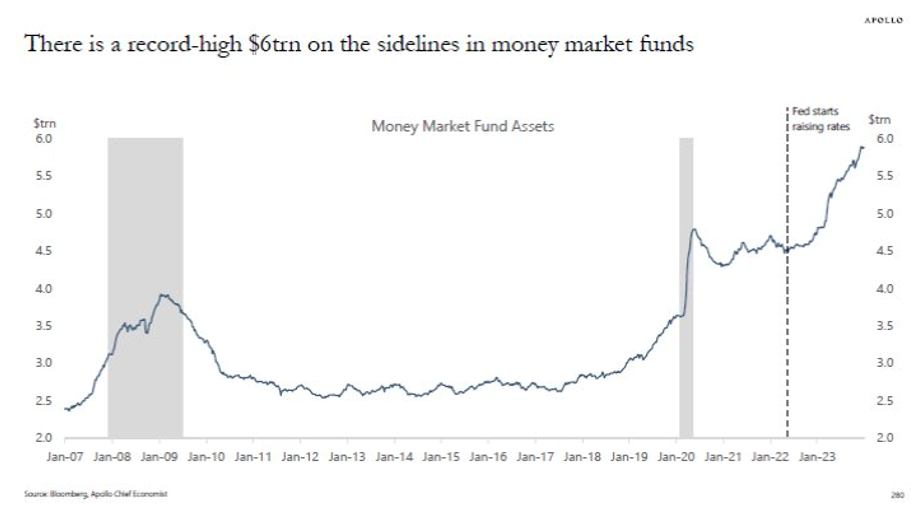

We spend a great deal of time in the ETF Think Tank engaging with global macro traders who heighten our focus on risk. Is this important, or a waste of time after a year where the S&P 500 was up 26%? The answers lie with an investor’s timeline and risk tolerance. A 10-15% drawdown that is recouped within a one-year period will keep an investor at the craps table. However, investors in retirement who are not receiving excess to reinvest will highly avoid volatility, as the risk of a lost decade is a nightmare. This risk combined with the very comfortable 5% yield earned by “risk free” money markets makes it unsurprising they are now at an all-time high of $6 trillion. The good news is that when the correction comes around, those with the money market money will be able to seize the opportunity. Of course, all this assumes that a disciplined seller has the same skills as a buyer and is willing to catch that falling knife.

