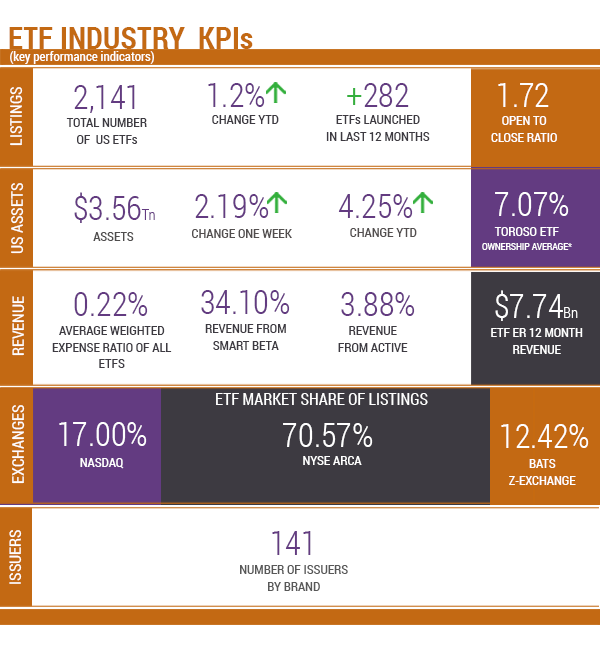

Source of KPIs: Toroso Investments Security Master, as of May 14, 2018

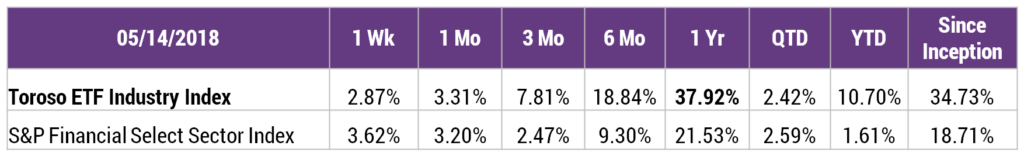

INDEX PERFORMANCE DATA

Returns as of May 14, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

WHO SPENT $932 MILLION ON MOTHER’S DAY?

Growth over Value: What She wanted for Mother’s Day!

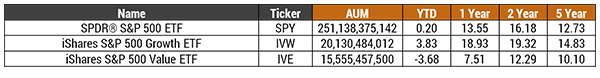

So far in the month of May – perhaps it was a gift for Mother’s Day – we note that the iShares S&P500 Value ETF (IVE) has seen $932 Million in increased AUM. This asset flow is curious because there is a long history of outperformance by growth investments over value investments during this current extended market cycle. This outperformance is also arguably the reason why there are $176 billion in assets of Growth-focused ETFs versus $172 billion of Value-focused ETFs. The chart below highlights the outperformance by growth versus value, but even more noteworthy are the charts below that highlights how the top 10 Value and Growth ETFs have performed YTD.

