Broad Market

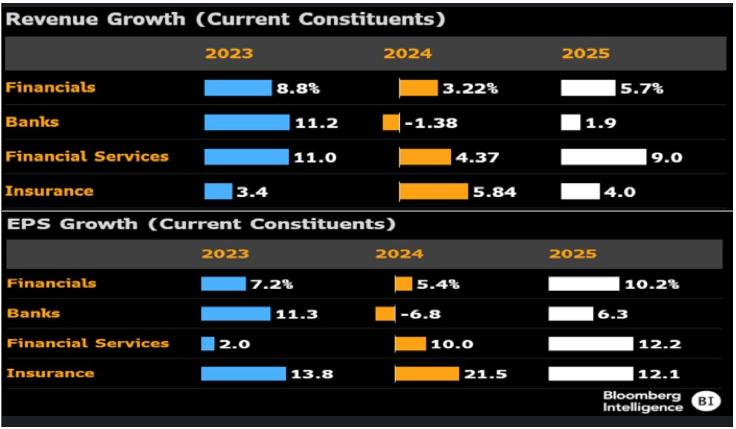

The Active over Passive argument has never been stronger than it is today in the financial services sector. Why? Bulls embracing Blockchain will say TradFi is in trouble or that they are simply poised with no choice but to dynamically embrace and adopt the technology change on a long-term basis. However, make no mistake about it. Speaking about the financial service area is like broadly speaking about food knowing that there are regional banks, service providers, commercial banks, platforms, and my favorite, insurance companies like Berkshire Hathaway. Breaking this down, Gina Martin Adams at Bloomberg highlights in the above diagram that “pure banking is no longer the dominant industry by market cap in the sector. Based on current constituents, she points out that insurance companies may be the place to overweight, with a 13.8% weighting in the constituency and an earnings growth rate forecasted at 21.5% in 2024 and 12.1% in 2025. Moreover, to be clear, this is not to say that big commercial banks are not positioned to do well given many may be very conservatively reserved.

