Fixed Income: Core Wars Are The Wrong Place To Be Allocated For The Long Battle Ahead

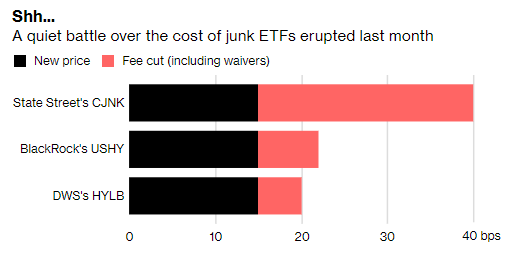

According to Eric Balchunas @EricBalchunas Core Wars are drawing the most attention in ETFs and now are dribbling into the junk bond ETF category, i.e. $HYLB, $USHY and $CJNK.

All 3 ETFs cut their fee 15bps, but are investors missing the point when it comes to High Yield? Story via @RachelEvans_NY.. https://www.bloomberg.com/news/articles/2019-04-08/blackrock-is-fighting-a-secret-fee-war-for-junk-debt-etf-assets … pic.twitter.com/ydvTOe038e.

Recipe for Disaster

We would argue that effective credit analysis is not something that is universal and certainly upside down when the investment process is is based upon liquidity and size as factors. Owning more debt in a strategy simply because there is more available/liquidity is a recipe for disaster; especially if that debt is being acquired because of inflows searching for a cheap access point. Furthermore, knowing your duration is an equally important point or an investor ultimately could find themselves owning a credit crisis for the long term.

Active Management or A Truly Diversified Approach

Active management or at least a thoughtful approach to fixed income is our recommendation in fixed income. Maybe there is nothing wrong with cheap beta in high yield, but buyers had better be careful and tactical.

Investing is a Battle!