Week of September 30, 2024 KPI Summary

During the first week of October, the ETF industry saw 23 new launches, 12 fund closures, and 1 ticker change.

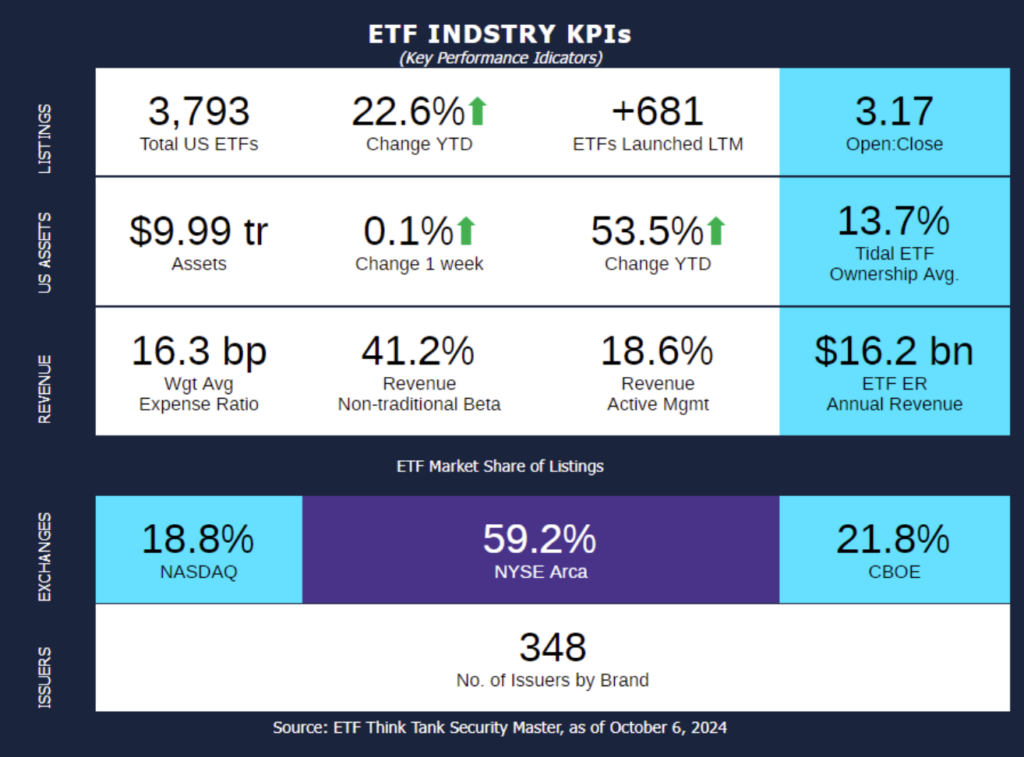

- The current 1 Year ETF Open-to-Close ratio sits at 3.17.

- The total number of US ETFs has risen to 3,793.

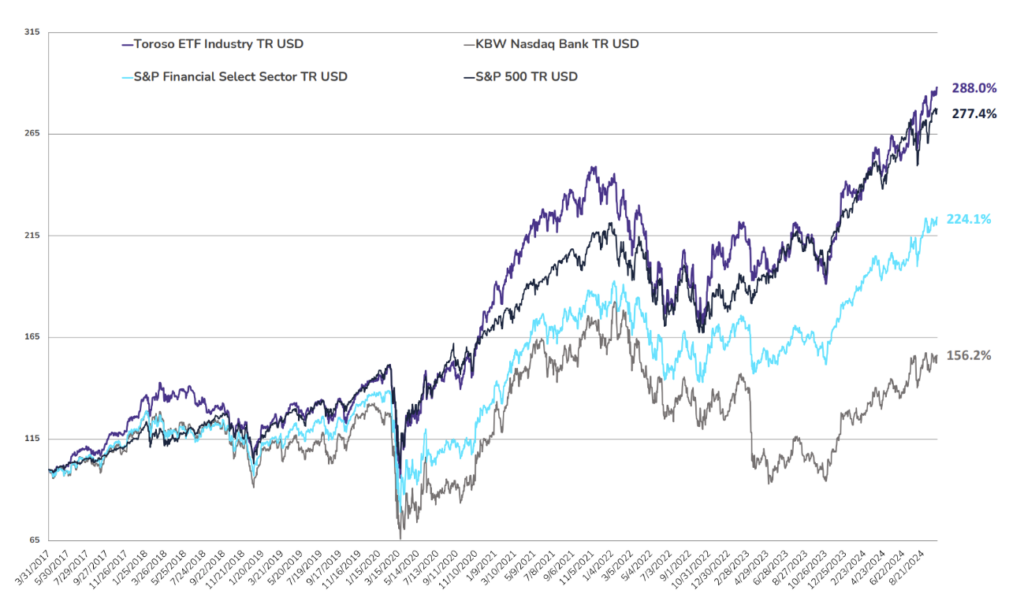

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 0.67% last week, underperforming the S&P Financial Select Sector Index, which rose by 1.14%.

