Broad Market Commentary & Social Media Shares

Fixed income was all in the news last week. Arguably, the Fitch treasury downgrade and other signs of trends in credit spreads could throw a wrench into the possibility of a soft landing. Worse than that, it also seems that inflation will remain higher for longer, which could present further challenges for the 60/40 model and the Federal Reserves’s ability to manufacture economic stimulus. To say this market is reliant on momentum built off a bottom is an understatement. Even Apple, from the much anticipated earnings report looks to be giving back part of its trillions of market cap. These are paradoxical conditions for sure, and a reason for financial advisors to look even closer at non-correlated and alternative asset classes than ever before. Of course, the simple truth is that evidence of healthy capital markets would be be seen in a broadening of the equity market and boring conditions in the fixed income market. Wouldn’t it be wonderful if we just went sideways for a couple of months while conditions stabalized?

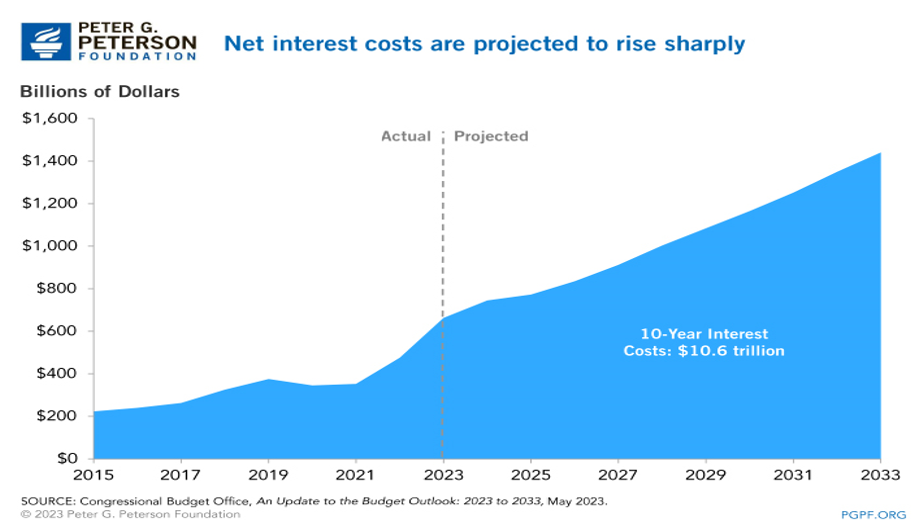

There are few certainties right now, but with higher interest rates and more U.S. debt, it remians certain that regadless of a recession, stagflation, or economic growth, the interest payments on America’s debt wil continue to rise. Those looking for KPI’s to shake confidence will find the Peter G Pertson article, which states “The Congressional Budeget Office (CBO) projects that interest payments will total $663 billion in fiscal year 2023 and rise rapidly thoughout the next decade – climbing from $745 billion 2024 to $1.4 trillion in 2023. In total, net interest payments will total nearly $10.6 trillion over the enxt decade.” See image below:

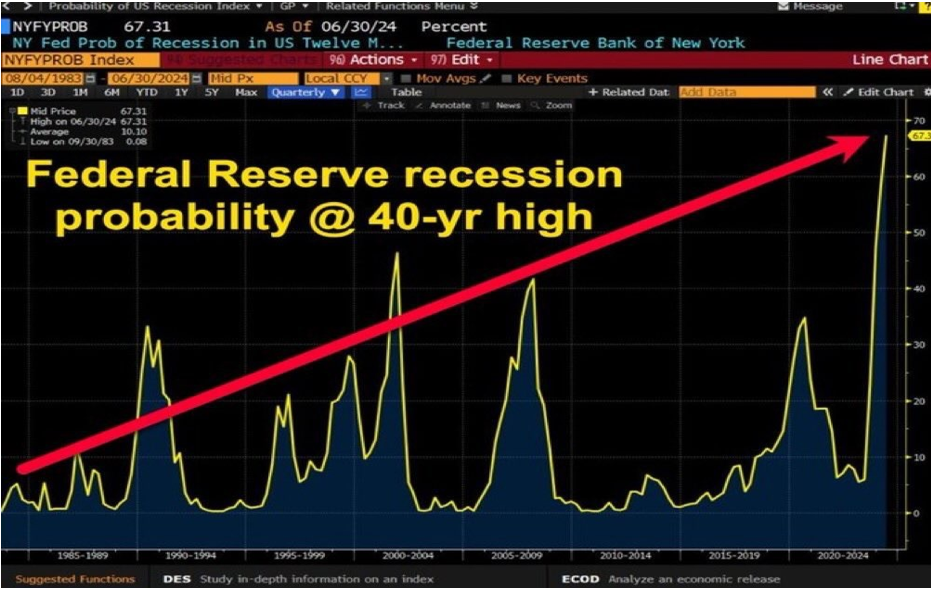

Those looking for certainties and confidence around the most forecasted recession in history will find the news that the probability did hit a high, and then pull back to below 66%. The high was 70.84%. Historically, playing such odds would lead to the purchase of TLT, but given the downgrade, this trade may not work as well. Again, there is a reason why they say past performance is not indicative of future outcomes, aka conditions are different!

