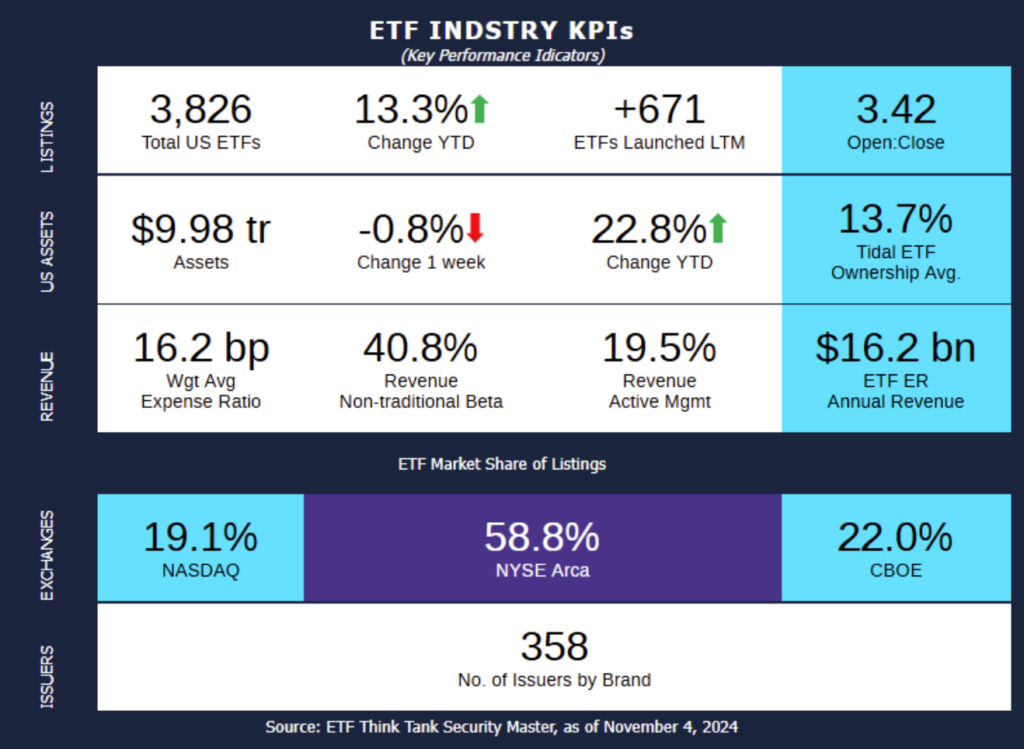

Week of October 28, 2024 KPI Summary

During the week of October 27th – November 2nd, the ETF industry saw 13 new launches, 1 ticker change, and 6 fund closures.

- The current 1 Year ETF Open-to-Close ratio sits at 3.42.

- The total number of US ETFs has risen to 3,826.

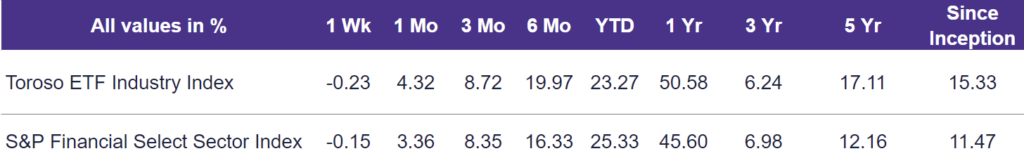

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, fell 0.23% last week, underperforming the S&P Financial Select Sector Index, which fell by 0.15%.

ETF activity from the past week includes:

Emerald Asset Management: Life Sciences Innovation: Emerald Life Sciences Innovation ETF (LFSC), launched by Emerald Asset Management, dives into the fast-evolving biotech and life sciences sectors. This actively managed ETF seeks out companies driving breakthroughs in genomics, biotechnology, and healthcare innovation, covering both established firms and emerging players. LFSC stands out by capturing the full spectrum of life sciences innovation rather than focusing solely on traditional pharma, offering investors a unique thematic play on the future of health and biotech.

GMO Expands with Three New Active ETFs: GMO launched three new active ETFs this week: the GMO International Quality ETF (QLTI), GMO U.S. Value ETF (GMOV), and GMO International Value ETF (GMOI). With QLTI, GMO extends its quality strategy internationally, targeting non-U.S. companies with strong balance sheets and reliable cash flow at a 0.60% expense ratio. GMOV and GMOI, with fees of 0.50% and 0.60%, respectively, focus on value, tapping into both domestic and international equity markets for deep value plays that active management can uncover. This lineup builds on the success of their U.S. Quality ETF, QLTY, which has attracted over $1.2 billion in assets since launching last year.

