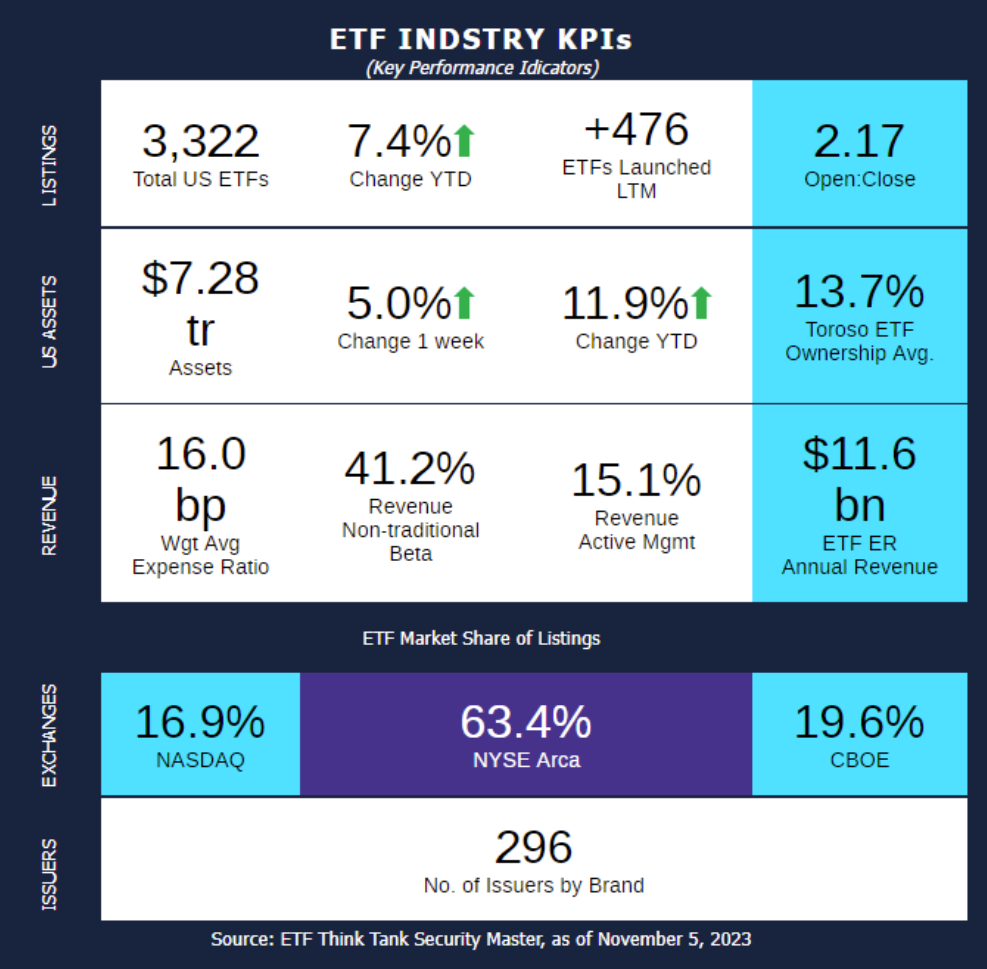

Week of October 30, 2023 KPI Summary

- This week, the industry experienced 14 ETF launches and 13 closures, shifting the 1-year Open-to-Close ratio to 2.17 and total US ETFs to 3,322.

- Firstly, the 1-week change of 5.00% this week is the highest since November 13th, 2022 (5.53%).

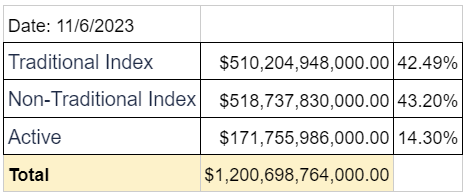

- Back in March, we gave an update on the Predicted 12-Month Revenue from Active, Traditional, and Non-Traditional ETFs, a KPI the ETF Think Tank has been tracking for over 4 years. Eight months later, let’s give an update on how it has trended in 2023 thus far.

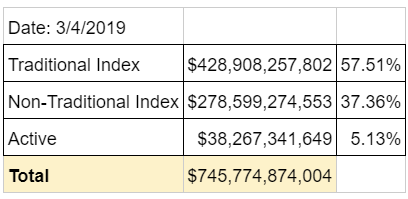

- On 3/4/2019, the breakdown looked as follows:

- Traditional ETFs dominated revenue with Active ETFs being just a sliver of the market (5.13%).

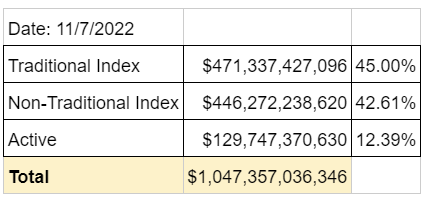

- Just a year ago (11/7/2022), the chart looked very different.

- Not only had Non-Traditional nearly matched Traditional Index ETFs, but Active more than doubled its predicted revenue percentage of the industry and more than tripled the actual revenue total.

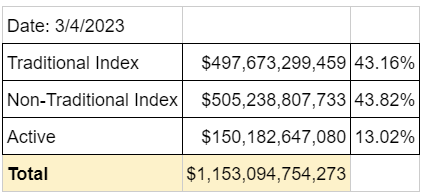

- By last March, Non-Traditional had finally overtaken Traditional Index ETFs and Active stood at 13.02% of the 12-month predicted revenue.