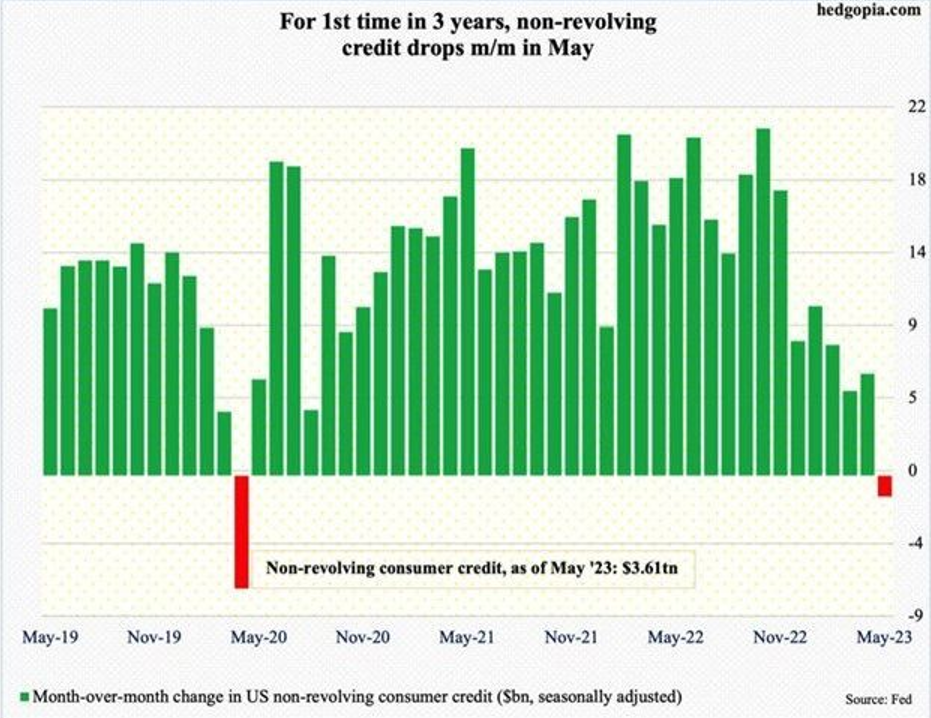

The risks of a credit contraction needs to be monitored closely, which is why there should be concern that for the first time in 3 years, non-revolving credit dropped in May.[i] After all, what would it mean if credit spreads widen out on higher Treasury costs? Oh my word that would be ugly!

The mortgage refinance market has, not surprisingly, plunged to multi-decade lows, as 7% rates provide little opportunity for cost savings.[ii] This is arguably a good thing for certain consumers who are well positioned with their housing opportunity, and a bad thing for others. Regardless, here is a twist of fate irony. Unemployment, a key inflationary driver, will continue to remain low, so long as stock market prices remain high. After all, it is difficult to lay people off when your stock price is trending higher, or even near an all-time high. Think about this issue when you are hoping for a stock market rally, when interest rates remain trending higher. We can only hope that the Treasury bond market ends up being the exception to logic and math.

Hidden Gems: Measuring Performance

Hidden Gems: ETFs Worth a Second Look

While taking a second look at these funds which are currently positioned defensively and focused on Strategus’s analysis around policy and lobbying, one should wonder how Dianne Feirstein can continue her role in Congress when she has ceded power of attorney to her daughter? Thank you for your service Dianne Feirstein, but isn’t this kind of a conflicting decision, at odds with your California voters’ interest? Sorry for talking about politics here, but this was too juicy! By the way, to be clear – and with respect, somehow this 90-year-old person seems to be very active. Check out her press releases. (see link here)

Highlighting the two Strategas Asset Management Funds (SAMT and SAGP), we suggest the key thesis that drives the performance – structure matters. In times when alpha is achieved, the inflexion point will validate the structure and strategy. However, we should always remember that performance is backward-looking and not always indicative of what might work in the future. What we invest in is always about the outlook for the future and not the past. Thus, we believe that sometimes, looking under the hood to determine what has not worked recently is just as important as catching the buzz and momentum on what is working well.

