Week of August 19, 2024 KPI Summary

During the week of August 19-13, the ETF industry saw 11 new launches and 1 fund closure.

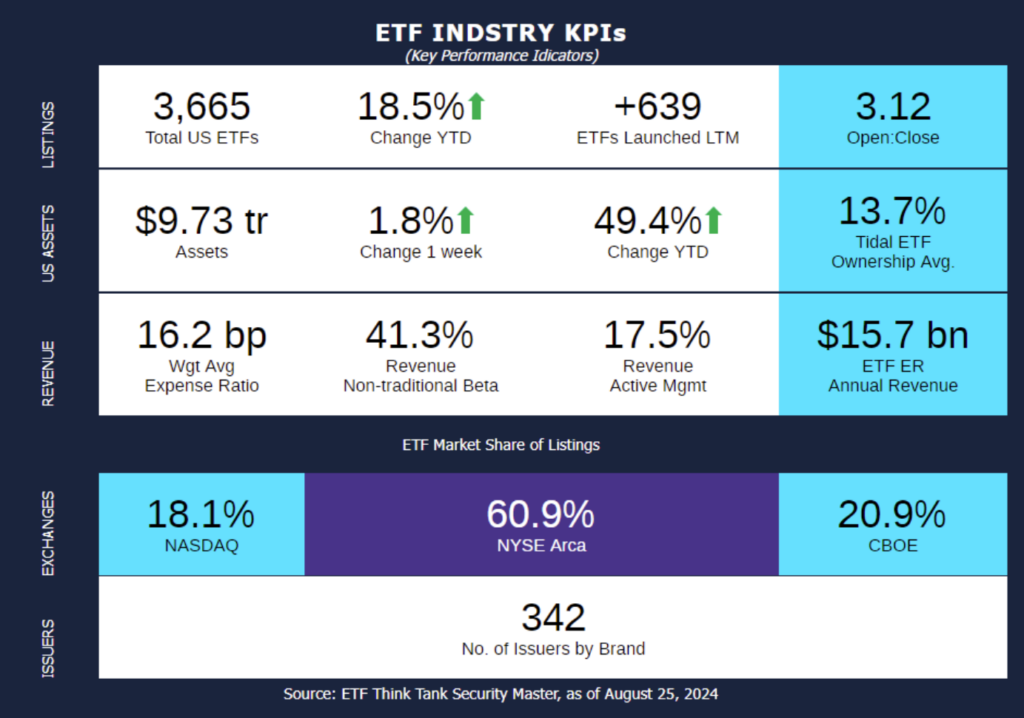

- The 1 Year ETF Open-to-Close ratio sits as 3.12, representing a significant year-over-year uptick of 61.7% from its previous level of 1.93.

- The total number of US ETFs has risen to 3,665, representing a year-to-date growth of 8.4%.

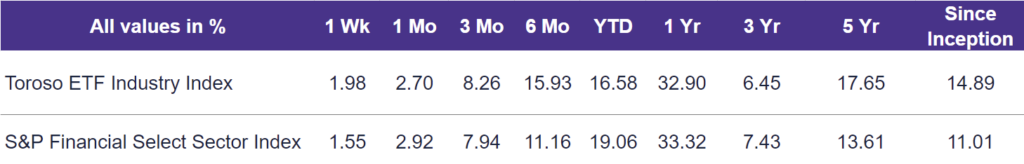

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 1.98% last week, outperforming the S&P Financial Select Sector Index, which rose by 1.55%.

Recent ETF launches from the past week include:

- Nasdaq Focused ETFs Hit the Market

- Innovator Launches First-Ever Hedged Nasdaq-100 ETF: The “Innovator Hedged Nasdaq-100 ETF” (QHDG) breaks new ground as the first ETF to combine capital appreciation potential with mitigated downside risk, achieved through an options overlay tied to the Nasdaq-100 index. ETFs like this are designed for investors who can’t afford to take on the market’s full downside risk, but who require higher upside potential than what fixed income can offer.

