Broad Market

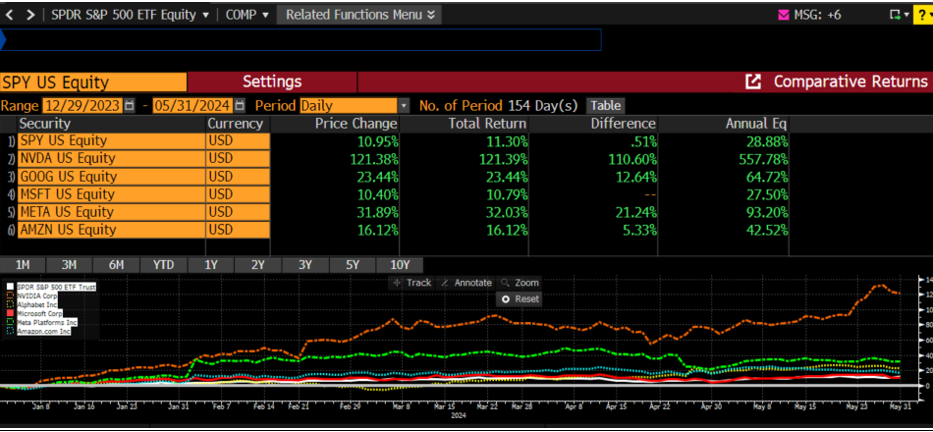

If your client thinks matching the S&P 500’s return is easy, you should remind them that according to UBS, 26% of the S&P 500 return was made up of Alphabet, Microsoft, Meta, and Amazon, while Nvidia Corp made up another 34%. Yes, that means that as of May 31st, about 60% of the 11.3% return is coming from the top names in the S&P500. Apple, as the second largest holding in the S&P 500, is about flat on the year, thus reflecting similar sequential operating performance. Skeptics of the Nvidia rally should consider the company’s substantial cash reserves and strategic vision. Under the leadership of Jensen Huang, Nvidia is expected to have free cash flow of $130 to $150 billion over the next two years, and we would argue that companies with that kind of momentum are better served by diversifying their treasury for a rainy day than buying back stock. Again, like Apple, we believe that management of technology companies are well positioned to seek out such diversification since their employee culture is naturally inspired to lean into disruption. Furthermore, we would argue that shrinking the float with shareholder money when a stock price multiple is relatively high historically is only piling on greater risk and presuming that past performance and near perfect business execution will be repeated.

There is no question that social media has changed the way people consume investment information. During last week’s Happy Hour, we discussed this issue with Ron Insana, coincidentally as the Trump verdict was announced. Most people remember Ron Insana as a CNBC anchor, but my history with Ron dates to when we were both starting out and the Financial News Network was acquired by NBC/CNBC as it was just forming. Of course, this personal history is just coincidental. More to the point, media today is largely a shared platform where audience engagement is more important than the voice delivering the message. Without an intelligent and actively engaged audience, media feels like a dead zone in today’s world. A media platform is very valuable when it builds upon a network of investors and fiduciaries who regularly debate, share information, and intelligently expand each other’s personal opportunity set. This can, of course, be found on X (formerly known as Twitter), LinkedIn, and YouTube.

Another platform for active and engaging conversation is what we call the ETF Think Tank. To this point, please be on the lookout for the old gang to get together for a happy hour in the original ETF Think Tank Zoom format. On this Happy Hour, microphones will be open to all Think Tank members and loyal engaged listeners. Who knows who might make a cameo as a surprise guest! It has been almost three years of weekly Happy Hours.