In the white line is the SAGP Fund whose mandate is to identify 5 Global Macro themes. The interesting part of this ETF is the fact that its high active share strategy only has a 15% overlap to the Invesco Aerospace & Defense ETF (PPA). Note we recently also wrote about defense as a theme, so this is consistent with our overall posture (see link here).

Today, these themes are:

- Geopolitical Risk/Global Defense Spending

- Supply Chain/Manufacturing/Onshoring

- Healthcare Innovation/Merger Activity

- Corporate Tax Increases

- A Global Allocation with a US Tilt

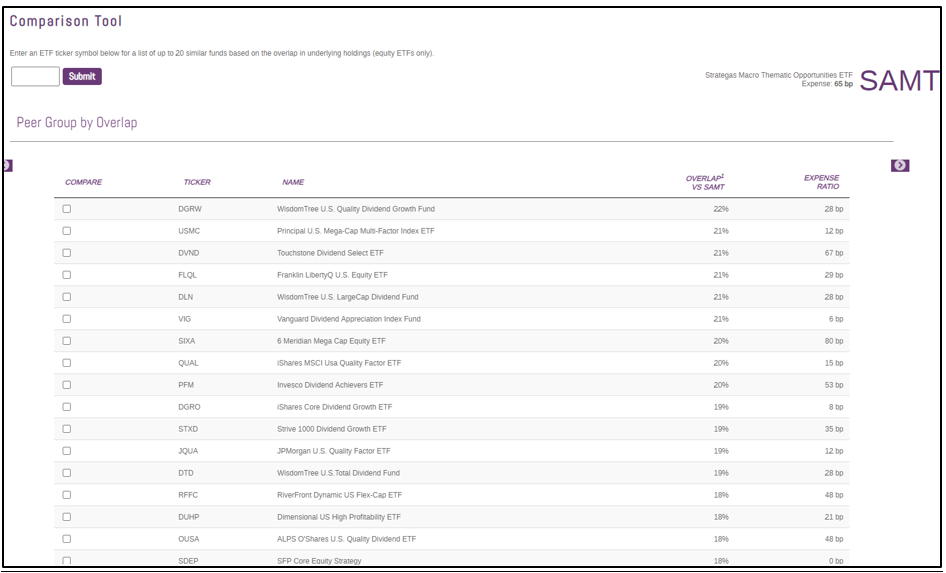

Noteworthy is the fact that the Strategas Macro Thematic Opportunity Fund (SAMT), by design, currently has similar minimum low overlap to funds, but clearly emphasizes high quality, low volatility, and dividends.

Real Life Tank Battle Ground Stories

Inquiry/Perspective: Financial Advisors drawn to the ETF Think Tank tend to be seeking research on alpha and risk management. Thus, when a 90-day T-bill is offering a yield of 5.44%, this presents both an opportunity to grow your book of business, and a simple place to allocate to “risk free return.”

Answer: Boring may be better these days as we are in the summer months. Most importantly, these yields are compelling prospecting tools. We know several financial advisors who have drawn big pools of capital by simply reminding people that these yields are available and an opportunity.

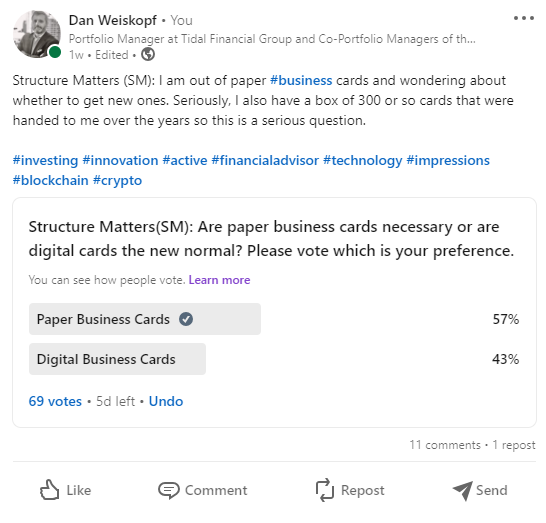

Speaking about prospecting tools, we want to hear from you. Please do find some time to vote on the poll regarding which kind business card you prefer to use, paper or digital (see link here).

Summary

Markets sometimes offer a gift, especially when uncertainty is high. We see cash as an asset class that yields 5% as a smart investment given these uncertain times. We remain avid believers in innovation and growth, but while looking under the hood at the Strategas funds, we are reminded that thematic investing is about where the puck may be going, which is sometimes driven (or at least influenced by) government policies.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).