Rockefeller Asset Management Expands ETF Lineup: Rockefeller Asset Management has launched its first Global equity ETF. This ETF is actively managed and focuses on identifying high-quality businesses around the globe with strong growth potential, with the goal of delivering long-term outperformance to investors.

ETF Launches

AllianzIM U.S. Equity Buffer15 Uncapped November ETF (ticker: NVBU)

Amplify Bloomberg U.S. Treasury Target High lncome ETF (ticker: TLTP)

Calamos S&P 500 Structured Alt Protection ETF – November (ticker: CPSN)

Emerald Life Sciences Innovation ETF (ticker: LFSC)

FPA Short Duration Government ETF (ticker: FPAS)

GMO International Quality ETF (ticker: QLTI)

GMO International Value ETF (ticker: GMOI)

GMO U.S. Value ETF (ticker: GMOV)

Innovator Equity Defined Protection ETF – 1 Year November (ticker: ZNOV)

Innovator Growth-100 Power Buffer ETF – November (ticker: NNOV)

Innovator U.S. Small Cap Power Buffer ETF – November (ticker: KNOV)

Rockefeller Global Equity ETF (ticker: RGEF)

Roundhill S&P 500 Target 20 Managed Distribution ETF (ticker: XPAY)

ETF Closures

JPMorgan BetaBuilders U.S. Tips 0-5 Year ETF (ticker: BBIP)

JPMorgan BetaBuilders 1-5 Year US Aggregate Bond ETF (ticker: BBSA)

VictoryShares International High Div Volatility Wtd ETF (ticker: CID)

VictoryShares Developed Enhanced Volatility Wtd ETF (ticker: CIZ)

Procure Disaster Recovery Strategy ETF (ticker: FIXT)

VictoryShares Nasdaq Next 50 ETF (ticker: QQQN)

Fund/Ticker Changes

Neuberger Berman Energy Transition & Infrastructure ETF (ticker: NBCT)

became Neuberger Berman Energy Transition & Infrastructure ETF (ticker: NBET)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of November 1, 2024)

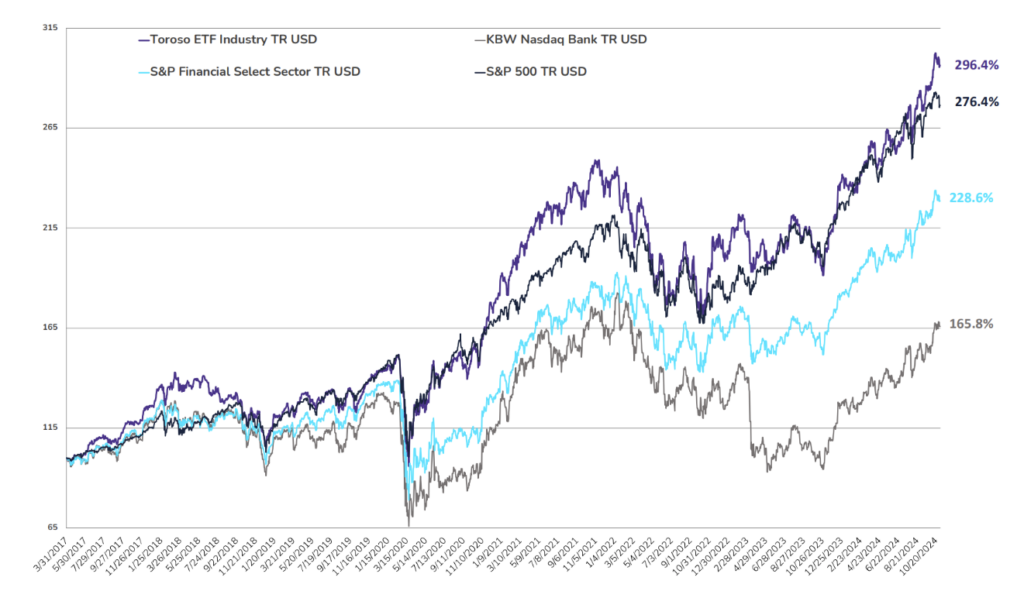

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through November 1, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.