Social Media Research

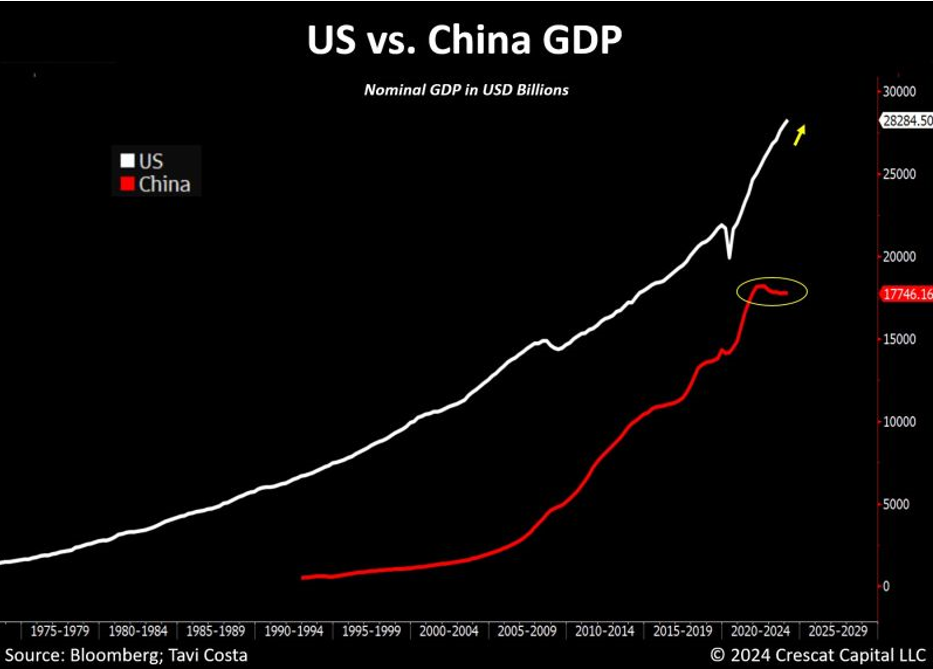

Navigating through the junk, friction, and fear mongers is the challenge in using social media as a resource for research. On LinkedIn, Otavio (Tavi) Costa, the Macro Strategist of Crescat Capital, provides frequent helpful charts and commentary even though his clear bias is in favor of gold and gold mining stocks. Everyone posting has an agenda, and due diligence and skepticism are encouraged by all. To this point, as a follow up to the image above, in a recent post Tavi writes:

- China’s stagnation in one picture.

- Their economy is facing a similar issue to what Japan experienced after the bursting of its asset price bubble in the late 80s, which led to a long period of low growth known as the “Lost Decades”.

