Week of December 11, 2023 KPI Summary

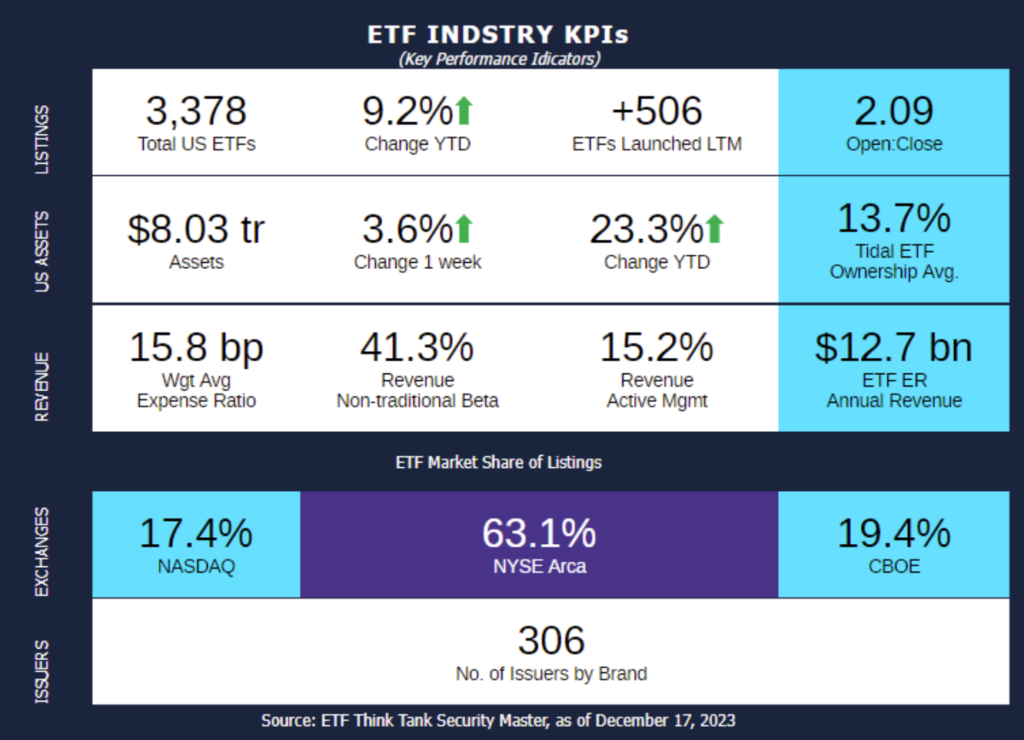

- This week, the industry experienced 23 ETF launches and 11 closures, shifting the 1-year Open-to-Close ratio to 2.09 and total US ETFs to 3,378.

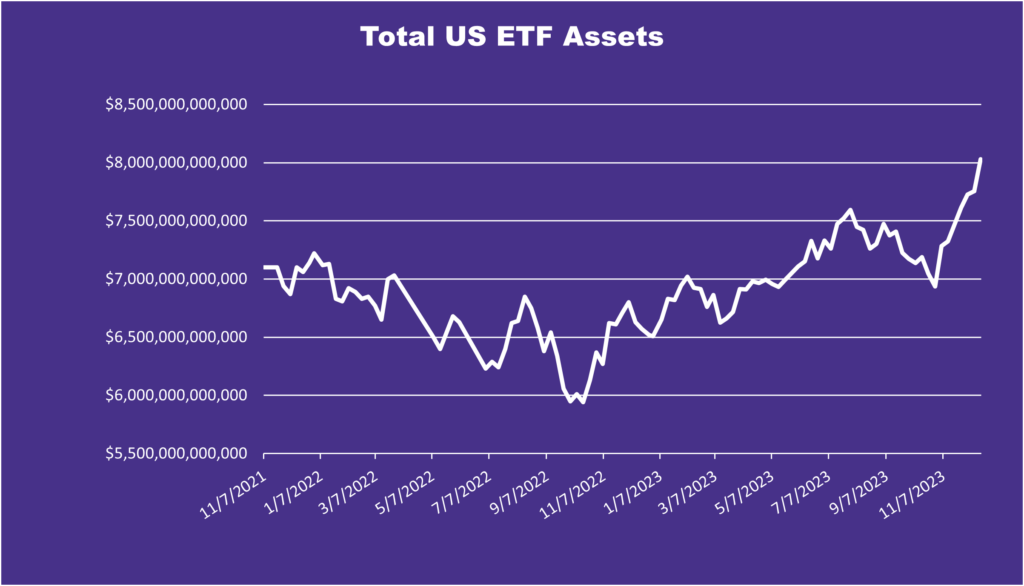

- US ETF Assets have crossed $8 Trillion for the first time! It has been 110 weeks since we crossed the $7 Trillion mark for the first time on November 7, 2021. In fact, US ETF Assets surged from $5 Trillion to $7 Trillion in one year, from November 2020 to November 2021. Since then, it has been a turbulent ride to $8 Trillion.

- Referencing the chart below, assets generally trailed from January 2021 to October 2022, where they bottomed out around $5.94 Trillion.

- Since October 16, 2022, assets have increased $2.09 Trillion in 61 weeks.

- The most recent upswing in assets has been $1.04 Trillion in 7 weeks, since October 29, 2023. As portrayed by the graph below, this is the steepest increase in assets for the 6+ week span in the last two years.