Growth, Value and S&P 500

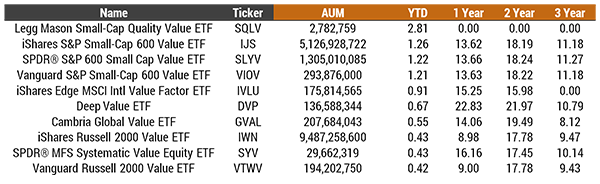

Top 10 Value ETFs by YTD Performance

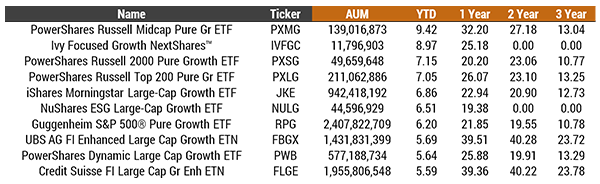

Top 10 Growth ETFs by YTD Performance

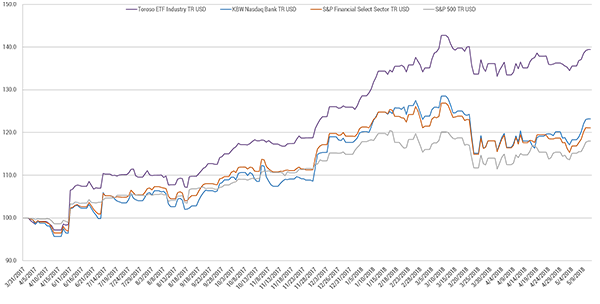

But let’s not be too frugal about Mom’s gift. Nothing says I love you like high performance in an ETF! All this is also relevant to us because the ETF Ecosystem, as measured by TETF.Index, captures the industry expansion with its 59% weighting towards growth. So when you compare the growth of the TETF.Index to other financial sector ETFs like Vanguard Financials ETF (VFH) and Financial Select Sector SPDR® ETF (XLF) which have only 21% and 17% allocation to growth stocks, respectively, you start to see the vivid difference an ETF based on the ETF Ecosystem and those broad based financial ETFs that are heavily skewed to value stocks (essentially the 35 other financial services ETFs representing $65.67 Billion in AUM.)

Now shopping for Mom may have had its challenges when you don’t have $932 million to spend, but thematically here are four of our uniquely themed Mother’s Day choices. First, since Mom may be very conservative, the AGFiQ US Market Neutral Momentum ETF (MOM) could be that perfect present to let her sleep at night. Second, we all want Mom to eat right and workout, so the Global X Health and Fitness (BFIT) ETF could be on her list. Third, a popular ETF that may dumbfound her could be the $9 Billion iShares Timber and Forestry ETF (WOOD). Admittedly, flowers may be more elegant, but the 12% YTD return for WOOD would certainly have brought a smile to Mom’s face. Fourth, because mothers-in-law are super cool and performance is not only in investments, some Moms look forward to zipping down the road in their new Tesla (TSLA).

But don’t jump to the conclusion that ETFs have driven the performance of Tesla stock. You can gain exposure to Tesla through 65 ETFs, with above average exposure you can get by buying the Industrial Innovation ETF (ARKQ) and the ARK Web x.0 ETF (ARKW), two active portfolio ETFs currently are at about 12% and 5%, respectively. However, it may surprise many to learn that ETFs own only 3.1% of TSLA stock which is about half the 7.07% stock ownership average of ETFs. In fact, only with a few passive exceptions like the VanEck Vectors® Global Alternative Energy ETF (GEX®) and the First Trust NASDAQ® Clean Edge® Green Energy Index Fund (QCLN), the weighting towards TSLA is very small in the passive space. So we cannot blame ETFs for any of the Tesla controversy! ETF investors, including my mother-in-law, may love the cars, but ETF ownership at 3.1% is not the reason why the stock trades widely at its current valuation.

We hope everyone was “Smart”, “Active” and certainly anything, but “Passive” on Mother’s Day. Mothers of the world deserve a thank you. For my working wife, the Mother of my two children, – the Amplify Online Retail ETF (IBUY) certainly benefitted from how I buy her gifts. Additionally, we proudly note that the ETF industry continues to promote the advancement of women through products like the upcoming launch of WOMN, the first not-for-profit ETF with excess revenues going to support the YWCA. This product follows the success of SPDR’s SHE, and having two solutions that encourage diversity and the role that women have in the work force can only be a great step forward.

Thank you to all the great Moms of the world. We hope to make you proud and financially sound through the advancement of the ETF Industry!

ETF LAUNCHES

| iShares Inflation Hedged Corp Bd ETF | LQDI |

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

Returns as of May 14, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

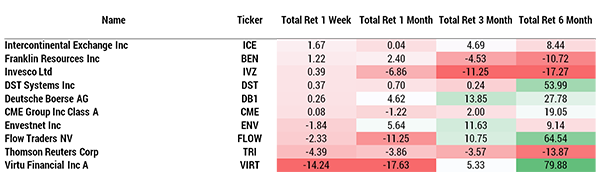

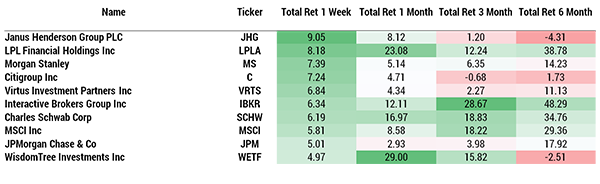

TOP 10 HOLDINGS PERFORMANCE

BOTTOM 10 HOLDINGS PERFORMANCE