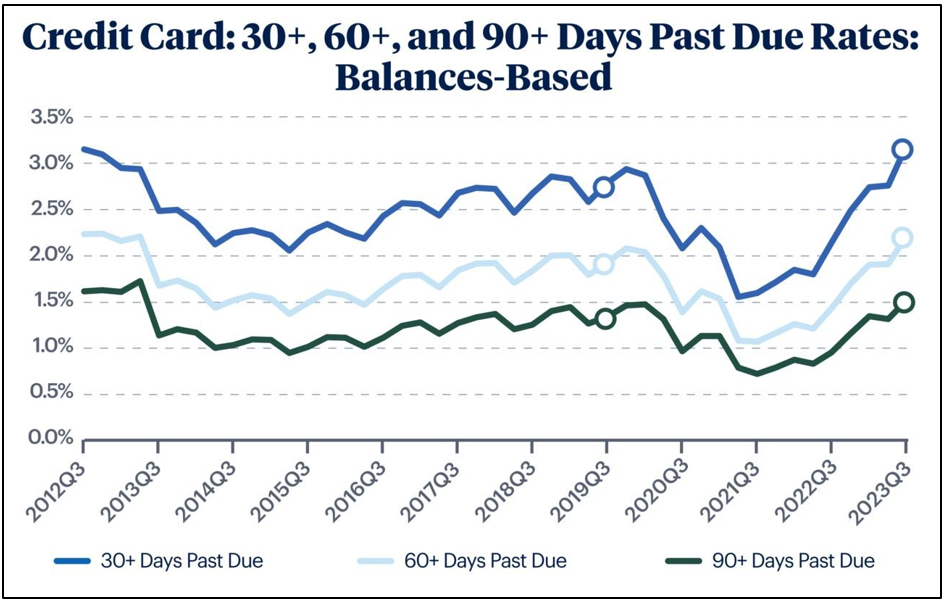

We can’t make promises, but the concern is that if we are looking to the bond market for signals, what will happen if there is stagflation, or if the risk of a recession suddenly sparks a very quick decline in interest rates? If higher-for-longer keeps investors concerned about credit spreads, and an economic contraction leads to a recession where the debt-ridden consumer is overwhelmed, how will the fed build confidence again except to lower rates, buy bonds, and accelerate the policy that continues to box a generation of investors into a bad situation? Again, this is why we see the need for alternatives. Bonds may not protect as they have in the past.