- Pacer Adds the Nasdaq to Flagship Cash Cow Line-up: This latest addition to the Cash Cows Growth Series, the “Nasdaq 100 Top 50 Cash Cows Growth Leaders ETF” (QQQG), uses a rules-based approach to track the top 50 large-cap growth companies in the Nasdaq-100 Index, selected for their free cash flow margins and price momentum. With the addition of this new fund, Pacer ETFs expands its Cash Cows series to 11 ETFs and its total US ETF offerings to 48, collectively managing approximately $45 billion in AUM.

- Amplify Expands Active Income Offerings: Bringing together growth and income, the “CWP Growth & Income ETF” (QDVO) combines capital appreciation from growth stocks with high monthly income from dividends and option premiums. Leveraging Amplify ETFs’ proven expertise in income-driven strategies, QDVO follows in the footsteps of the successful CWP Enhanced Dividend Income ETF (DIVO), which has attracted approximately $3.4 billion in AUM.

- One issuer makes their market debut:

- Twin Oak ETF Company launches its debut fund, the Twin Oak Short Horizon Absolute Return ETF (TOAK), designed to deliver capital appreciation while minimizing price volatility. TOAK aims to achieve this objective by employing a defined risk options strategy, targeting absolute returns with a short duration of zero to one year.

ETF Launches

Amplify CWP Growth & Income ETF (ticker: QDVO)

Defiance Daily Target 1.5X Short MSTR ETF (ticker: SMST)

Defiance Daily Target 2X Long AVGO ETF (ticker: AVGX)

Defiance Daily Target 2X Long SMCI ETF (ticker: SMCX)

FT Vest Nasdaq-100 Moderate Buffer ETF – August (ticker: QMAG)

FT Vest U.S. Equity Max Buffer ETF – August (ticker: AUGM)

Innovator Hedged Nasdaq-100 ETF (ticker: QHDG)

Pacer Nasdaq 100 Top 50 Cash Cows Growth Leaders ETF (ticker: QQQG)

Return Stacked Bonds & Futures Yield ETF (ticker: RSBY)

Twin Oak Short Horizon Absolute Return ETF (ticker: TOAK)

YieldMax TSM Option Income Strategy ETF (ticker: TSMY)

ETF Closures

Veridien Climate Action ETF (ticker: CLIA)

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of August 23, 2024)

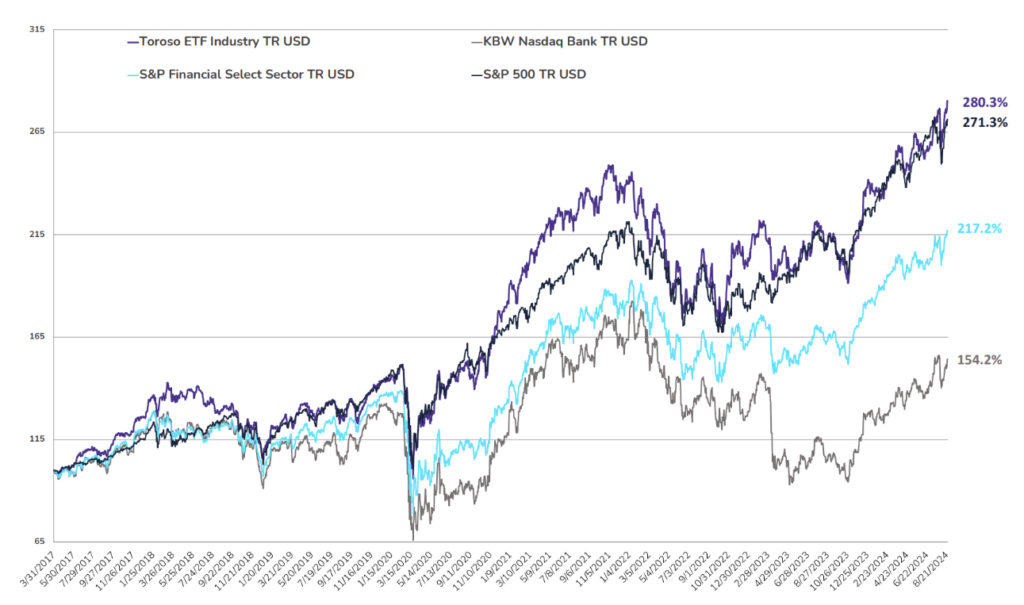

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through August 23, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.