Week of July 8, 2024 KPI Summary

In the 2nd week of July, the ETF industry experienced 13 ETF launches and 1 closure.

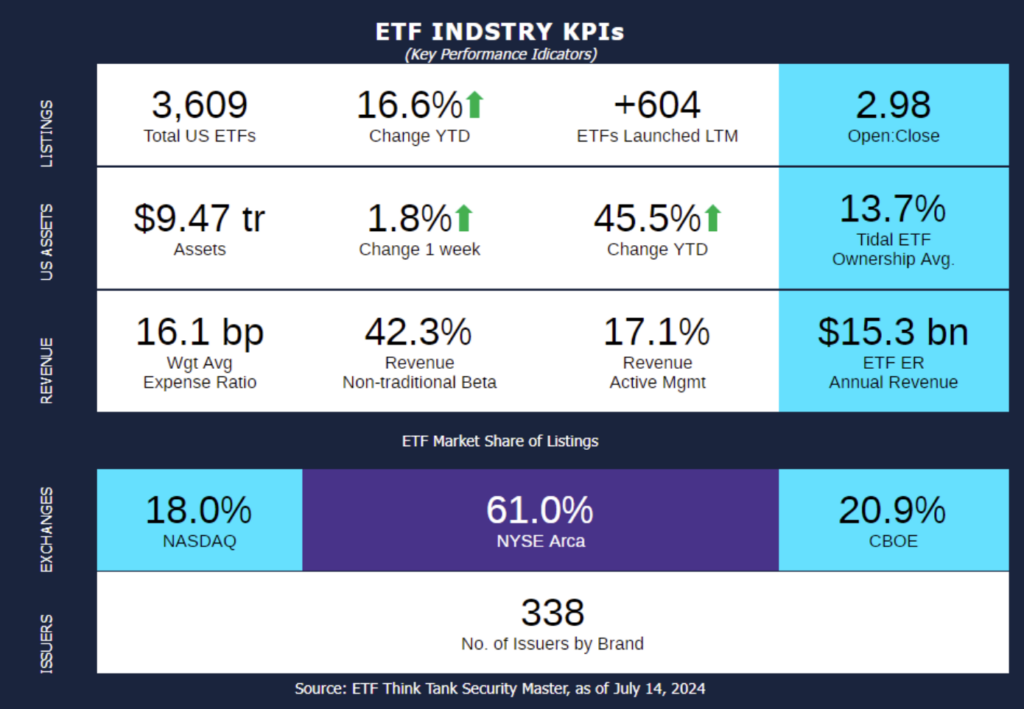

- The 1 Year Open-to-Close ratio has risen to 2.98, marking a significant year-over-year increase from 2.02.

- Total US ETFs increased to 3,609, a +12.9% YoY Increase.

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 3.24% last week, outperforming the S&P Financial Select Sector Index, which rose by 2.01 %.

The ETF industry itself had a very busy week.

- SS&C ALPS Advisors: SS&C ALPS Advisors, a subsidiary 100% owned by SS&C Technologies Holdings, has collaborated with CoreCommodity Management to introduce the ALPS CoreCommodity Natural Resources ETF (CCNR). The Fund utilizes a “pure play” strategy, concentrating on equity securities of upstream commodity producers to gain exposure to natural resources. Assets under management (AUM) for this fund have already exceeded $300 million.

- Cambria: Cambria launched the Cambria Large Cap Shareholder Yield ETF (LYLD), which is the 5th ETF to join their Shareholder Yield suite, that has a combined total of ~$2b AUM. This ETF targets large-cap companies that prioritize high-cash distribution to investors through three methods: dividends, buybacks, and debt reduction, collectively referred to as shareholder yield.

- REX Shares Joins the Leveraged Bitcoin Market: REX Shares launched 2 new enhanced bitcoin strategies: the T-REX 2X Long Bitcoin Daily Target ETF (BTCL) and the T-REX 2X Inverse Bitcoin Daily Target ETF (BTCZ), providing 200% and -200% exposure to Bitcoin’s daily performance. REX Shares will directly compete with ProShares & Volatility Shares who currently offer their own enhanced products revolving around Bitcoin.

- 2 ETF Issuer Debuts:

- Draco Capital Partners, headed by Jack Fu and YouTube co-founder Steve Chen, debuted their inaugural investment offering, the Draco Evolution AI ETF (DRAI). This ETF blends a proprietary artificial intelligence model with macroeconomic quantitative models and aims to allocate investments across diverse asset classes such as commodities, bonds, and equities.

- Ocean Park Asset Management, established in 1987 and overseeing ~$5 billion in AUM, recently introduced their inaugural suite of 4 ETFs. These ETFs utilize decades of strategic research and employ a tactical, rules-based investment methodology across domestic, international and income-based strategies.

ETF Launches

T-REX 2X Inverse Bitcoin Daily Target ETF (ticker: BTCZ)

T-REX 2X Long Bitcoin Daily Target ETF (ticker: BTCL)

ALPS/CoreCommodity Natural Resources ETF (ticker: CCNR)

Cambria LargeCap Shareholder Yield ETF (ticker: LYLD)

T. Rowe Price Intermediate Municipal Income ETF (ticker: TAXE)

Draco Evolution AI ETF (ticker: DRAI)

Ocean Park Diversified Income ETF (ticker: DUKZ)

Ocean Park Domestic ETF (ticker: DUKQ)

Ocean Park High Income ETF (ticker: DUKH)

Ocean Park International ETF (ticker: DUKX)

Harbor AlphaEdge Small Cap Earners ETF (ticker: EBIT)

VictoryShares Hedged Equity Income ETF (ticker: HEJD)

YieldMax Short COIN Option Income Strategy ETF (ticker: FIAT)

ETF Closures

Tema Global Royalties ETF (ticker: ROYA)

Fund/Ticker Changes

WisdomTree U.S. Short Term Corporate Bond Fund (ticker: SFIG)

became WisdomTree U.S. Short Term Corporate Bond Fund (ticker: QSIG)

WisdomTree U.S. High Yield Corporate Bond Fund (ticker: WFHY)

became WisdomTree U.S. High Yield Corporate Bond Fund (ticker: QHY)

WisdomTree U.S. Corporate Bond Fund (ticker: WFIG)

became WisdomTree U.S. Corporate Bond Fund (ticker: QIG)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of July 12, 2024)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through July 12, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.