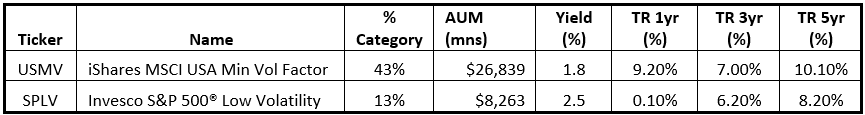

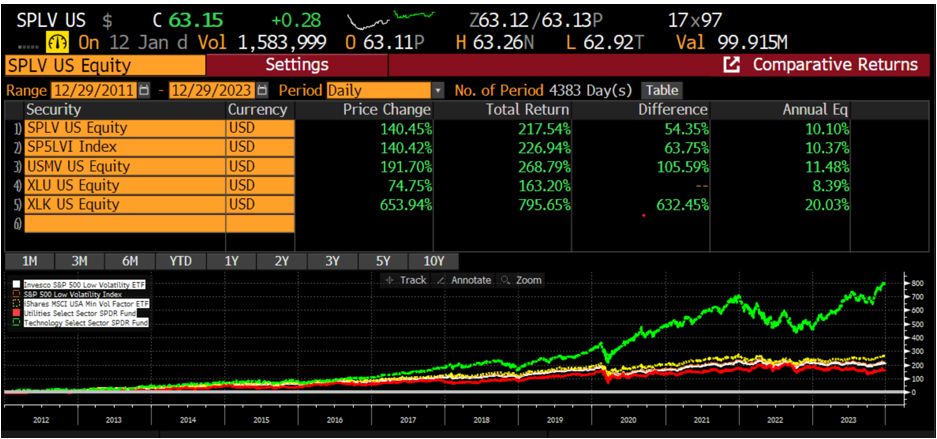

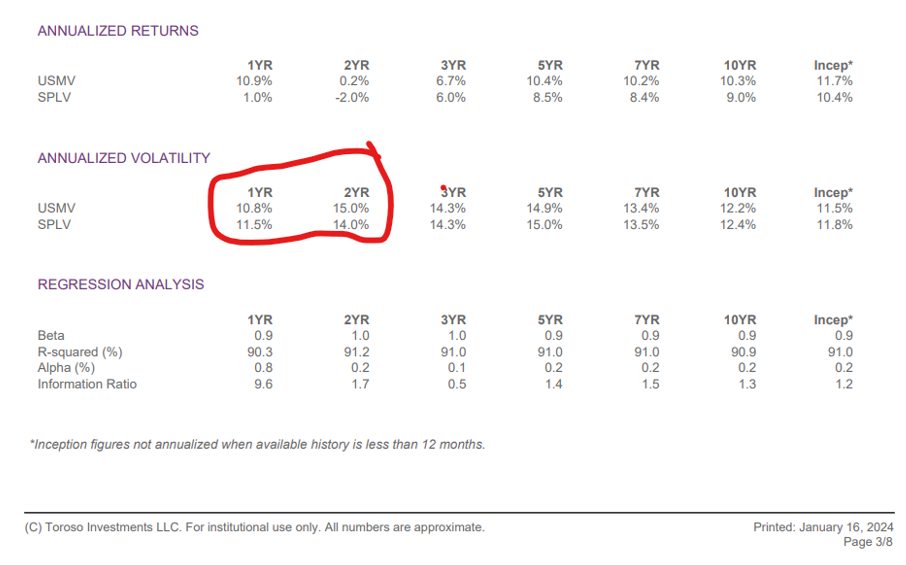

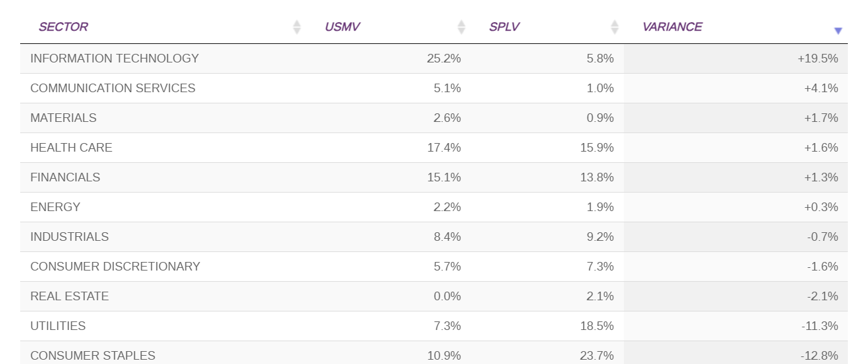

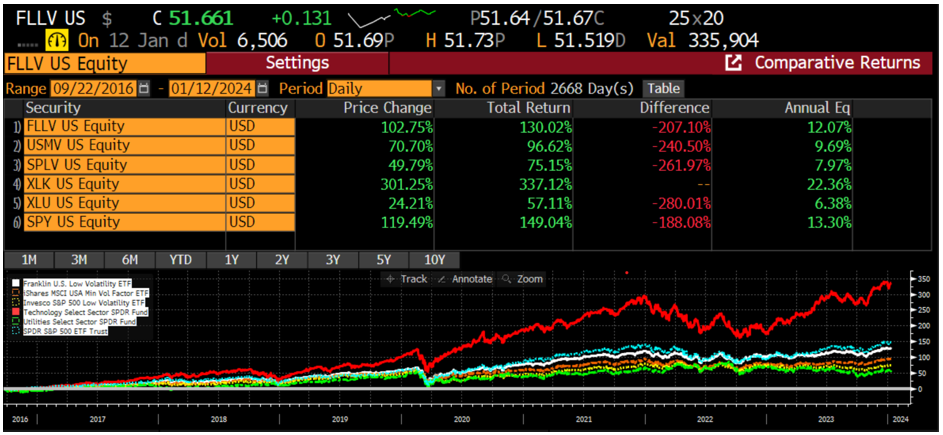

If you are paying attention, hindsight is one of the few guarantees we can offer in this business. It is ironic, therefore, that we point out the comparison between the iShares MSCI USA Min Vol Factor ETF (USMV) and the Invesco S&P 500® Low Volatility ETF (SPLV). These two ETFs share a very similar stated mandate: large cap minimum volatility and large cap low volatility. Maybe this is a case of truth in labeling. Regardless, the outcomes these past two years have been remarkably dissimilar, with USMV simply blowing away SPLV. Yes, this is a positive outcome for about 43% of the dollars allocated in the category. USMV represents about 43% of the AUM in the category and SPLV about 13%. To no surprise, 89% of the category is concentrated in the Top 10 ETFs. However, the reasons may surprise those who have not been paying attention. Note that the “minimum” volatility and outperformance in USMV has been driven by a very large allocation to technology stocks. Statistics work this way when stocks just go up and it is easy. Therefore, the question is: when things are too easy, should allocators review such a holding for purposes of a swap? Investment processes tend to revert to a mean and clearly large cap technology stock multiples are very rich. The problem with this decision is that it also assumes that interest rates will again drive utility stocks higher. However, while a swap might end up being the smart active decision to mitigate a drawdown, the other question is which business a financial advisor really thinks will work long-term, into 2025 and beyond.

