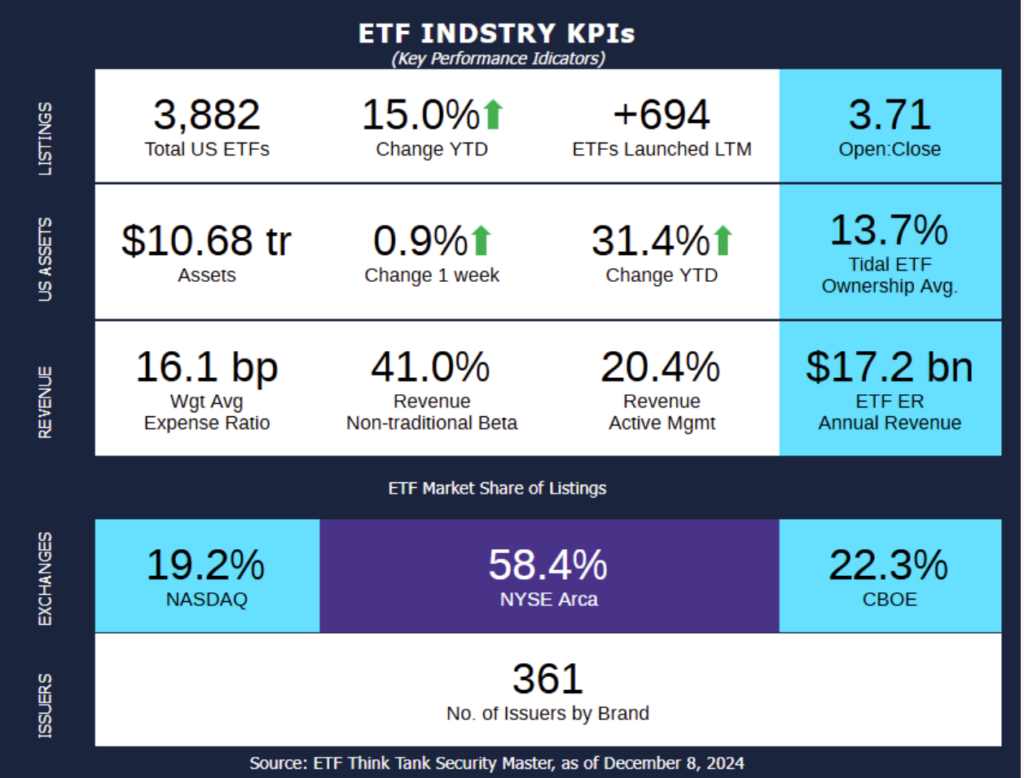

Week of December 2, 2024 KPI Summary

The ETF industry had a big rebound the week after Thanksgiving, highlighted by 33 Launches and 2 ETF Ticker Changes.

- The current 1 Year ETF Open-to-Close ratio raised to 3.71.

- The total number of US ETFs jumped to 3,882.

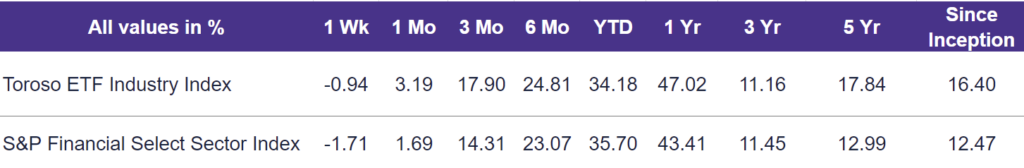

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, fell 0.94% last week, outperforming the S&P Financial Select Sector Index, which fell by 1.71%.

ETF activity from the past week includes:

Invesco launches 2 Nasdaq focused ETFs: Invesco has launched two new ETFs targeting the Nasdaq-100: Invesco Top QQQ ETF (QBIG) and the Invesco QQQ Low Volatility ETF (QQLV). QBIG uses an active, rules-based approach to capture the top 45% of Nasdaq-100 companies by market cap. Meanwhile, QQLV takes a passive approach, focusing on the least volatile names in the Nasdaq-100. These launches solidify Invesco’s commitment to innovation within the Nasdaq-100 space, catering to both aggressive and conservative growth strategies.

Zacks Releases Growth ETF: Zacks Investment Management has launched its third actively managed ETF, the Zacks Focus Growth ETF (GROZ), targeting large-cap companies with strong fundamentals and growth potential. Zacks Investment Research, a leading provider of financial data and analysis, is slowly starting to carve its space into the ETF landscape.

Active Option Income ETFs continue to roll out:

- REX Financial and Simplify Asset Management are diving deeper into the options-income game with innovative ETFs tailored to niche markets. REX’s Crypto Equity Premium Income ETF (CEPI) combines exposure to top U.S. crypto-related companies with an advanced covered-call strategy to deliver enhanced monthly income — offering a rare play on crypto with a steady cash flow twist.

