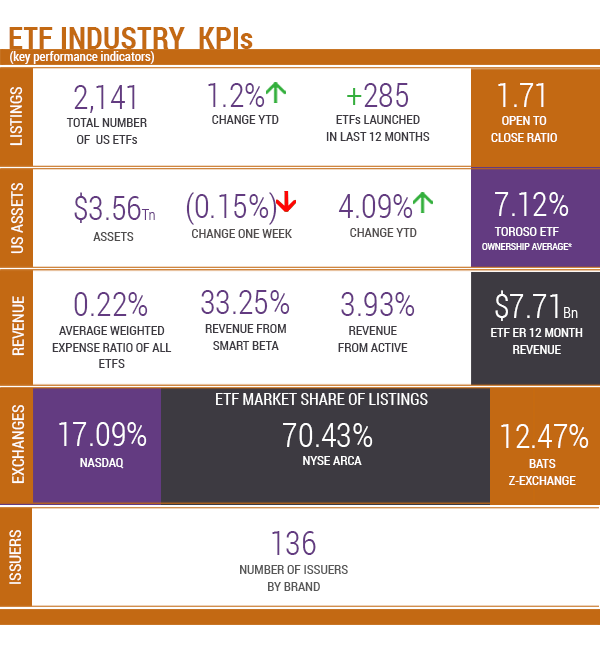

Source of KPIs: Toroso Investments Security Master, as of May 22, 2018

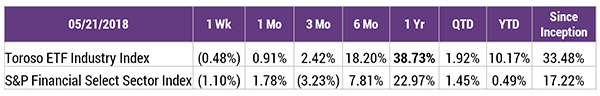

INDEX PERFORMANCE DATA

Returns as of May 22, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

LET’S TALK ASTROLOGY AND MARKETS

Uranus entered Taurus last week on May 15th, and will remain in Taurus for 8 years. The last time Uranus entered Taurus was in 1934 (ending 1942), 84 years ago. Unlike all other planetary bodies, Uranus’s axis rotates almost entirely on its side. While Uranus is known for its unconventionality, Taurus is the most stabilizing and grounding of earth zodiac signs.

Uranus’s time in Taurus historically has been a time of change and innovation. Breakdowns and breakthroughs in banking systems, land ownership/occupation, and how we work with resources. We thought it would be fun to review and reflect market environments during that period to see if we can make any logical connections to today’s economic environment.

The 1937 recession began the recovery period from the Great Depression (started with stock market crash in 1929). The recovery that began in 1933 ended in May of 1937. Causes of the recession were attributed to the contraction of the money supply caused by the Federal Reserve, Treasury Department policies, and contractionary fiscal policies. To prevent excess credit expansion in 1936, Fed policy makers doubled reserve requirement ratios to soak up excess bank reserves. This was complemented by the Treasury’s decision in June of 1936 to sterilize gold inflows and reduce excess reserves, and gold had been on a tear since 1934. These were complemented by changes in fiscal policies cutting government spending 17% over two years and the debut of the Social Security payroll tax.

(Don’t worry. We won’t go on to theorize and connect specific actions of government bodies then compared to today in an attempt to put you all to sleep!).

Most importantly, values are changing. How we view planetary resources, our global footprint, and currencies are changing. What’s not changing is government bodies’ confidence in their ability to tinker to perfection. Our overall perception of value, whether a currency, gold, cryptocurrency, commodity, a company as a source of centralized trust, or a highly priced growth company built on faith of the founder have been changing at an increasing pace.

While we considered building the first astrology based quant model (Astro-Quant Risked Weighted Rotation Strategy?), instead we’ll leave you with a list of assumptions to ponder:

- What is a risk-free rate when government debt levels soar?

- What will the long-term effects of global quantitative easing be?

- What do you consider a store of value?

- Is it the currency of the country you are a citizen of?

- A basket of currencies?

- Precious Metals?

- Cryptocurrencies?

- Commodities?

- What’s an alternative investment?

One more thing to ponder is that there are rumors of a Space ETF coming!

Now is a time for reflection, and for the sake of your clients, a time of process assessment. We encourage you to discuss your overall economic assumptions, portfolio construction, and use of alternatives with us at www.etfthinktank.com and we’ll leave you with some alternatives to consider below!

- Is it time for commodities / gold to run?

- Granite shares ETFs?

- AMZA

- Blockchain investments?

- BLOK

- Will long duration protect again?

- ZROZ

- True market alternatives?

- BTAL

- A new way to access large caps?

- RVRS

- Is ESG the next best factor?

- The new smart beta?

- Traditional Beta + Thematic investing?

ETF LAUNCHES

| Pacer Benchmark Data&Infras RE SCTR ETF | SRVR |

| Pacer Benchmark Retail RE SCTR ETF | RTL |

| REX BKCM ETF | BKC |

| Salt truBeta™ High Exposure ETF | SLT |

| Virtus InfraCap US Preferred Stock ETF | PFFA |

| First Trust Dorsey Wright DALI 1 ETF | DALI |

| Pacer Benchmark Industrial RE SCTR ETF | INDS |

| Global X Future Analytics Tech ETF | AIQ |

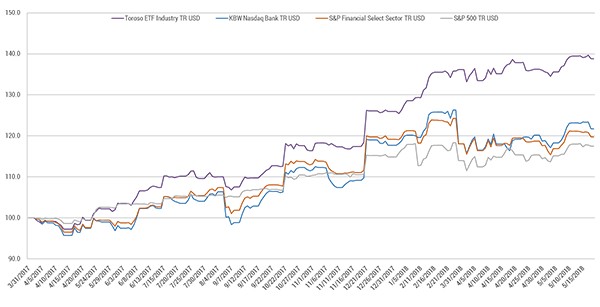

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

Returns as of May 22, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

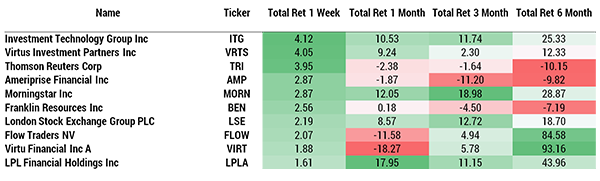

TOP 10 HOLDINGS PERFORMANCE

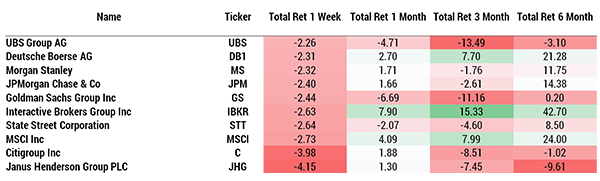

BOTTOM 10 HOLDINGS PERFORMANCE