Hidden Gems

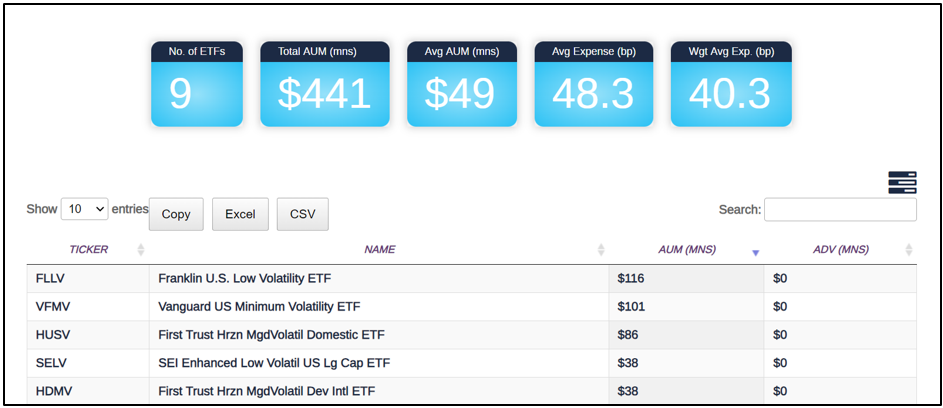

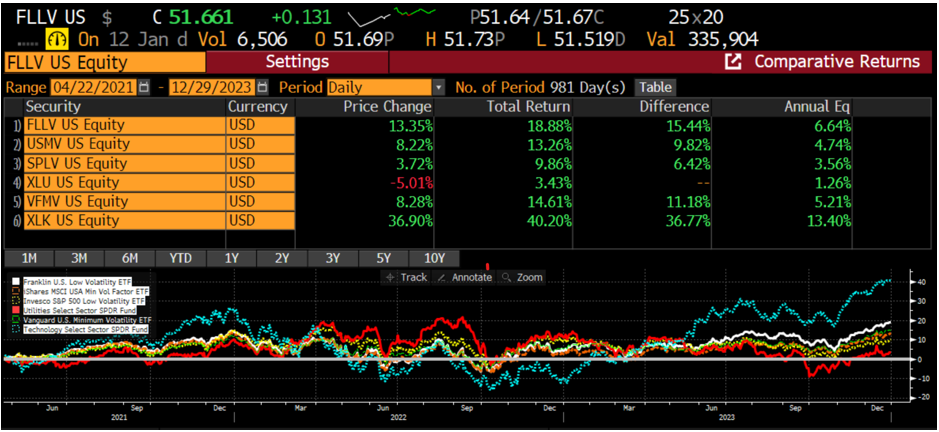

In looking at minimum volatility solutions, we also thought it interesting to screen through the 9 active funds in the category, which really proved to only be 7 funds. This is an area where active management and process discipline can truly demonstrate the advantages of the ETF wrapper. To this point, active management seems to be clearly delivering from the Franklin U.S. Low Volatility ETF (FLLV). The fund has about 40% overlap to USMV and 31% to SPLV. This may change pursuant to the portfolio management team’s decision making process, which is probably the reason why the fund has performed so well recently. Currently, we would also note that this fund is 28% invested in technology, 3% more than USMV. The challenge, of course, will be managing risk when multiples inevitably contract.

Summary

Investors and their respective financial advisors need volatility to be managed. Active management can be exercised by managing a position through rebalancing, or by an active decision to swap from one strategy to another. Yes, this is an obvious statement. However, looking under the hood at a fully transparent fund, it is also nice to review how a strategy is managed. More importantly, why own something that isn’t working when you can buy the decision-making process that adapts to industry changes?

Important: This Thursday, January 18th from 9:45am to 4pm ET, we are hosting a special, all-day Spaces on X, formerly Twitter. Bring a little Bit-of-Coin, but the true excitement is that we are bringing together almost 30 different speakers. Join us to hear some truly great Global-Macro insights! Look for link details on the @ETFThinkTank.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).