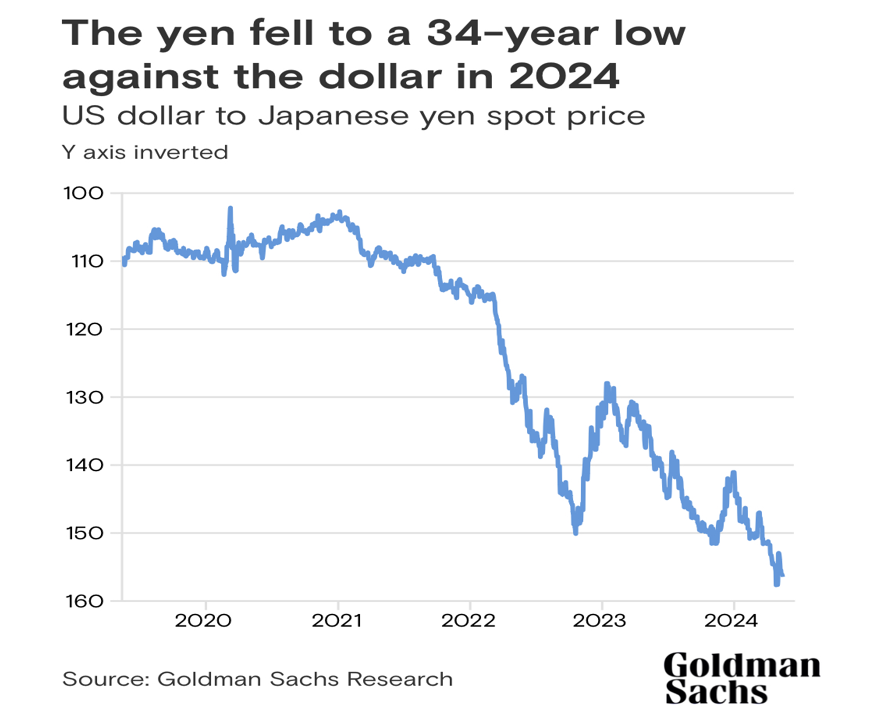

- After three decades of accruing more debt to produce less GDP, the persistent devaluation of the Japanese yen emerged as one of the most important resolutions to their extreme macro imbalances.

- There is a reason China appears eager to enhance the quality of its international reserves.

- The ongoing pressure on its monetary system to devalue is precisely what is driving their urgent need to persist in accumulating gold.

- If anything, China’s macro imbalances only reinforce the case for owning gold.

Of course, with the yellow arrow pointing upwards for US GDP growth, many responded with visceral commentary about excessive spending, the problems with excessive money printing, and the dangers of growth funded by debt. Granted, gold bugs are generally calling for an end of society as we know it. However, what is interesting this time is the fact that in this cycle we are having to address two different currency issues in Japan and China. In Japan, the steady decline of the Yen vs the dollar is likely to continue if US GDP growth holds steady relative to Japanese GDP growth. Put differently, Japan needs GDP growth in US terms to continue so they will be sensitive to their weakening currency and get out of the deflationary economic trends that have hurt their economy for some 20 years. Here is what Goldman is saying:

Every week we update our readers on the expansion of the ETF market through our Monday ETF Industry KPI Update. For the industry, this piece provides quick insight on ETF launches, closures and asset growth. Healthy highlights include Assets Under Management (AUM) continuing to climb past the $8.99 trillion mark with 14% net ETF launch growth (+595) on twelve-month basis. We think this growth is important to note as it demonstrates how the evolution of the wrapper will benefit investors. It is easy to just focus on investing in the broadest low-cost ETFs, but being on the forefront of expansion can provide financial advisors a way to demonstrate how they add value in terms of selection. Moreover, we admit that the selection of 1,628 US focused ETFs is quite overwhelming.

However, if there is one lesson to be learned about China, it is that future model portfolios may seek to isolate individual country exposure more. As such, we would remind our readers that targeting Japan (17) and China (40) provide very different attributions across asset classes and sectors. This is important because portfolios in the US are probably very overweighted by technology and the Mag 7, so moving to international exposure can be even more tricky.