- Today, Active and Non-Traditional continue to take revenue from Traditional ETFs. In the past year, Active revenue has increased by $42 Billion, $21 Billion in the previous 8 months (March) and $21 Billion the 4 months before that.

- The same message from March reigns true today.

- “Active management continues to grow its influence and revenues in the ETF industry as investor’s preferences potentially shift from little to no cost cookie-cutter ETFs to actively managed, higher-expense funds.”

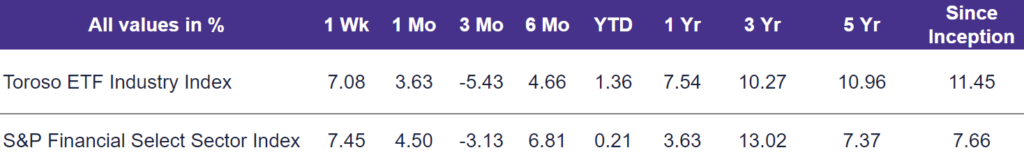

- The highlighted indexes experienced high performance last week. The Toroso ETF Industry Index was up 7.08% while the S&P Financial Select Sector Index led at 7.45%.

ETF Launches

Defiance R2000 Enhanced Options Income ETF (ticker: IWMY)

Dimensional US Large Cap Vector ETF (ticker: DFVX)

First Trust Emerging Markets Human Flourishing ETF (ticker: FTHF)

Innovator International Developed Power Buffer ETF – November (ticker: INOV)

John Hancock Dynamic Municipal Bond ETF (ticker: JHMU)

John Hancock Fundamental ALL Cap Core ETF (ticker: JHAC)

JPMorgan Healthcare Leaders ETF (ticker: JDOC)

Kingsbarn Dividend Opportunity ETF (ticker: DVDN)

Kurv Yield Premium Strategy Amazon (AMZN) ETF (ticker: AMZP)

Kurv Yield Premium Strategy Google (GOOGL) ETF (ticker: GOOP)

Kurv Yield Premium Strategy Microsoft (MSFT) ETF (ticker: MSFY)

ProShares Short Ether Strategy ETF (ticker: SETH)

Roundhill S&P Dividend Monarchs ETF (ticker: KNGS)

SRH REIT Covered Call ETF (ticker: SRHR)

ETF Closures

AdvisorShares Alpha DNA Equity Sentiment ETF (ticker: SENT)

Advocate Rising Rate Hedge ETF (ticker: RRH)

KraneShares CICC China Leaders 100 Index ETF (ticker: KFYP)

KraneShares Emerging Markets Healthcare ETF (ticker: KMED)

KraneShares MSCI China ESG Leaders ETF (ticker: KESG)

Parabla Innovation ETF (ticker: LZRD)

ROC ETF (ticker: ROCI)

WisdomTree Chinese Yuan Strategy ETF (ticker: CYB)

WisdomTree Germany Hedged Equity ETF (ticker: DXGE)

WisdomTree Growth Leaders ETF (ticker: PLAT)

WisdomTree India ex-State Owned Enterprises ETF (ticker: IXSE)

WisdomTree US Growth & Momentum Fund ETF (ticker: WGRO)

AXS Brandan Wood TopGun ETF (ticker: TGN)

Fund/Ticker Changes

Loncar China BioPharma ETF (ticker: CHNA)

merged into Range Cancer Therapeutics ETF (ticker: CNCR)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of November 3, 2023)

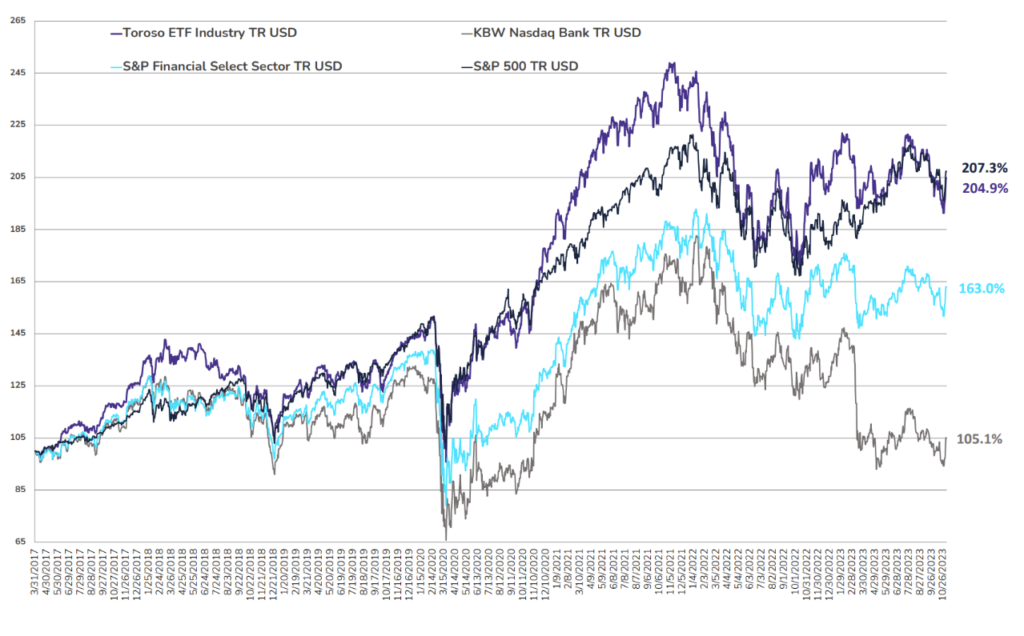

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through November 3, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.