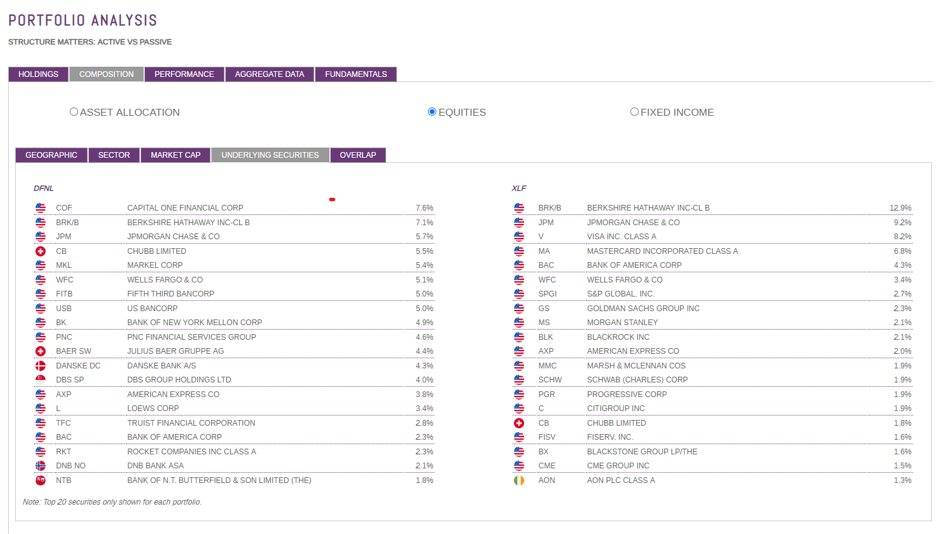

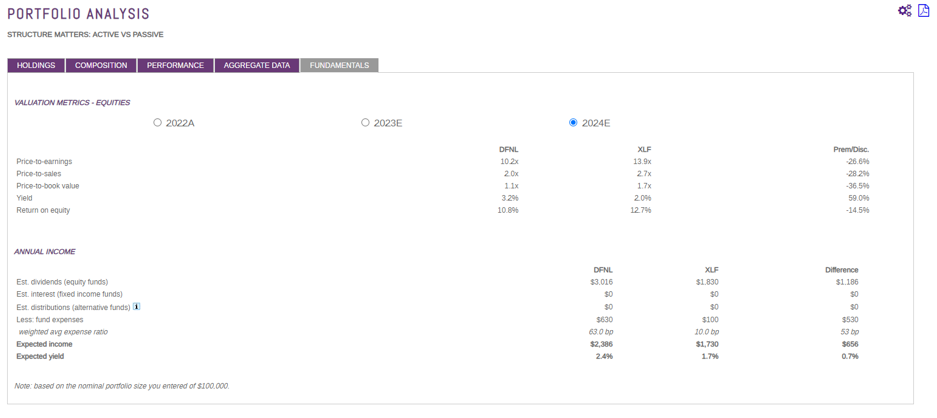

This, of course, is very good news for the overall equity market. A strong financial sector is a solid tell that a foundational base has been formed. Whether an investor is long financial stock is not important when compared to the reality that being long the equity market almost always lines up with questions around how this sector is set to perform. Remember the recent regional bank crisis and the Fed’s need to step up and protect the system. This is what happens in bad times. However, in favorable times, the financial service sector can benefit from expectations on financial growth metrics and the increased confidence that investors are willing to place on the valuation shifts around book value, cash flow, and earnings. In such times, the financial sector is also known for overachieving during swings in economic conditions. This is one of many reasons why active could outperform passive or at least why investors must be proactive in their decision to allocate to this sector. Yet, 93% of the $57,585,000,000 is held in the largest 10 ETFs, including the Financial Select Sector SPDR® ETF (XLF) which holds 56% of the total.

In fact, in comparing XLF to DFNL, you’ll find only a 30% overlap and different portfolios. In terms of PE, DFNL is trading at a 10x multiple versus almost 14x for XLF.

Over the years, we think change and disruption in the financial sector will accelerate and define how blockchain technology and infrastructure can benefit other industries and the customers they serve. This investment will be born out of necessity due to competing companies preparing to shave costs by removing some of the middle layers. We would also note that disintermediation can expedite client efficiencies and is not always good for different businesses that provide the service. Companies that do not embrace the value proposition of blockchain may themselves be disintermediated. There is a clear battle coming in the Total Addressable Market (TAM) that is served by Visa, Mastercard, and American Express on this issue. Watch out for Square, Paypal and this little company called Apple. This is why you have banks like JP Morgan, Bank of America, DBS Group, Societe Generale, and HSBC with defined solutions in stablecoin, tokenization, and/or blockchain. The internet changed how business is done and so will blockchain. Imagine how insurance, commercial banking, mortgage, and payment services will be changed in 2025 and beyond. Regulation is embracing blockchain, so don’t be passive.