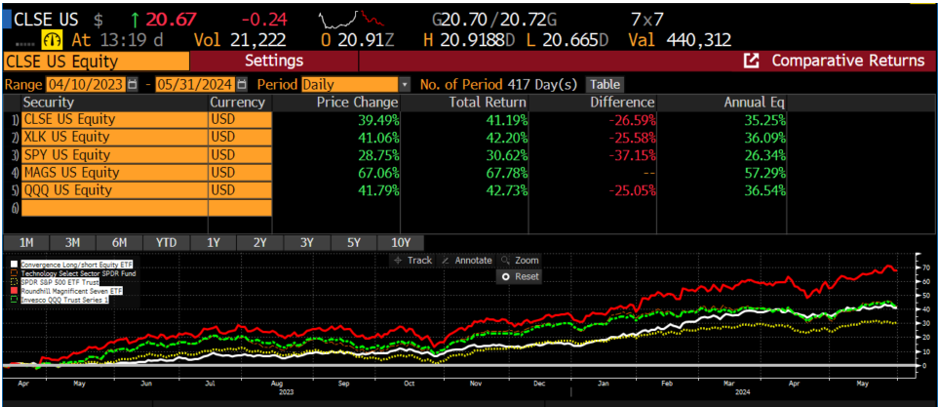

Hidden Gems: Long/Short Strategy that Captures Long Momentum

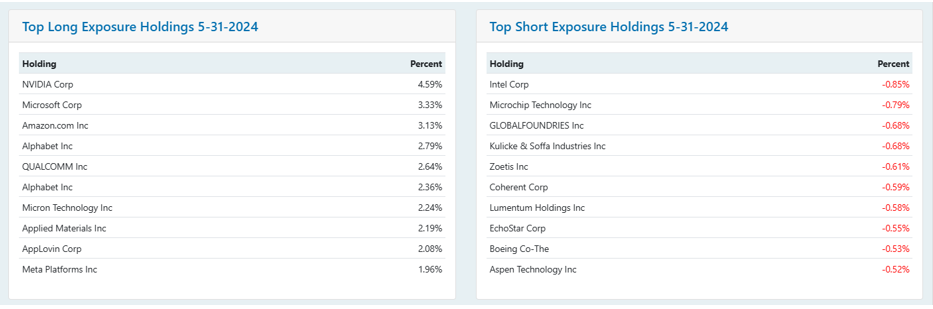

Back on February 22, 2022, Convergence Investment partners launched the Convergence Long Short equity ETF (CLSE). Maybe sometimes it is good to be lucky. Is 2,222,022 a lucky even number? The strategy seeks to provide “greater return potential than traditional approaches with its proprietary dynamic quantitative model.” See portfolio link for details and the top holdings in the current portfolio below.

Real Life Tank Battle Ground Stories

Last week we visited Texas during Consensus 2024 in Austin and met with some of the financial advisors who attended through our free conference code. Membership of the Tank has many privileges, but we don’t always have the time to meet face to face. The conference presented such an opportunity.

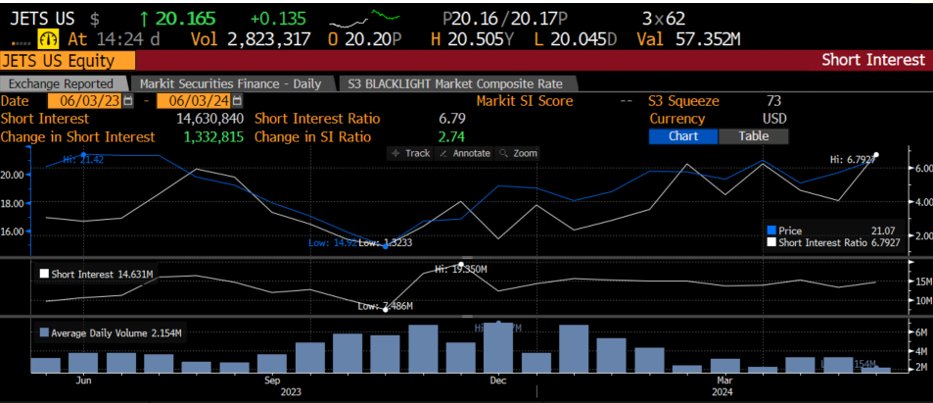

On a negative side, traveling back and forth to Texas reminded us why air travel can be so exhausting, and why the JETS ETF could be a short. We don’t frequently talk about shorting in the ETF Think Tank, but with 27% of the companies in the ETF potentially being exposed to a strike, there could be an opportunity here for traders. Within the next two weeks, it is possible that flight crews from American, United, Alaska, and Frontier will strike based upon issues around compensation and how the compensation is measured.

Summary

The YTD S&P 500 return is positive 11.3% as of May 31, 2024. This is a strong start for the year for sure, but with 60% of the return coming from 5 large caps, we really need breadth to broaden out. Social media can be an effective source of due diligence, but investors need to know the agenda of the resource and the bias of the shared information. However, just because someone has a bias or agenda that you don’t agree with does not mean that their position and argument is not constructive. Lastly, it was great to visit with financial advisors at Consensus, but flying can be a headache and travelers need to be aware that a June strike is pending (Sorry to warn you!).

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).