Broad Market

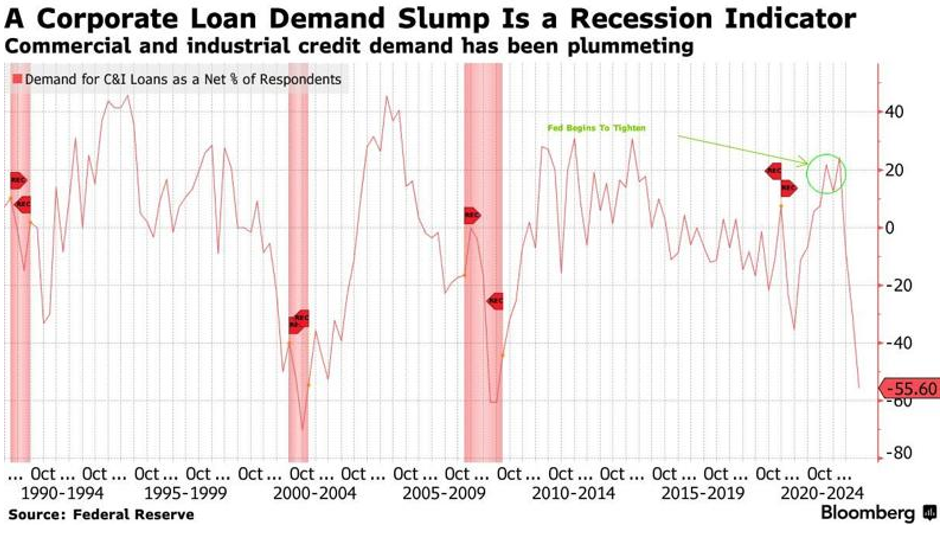

Commercial loan demand has slumped to the point that it is consistent with past recessionary periods, and investors may start to feel like they are drifting on Noah’s Ark in fear of the lost decade. The good news, however, is that under such conditions, you can at least lock in yields with positive cash flow in the range of 5-10%. The question, of course, is who has the nerve to lock in yields knowing that credit spreads are tight and, in a recession, will mostly likely widen out as the risk of defaults gathers momentum, and media attention drives fear of a handicapped Fed, a desperate Treasury, and an economy that is spinning out of control? Put differently, all this is especially interesting in the context that bonds may be relatively good value and stocks are looking at headwinds around a rationale for expanding multiples. Wouldn’t it be great to have a crystal ball? Again, good news! You are now getting paid on your cash, which is clearly an asset class!

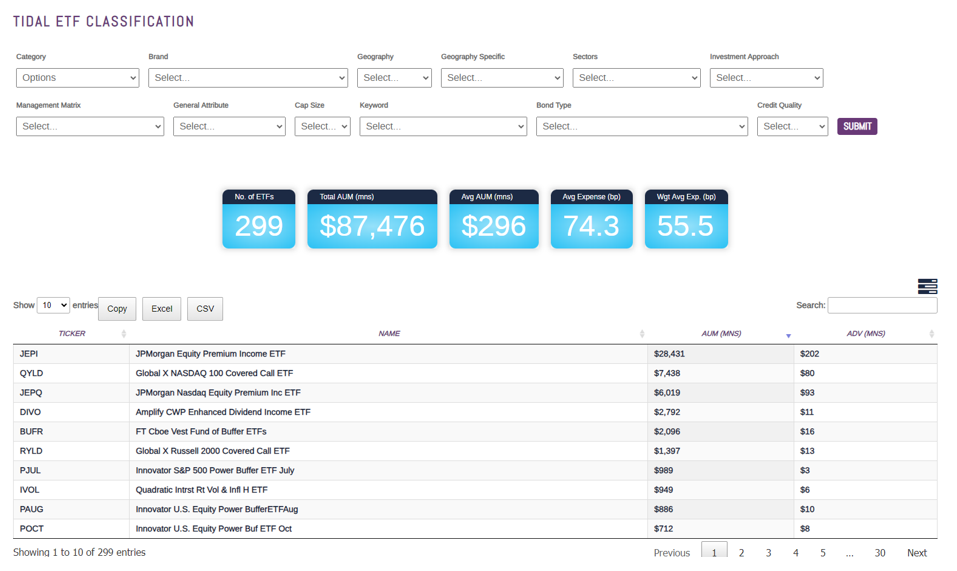

As investments, ETF solutions generate income, capture or manage volatility, and target risk as “buffer shares.” In fact, it may surprise many that options, as a strategic tool wrapped in an ETF, have become similar to a fleet of aircraft carriers, battle ships, and speed boats. This is the case for broad traditional strategies focused on the QQQs – dividend focused strategies focused on “high quality companies.” The Global X Nasdaq 100 Covered Call ETF (QYLD) has a 12 month yield of about 12%, the JP Morgan Equity Premium Income ETF (JEPI) offers a 12 month yield of about 10%, and the Amplify CWP enhanced Dividend ETF (DIVO) yields about 5%. Some of these ETF solutions are even like speed boats, aka targeted single stock positions that can yield 50%. We see the buffer shares as aircraft carriers, but these kinds of solutions may be best mixed with battle ships that provide the steady dividends from covered call writing. The point is that financial advisors looking at the different conditions should look deeper into the almost 300 ETFs and $88 billion in AUM.

We would note that the overlap between the high AUM winners remains low, below 40%. Of course, capturing option premium is not just limited to equities.

Hidden Gems: Targeting Cash Flows

Option premiums in bond ETFs can be quite exciting if an investor is thinking inflation will continue to spiral out of control or prices will simply take some time to stabilize. Yields are 18-20% on certain iShares buy-write bond strategies, like the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW), and the iShares High Yield Corporate Bond BuyWrite Strategy ETF (HYGW). Obviously, covered call strategies will not work if we go into a deep recession and the Fed has to take some action to lower interest rates. These strategies may, however, help in the event that volatility in the bond market continues and the options premiums soften the blow from credit spreads widening. However, we would highlight two points while reviewing covered call writing on bonds. First, the US 10- Year Treasury Bond since 1928 has never been down three years in a row. In 2021 it was down 4.4%, in 2022 it was down 17.8%, and in 2023 as of 10/18 it was down 5.3%. Second, since you are looking at a long direction investment, the volatility can be higher than the premium you are receiving, so do watch closely. It can be especially annoying to lose money on “fixed income” investments. Moreover, crazy as it sounds, from 1981 until 1986, the 10-year bond was up over 107%. Not bad for risk free return!!

Real Life Tank Battle Ground Stories

We have a friend in the ETF Think Tank whose name is Warren. He is always talking about covered call strategies. He has enjoyed the strategy of covered call writing over his 50 years of experience in quality stocks and ETFs. In many ways it is like clipping coupons to him, but the approach has to be maintained with discipline and an approach that is unemotional.

Summary

In many ways, especially during periods of inflation, the faster you receive your money back, the better your investments strategy is working. This is especially true in periods of uncertainty and for asset classes that have volatility. Where specific securities are even more volatile and interest rates are higher, the math can especially work. However, what is your exit strategy in these types of investments when conditions return to normal? Note that these kinds of securities should always be part of your alternatives universe strategy. We never recommend moving too far from what you know with an investment allocation because what is working feels good or looks like it will continue to work indefinitely. Nevertheless, as conditions warrant, investors should ways be open minded to look for innovative solutions.

If we are truly in a period where Noah’s Ark is different than Cathie’s, having a fleet of option-based ETF solutions may help with the journey to prosperity.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).