- A close second is last year around this time (10/16/2022 – 12/4/2022) with $0.86 Trillion over the 8 week period.

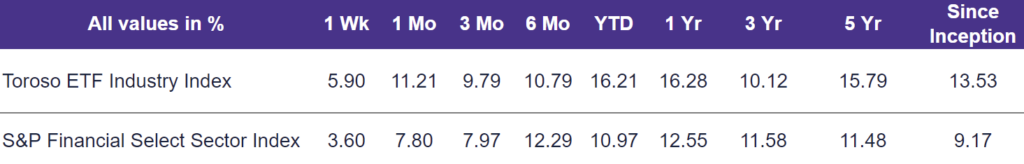

- The tracked indexes experienced similar great performances last week. The Toroso ETF Industry Index was up 5.90% while the S&P Financial Select Sector Index trailed at 3.60%.

ETF Launches

AB Conservative Buffer ETF (ticker: BUFC)

AB Core Plus Bond ETF (ticker: CPLS)

AB Corporate Bond ETF (ticker: EYEG)

AB Tax-Aware Intermediate Municipal ETF (ticker: TAFM)

AB Tax-Aware Long Municipal ETF (ticker: TAFL)

BlackRock Total Return ETF (ticker: BRTR)

Defiance Israel Bond ETF (ticker: CHAI)

FT Cboe Vest U.S. Equity Buffer & Premium Income ETF – December (ticker: XIDE)

FT Cboe Vest U.S. Equity Moderate Buffer ETF – December (ticker: GDEC)

InfraCap Small Cap Income ETF (ticker: SCAP)

JPMorgan Global Bond Opportunities ETF (ticker: JPGB)

Natixis Gateway Quality Income ETF (ticker: GQI)

Themes Cloud Computing ETF (ticker: CLOD)

Themes European Luxury ETF (ticker: FINE)

Themes Global Systemically Important Banks ETF (ticker: GSIB)

Themes Gold Miners ETF (ticker: AUMI)

Themes Natural Monopoly ETF (ticker: CZAR)

Themes US Cash Flow Champions ETF (ticker: USCF)

Themes US R&D Champions ETF (ticker: USRD)

Themes US Small Cap Cash Flow Champions ETF (ticker: SMCF)

Touchstone Dynamic International ETF (ticker: TDI)

Vanguard Core Bond ETF (ticker: VCRB)

Xtrackers California Municipal Bond ETF (ticker: CA)

ETF Closures

ETC Gavekal Asia Pacific Government Bond ETF (ticker: AGOV)

IQ Chaikin US Large Cap ETF (ticker: CLRG)

IQ Real Return ETF (ticker: CPI)

IQ Global Resources ETF (ticker: GRES)

IQ MacKay Multi-Sector Income ETF (ticker: MMSB)

IQ US Mid Cap R&D Leaders ETF (ticker: MRND)

UBS ETRACS NYSE® PicknsCore Midstream™ ETN (ticker: PYPE)

Kelly Hotel & Lodging Sector ETF (ticker: HOTL)

Kelly Residential & Apartment Real Estate ETF (ticker: RESI)

Kelly CRISPR & Gene Editing Technology ETF (ticker: XDNA)

Cabana Target Drawdown 5 ETF (ticker: TDSA)

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of December 15, 2023)

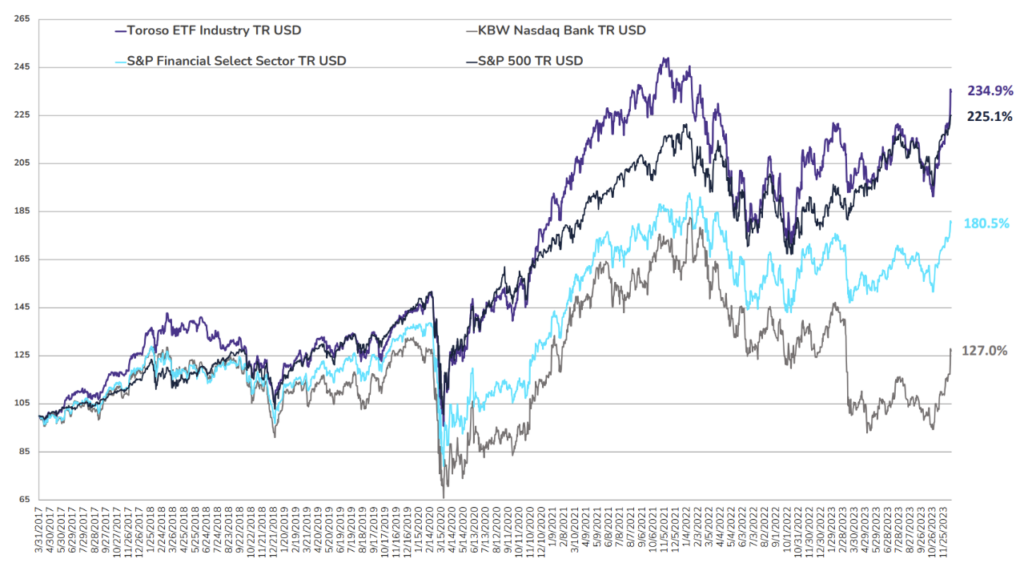

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through December 15, 2023)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.