ETF activity from the past week includes:

- Tradr ETFs Launches Industry’s First Quarterly Reset Leveraged ETFs: Tradr ETFs has launched the first leveraged ETFs with a quarterly reset, offering the longest leveraged investment horizon in the ETF industry. The company also expanded its Calendar Reset Leveraged ETF lineup to 12 products by introducing a new monthly reset ETF. These new offers target quarterly performance of SPY, QQQ, and TLT. (SPYQ, QQQP, TLTQ).

- 2 Issuers Launch Debut Products

- 3EDGE Asset Management makes a strong entrance into the market with the debut of four active ETFs: focusing on Fixed Income, Hard Assets, International Equity, and US Equity. 3EDGE manages around $1.8 billion in assets for individuals, family offices, and institutional clients.

- Eventide Asset Management, an investment adviser managing US$7 billion in assets as of Dec 2023, has launched its first ETF, the Eventide High Dividend ETF (ELCV), an actively managed fund with a 0.49% expense ratio. ELCV focuses on dividend-paying securities to provide income, income growth, and long-term capital appreciation, aiming to exceed the average yield of the Bloomberg US 3000 Total Return Index.

- Defined Outcome ETFs continue to launch: New ETF launches in 2024 continue to be dominated by Buffered and Alternative Protection ETFs, with last week seeing a surge in these products. Innovator led the way with three Defined Protection ETFs, while Calamos continued to expand its lineup of alternative protection offerings. Approximately 30% of last week’s ETF launches were in this category.

ETF Launches

3EDGE Dynamic Fixed Income ETF (ticker: EDGF)

3EDGE Dynamic Hard Assets ETF (ticker: EDGH)

3EDGE Dynamic International Equity ETF (ticker: EDGI)

3EDGE Dynamic US Equity ETF (ticker: EDGU)

AllianzIM U.S. Equity Buffer15 Uncapped Oct ETF (ticker: OCTU)

Astoria US Quality Growth Kings ETF (ticker: GQQQ)

Calamos Russell 2000 Structured Alt Protection ETF – October (ticker: CPRO)

Calamos S&P 500 Structured Alt Protection ETF (ticker: CPSO)

Direxion Daily NFLX Bull 2X Shares ETF (ticker: NFXL)

Direxion Daily TSM Bear 1X Shares ETF (ticker: TSMZ)

Direxion Daily TSM Bull 2X Shares ETF (ticker: TSMX)

Eventide High Dividend ETF (ticker: ELCV)

First Trust New Constucts Core Earnings Leaders ETF (ticker: FTCE)

Innovator Equity Defined Protection ETF – 1 Year October (ticker: ZOCT)

Innovator Equity Defined Protection ETF – 2 Year to October 2026 (ticker: AOCT)

Innovator Equity Defined Protection ETF – 6 Month April/October (ticker: APOC)

iShares Large Cap Max Buffer Sep ETF (ticker: SMAX)

NEOS Enhanced Income Credit Select ETF (ticker: HYBI)

Roundhill China Dragons ETF (ticker: DRAG)

Tradr 1.75X Long TLT Quarterly ETF (ticker: TLTQ)

Tradr 2X Long SPY Quarterly ETF (ticker: SPYQ)

Tradr 2X Long TLT Monthly ETF (ticker: TLTM)

Tradr 2X Long Triple Q Quarterly ETF (ticker: QQQP)

ETF Closures

Blue Horizon BNE ETF (ticker: BNE)

Goose Hollow Enhanced Equity ETF (ticker: GHEE)

Mohr Industry Nav ETF (ticker: INAV)

KraneShares S&P Pan Asia Dividend Arisotcrats ETF (ticker: KDIV)

KraneShares CICC China 5G & Semiconductor ETF (ticker: KFVG)

KraneShares Electification Metals Strategy ETF (ticker: KMET)

Natixis Loomis Sayles Short Duration Income ETF (ticker: LSST)

Mohr Growth ETF (ticker: MOHR)

Syntax Stratified MidCap ETF (ticker: SMDY)

Syntax Stratified SmallCap ETF (ticker: SSLY)

Syntax Stratified Total Market II ETF (ticker: SYII)

Syntax Stratified U.S. Total Market ETF (ticker: SYUS)

Fund/Ticker Changes

Ecofin Global Water ETG Fund (ticker: EBLU)

became Tortoise Global Water ETG Fund (ticker: TBLU)

Syntax Stratified MidCap ETF (ticker: SMDY), Syntax Statified SmallCap ETF (ticker: SSLY), Syntax Stratified Total Market II ETF (ticker: SYII) & Syntax Statified U.S. Total Market ETF (ticker: SYUS)

became Stratified LargeCap Index ETF (ticker: SSPY)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of October 4, 2024)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through October 4, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.