Hidden Gems: India is Hot and China Is Not

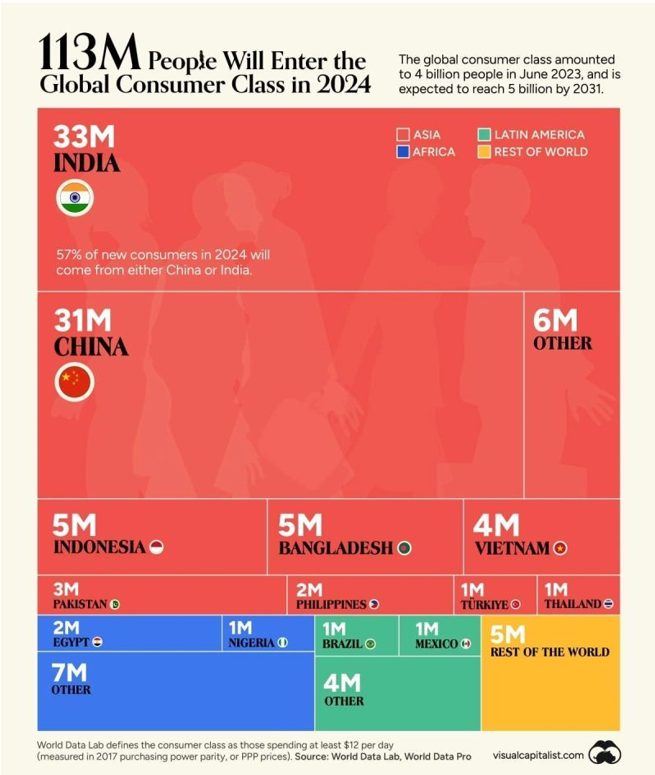

According to VisualCapitalist, 57% of new consumers in 2024 will come from either China or India, and these two economies are very important to global GDP. However, unlike China, the stock market in India remains hot. This suggests that EM investors who remain looking for a traditional strategic allocation approach may need to either invest in a fund that is X-China and/or an ETF that is targeted at India to generate alpha over the broad ETFs like EEM, IEMG and VWO. Excluding China, of course, has its own set of risks since its economy is so substantial and the broad weightings are 25-27% in China.

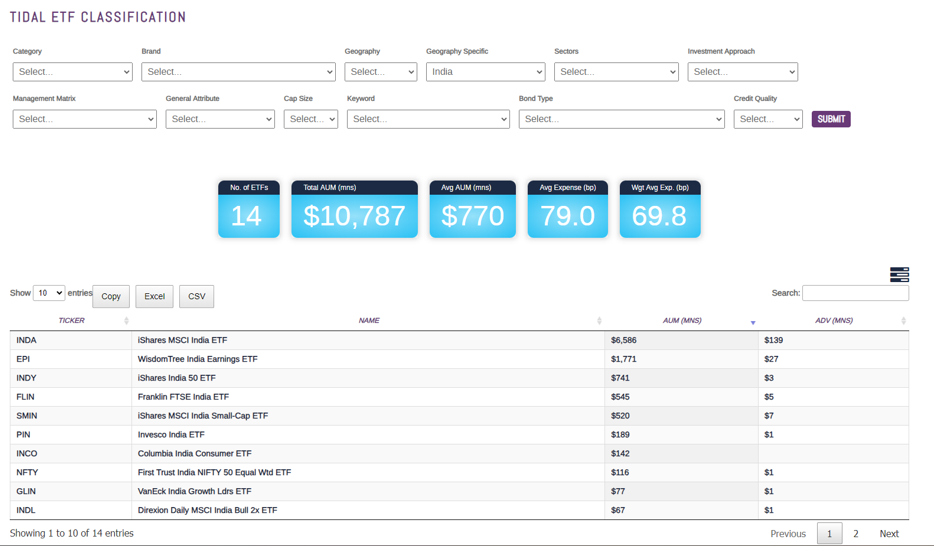

There are 14 ETFs with AUM aggregating nearly $10.8 billion dedicated to the India market, and the dispersion of returns is meaningful, but this is a function of an emphasis on the growing consumer, technology change, the small cap factor, and a broad allocation. In many cases, the largest of the funds (INDA) with a broad approach may not be generating the most alpha. Hence, we emphasize that investors should look at the individual structural differences. Earnings, as is the case for the WisdomTree India ETF (EPI), may be the call if your process has a bottoms up tilt or a focus on fundamentals over macro trends.

Summary

We think innovation and active management are in our DNA at the ETF Think Tank. Therefore, we are excited about what is happening in the financial service industry in the way of blockchain and disruption in general. To this point, over 450 ETFs have launched in 2023, up from some 378 in 2022. The fact is that the ETF market is expanding at a rapid pace, and we are encouraging all those involved to remain active in their outreach to building their business and approach to managing their client portfolios. In this week’s report we use our tools to highlight the fact that 93% of the AUM in the financial sector is using a passive approach to investing.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).