- Meanwhile, Simplify’s Gold Strategy PLUS Income ETF (YGLD) and US Small Cap PLUS Income ETF (SCY) are actively managed to amplify returns: YGLD pairs leveraged gold exposure with a put-spread overlay for added income, while SCY targets U.S. small caps with short-term options strategies.

ETF Launches

AllianzIM U.S. Equity Buffer15 Uncapped December ETF (ticker: DECU)

DoubleLine Multi-Sector Income ETF (ticker: DMX)

Innvator U.S. Small Cap Power Buffer ETF – December (ticker: KDEC)

Innovator Growth-100 Power Buffer ETF – December (ticker: NDEC)

Innovator Equity Defined Protection ETF – 1 Year December (ticker: ZDEK)

VistaShares Artificial Intelligence Supercycle ETF (ticker: AIS)

Calamos Nasdaq-100 Structured Alt Protection ETF – December (ticker: CPNQ)

Calamos S&P 500 Structured Alt Protection ETF – December (ticker: CPSD)

Defiance Daily Target 2X Long NVO ETF (ticker: NVOX)

Virtus SEIX AAA Private Credit CLO ETF (ticker: PCLO)

BondBloxx Private Credit CLO ETF (ticker: PCMM)

Simplify US Small Cap PLUS Income ETF (ticker: SCY)

YieldMax Target 12 Semiconductor Option Income ETF (ticker: SOXY)

Simplify Gold Strategy PLUS Income ETF (ticker: YGLD)

REX Crypto Equity Premium Income ETF (ticker: CEPI)

iShares International Country Rotation Active ETF (ticker: CORO)

VictoryShares Free Cash Flow Growth ETF (ticker: GFLW)

AAM SLC Low Duration Income ETF (ticker:LODI)

Oakmark U.S. Large Cap ETF (ticker: OAKM)

Tema Electrification ETF (ticker: VOLT)

Allspring Broad Market Core Bond ETF (ticker: AFIX)

Allspring Income Plus ETF (ticker: AINP)

Allspring Core Plus ETF (ticker: APLU)

2x Corn ETF (ticker: CORX)

Zacks Focus Growth ETF (ticker: GROZ)

Invesco Top QQQ ETF (ticker: QBIG)

Invesco QQQ Low Volatility ETF (ticker: QQLV)

2x Wheat ETF (ticker: WHTX)

MFS Active Core Plus Bond ETF (ticker: MFSB)

MFS Active Growth ETF (ticker: MFSG)

MFS Active International ETF (ticker: MFSI)

MFS Active Intermediate Muni Bond ETF (ticker: MFSM)

MFS Active Value ETF (ticker: MFSV)

ETF Closures

None

Fund/Ticker Changes

IQ MacKay ESG Core Plus Bond ETF (ticker: ESGB)

became NYLI MacKay Core Plus Bond ETF (ticker: CPLB)

First Trust Small Cap US Equity Select ETF (ticker: RNSC)

became First Trust SMID Growth Strength ETF (ticker: FSGS)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of December 6, 2024)

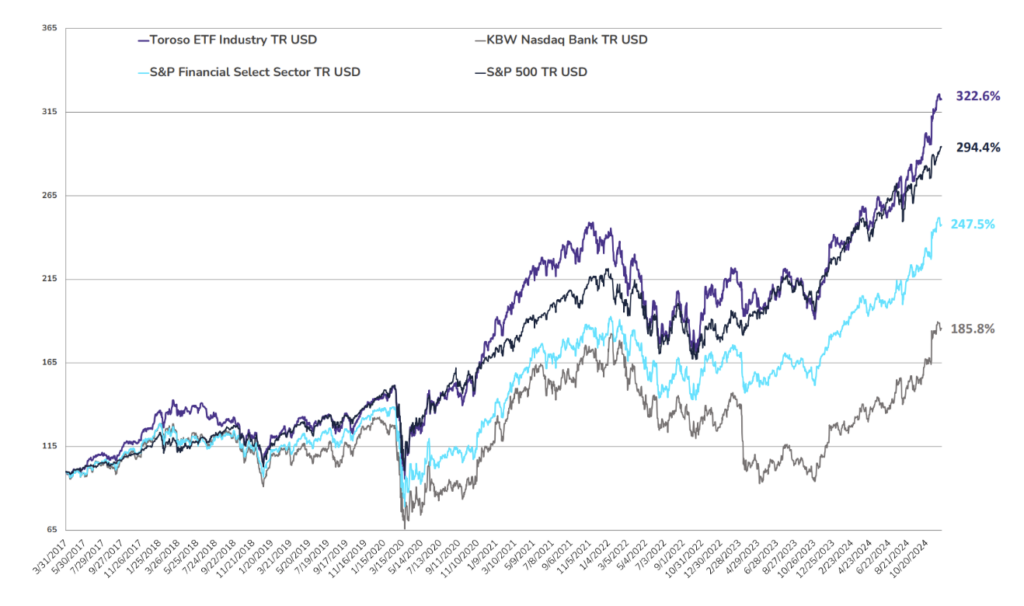

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through December 6, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.