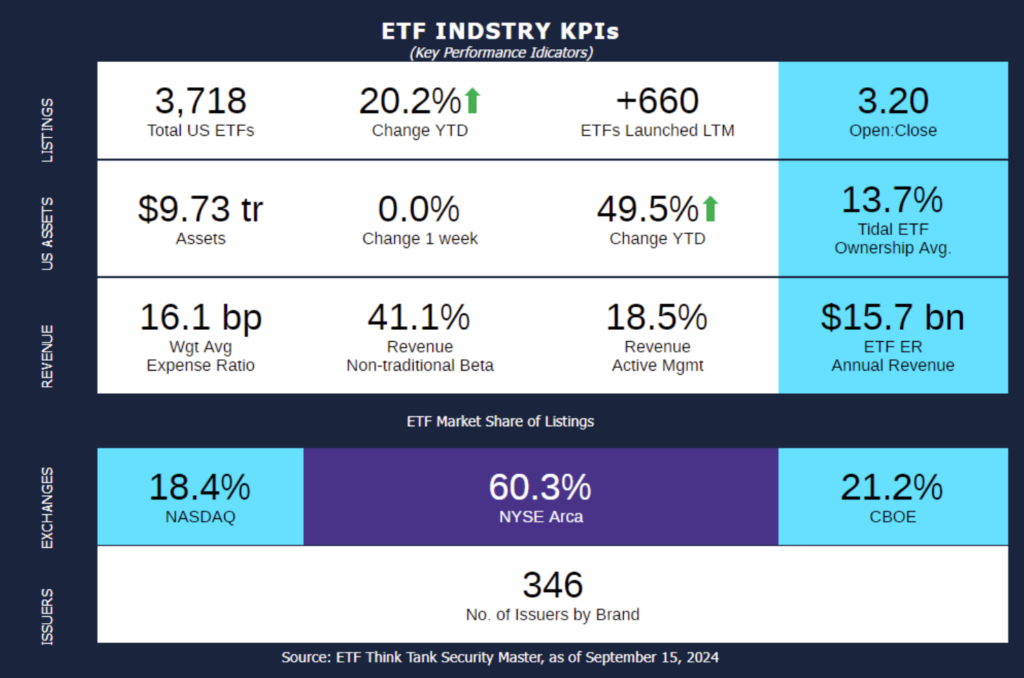

Week of September 9, 2024 KPI Summary

During the second week of September, the ETF industry saw 27 new launches and 1 fund closure.

- The ETF industry has launched a staggering tally of 57 ETFs over the past two weeks.

- The current 1 Year ETF Open-to-Close ratio sits at 3.20.

- The total number of US ETFs has risen to 3,718, representing a year-to-date growth of 10%.

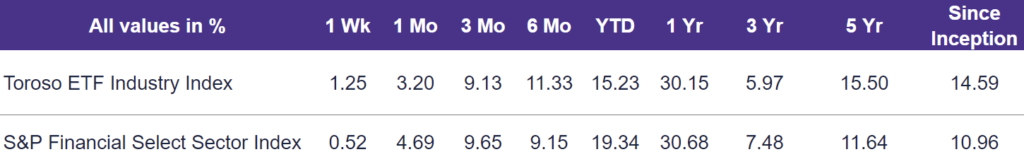

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 1.25% last week, outperforming the S&P Financial Select Sector Index, which rose by 0.52 %.

ETF activity from the past week includes:

- Calamos Introduces Groundbreaking ETF: Calamos Investments has launched the Laddered S&P 500 Structured Alt Protection ETF (CPSL), the first fund offering single-ticker access to a suite of 100% downside protection S&P 500 ETFs. Alternative Protection ETFs offer a distinctive investment approach, combining upside potential with downside protection. These funds are designed to track the positive price return of a specific index, such as the S&P 500, up to a predetermined cap, while providing 100% protection against losses over a one-year period. This means investors can participate in potential gains while limiting their exposure to market volatility and risk.

- Research Affiliates Enters ETF Market with an Innovative Approach: Research Affiliates has made a notable entrance into the ETF market with an interesting fund strategy. The Research Affiliates Deletions ETF (NIXT) capitalizes on the long-term price reversal of companies removed from traditional large/mid capitalization weight indices. By buying “unloved” stocks that have fallen out of favor, the ETF seeks to benefit from mean reversion, historically outperforming the market in the years following removal. This fund provides a unique approach, buying low and potentially unlocking attractive valuations.

- Roundhill offers income to Small-Cap: Roundhill introduces another innovative ETF, the Roundhill Small Cap 0DTE Covered Call Strategy ETF (RDTE), designed to produce weekly income by leveraging the Russell 3000 index through a zero-days-to-expiry (0DTE) options strategy. RDTE is the first to employ 0DTE options overlay on the Russell 3000 Index, expanding Roundhill’s suite of weekly income funds. This addition joins the S&P 500 0DTE Covered Call Strategy ETF (XDTE) and the Innovation-100 0DTE Covered Call Strategy ETF (QDTE), solidifying Roundhill’s position as a leader in 0DTE covered call strategies across all three major U.S. equity indices.

ETF Launches

Calamos Laddered S&P 500 Structured Alt Protection ETF (ticker: CPSL)

Congress Intermediate Bond ETF (ticker: CAFX)

Dimensional International Vector Equity ETF (ticker: DXIV)

Dimensional US Vector Equity ETF (ticker: DXUV)

Global X Intermediate-Term Treasury Ladder ETF (ticker: MLDR)

Global X Long-Term Treasury Ladder ETF (ticker: LLDR)

Global X Short-Term Treasury Ladder ETF (ticker: SLDR)

Invesco BulletShares 2034 Municipal Bond ETF (ticker: BSMY)

Neuberger Berman Japan Equity ETF (ticker: NBJP)

Polen Capital Emering Markets ex-China Growth ETF (ticker: PCEM)

Research Affiliates Deletions ETF (ticker: NIXT)

Roundhill Small Cap 0DTE Covered Call Strategy ETF (ticker: RDTE)

SanJac Alpha Core Plus Bond ETF (ticker: SJCP)

SanJac Alpha Low Duration ETF (ticker: SJLD)

Simplify National Muni Bond ETF (ticker: NMB)

Sparkline International Intangible Value ETF (ticker: DTAN)

SPDR Galaxy Digital Asset Ecosystem ETF (ticker: DECO)

SPDR Galaxy Hedged Digital Asset Ecosystem ETF (ticker: HECO)

SPDR Galaxy Transformative Tech Accelerators ETF (ticker: TEKX)

Stone Ridge 2054 Inflation-Protected Longevity Income ETF (ticker: LIAK)

Stone Ridge 2054 Longevity Income ETF (ticker: LFAN)

Stone Ridge 2059 Inflation-Protection Longevity Income ETF (ticker: LIAT)

Stone Ridge 2059 Longevity Income ETF (ticker: LFAV)

Themes US Infrastructure ETF (ticker: HWAY)

Tuttle Capital Self Defense Index ETF (ticker: GUNZ)

Tuttle Capital Shareholders First Index ETF (ticker: ESGX)

YieldMax SMCI Option Income Strategy ETF (ticker: SMCY)

ETF Closures

Copper Place Global Dividend Growth ETF (ticker: GDVD)

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of September 13, 2024)

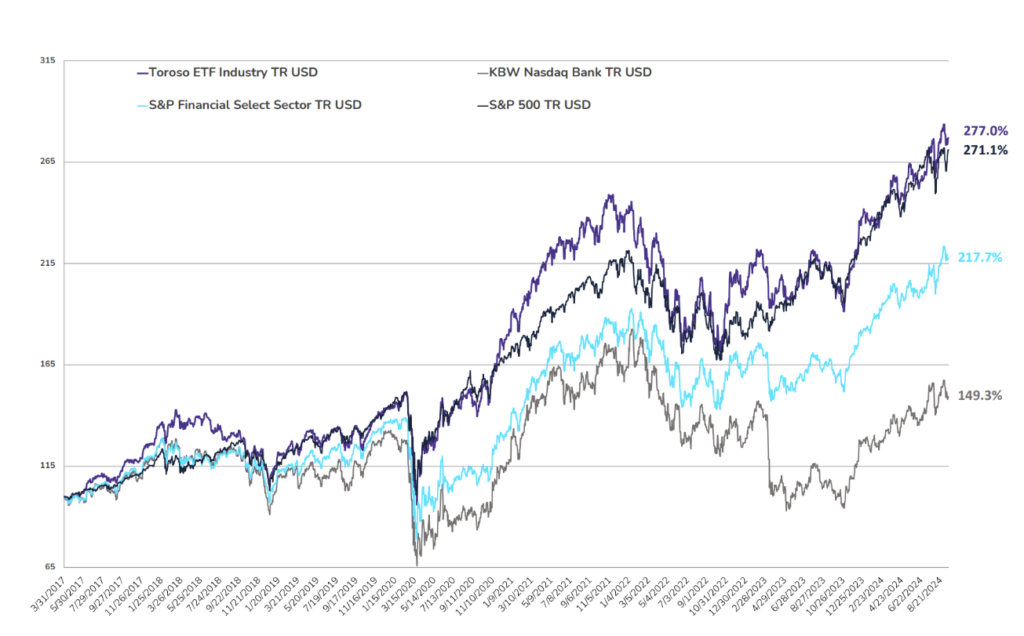

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through September 13, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.