The ETF Think Tank proudly supports capitalism and entrepreneurship. However, the expiration of Vanguard’s patent has had a negative impact on innovation within the ETF industry. While we don’t anticipate significant changes at Vanguard, it’s worth acknowledging that the firm’s core mission of saving billions of dollars for investors has positively affected millions of people. Some say investors have saved as much as $175 billion since the firm was created in 1974. Thank you, Mr. Bogle! Furthermore, the firm’s core mission is expected to target an additional $1 billion in savings for its shareholders in the coming years. [i]

So why are we excited to see the patent expire? Simply put, the patent enabled Vanguard to offer ETF shares as a side option to their giant mutual funds, giving them a pricing advantage in the asset management industry. Arguably, this advantage has led to Vanguard’s dominance in market share growth that focuses mostly on accelerating their efforts to lower fees across the industry as a “race to zero.” Why is this bad? In truth – isn’t this how capitalism should work?

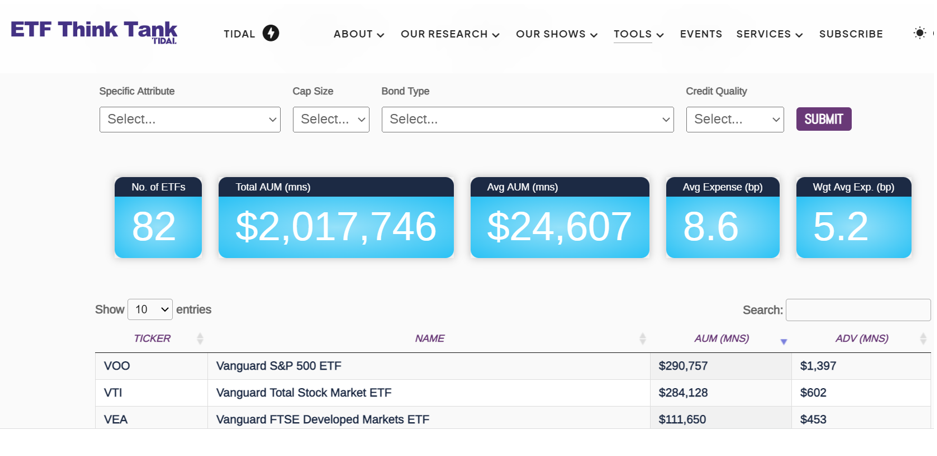

Investors have certainly voted with their wallets. Vanguard’s assets under management (AUM) are now above $2 trillion and represents almost 29% of the nearly $7 trillion in AUM in the U.S. As unpopular as this statement may sound, this is bad. When a major product provider focuses solely on fees and the commoditization of broad investor access, it creates a barrier to entry against competitors who want to launch creative or differentiated solutions from the broad ETFs. Call it the trickle-down effect in asset management. If the breakeven for an ETF requires 20% more AUM, the risk of success is that much harder to achieve. The average expense ratio today is now 16.8 basis points (Bps), while Vanguard Funds carry an average of 8.6 Bps. It’s worth noting that there was a time when the average expense ratio was 20 Bps.

Does the Patent Expiration Mark the Moment?

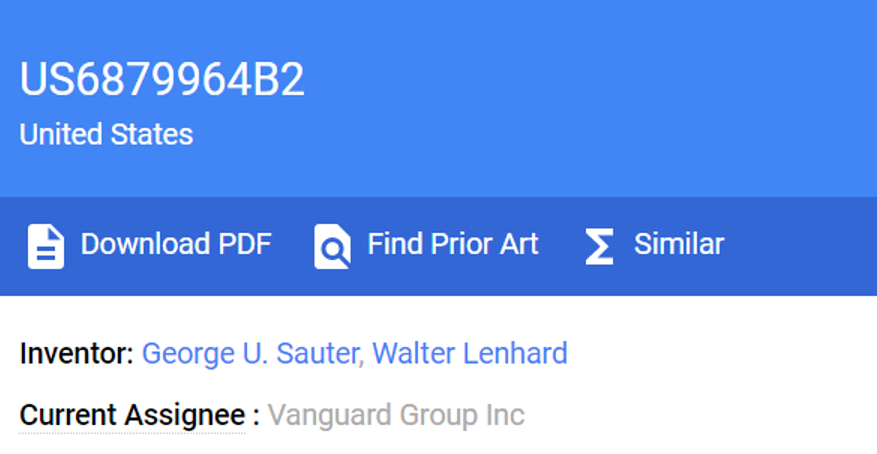

To clarify, we want to emphasize that we do not believe everything is negative. The patent protection of intellectual property is at the core of capitalism. Twenty-three years ago, when George Sauter and Walter Lenhard filed for patent US6879964B2 to further Mr. Bogles vision, it was pure innovation. However, the tribal focus on fees could have consequences if the bull markets in US stocks and bonds don’t go back to the normal environment that was led by cheap money over these past 10+ years. The power of effective compounding and the continued addition to 401Ks make for a very satisfied investor base around a core philosophy of setting and forgetting a portfolio.

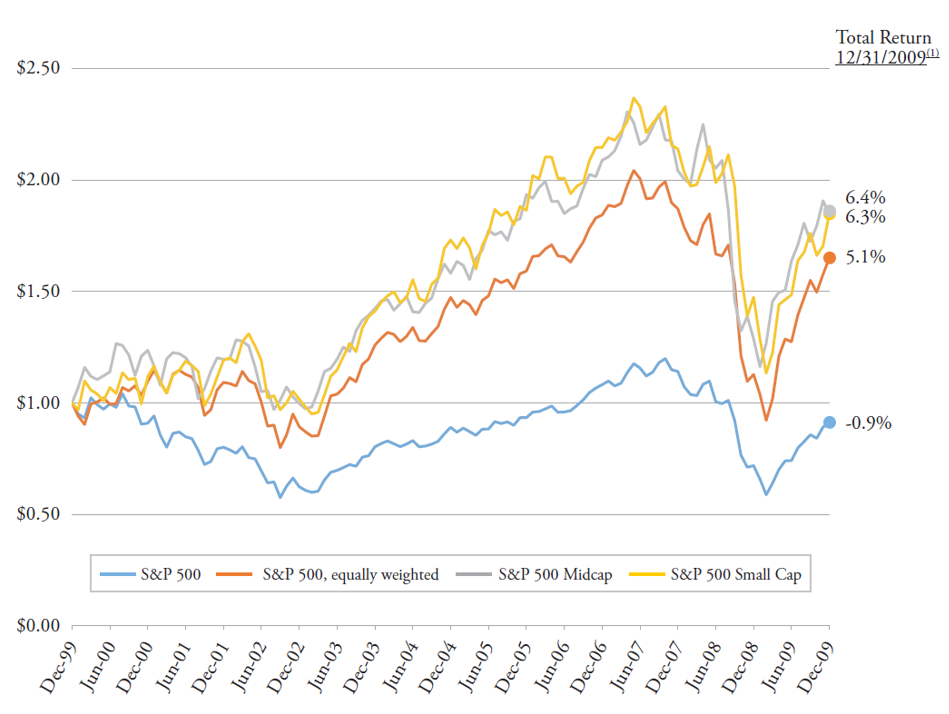

What would happen if we had another lost decade? Wouldn’t it be ironic if we went through another “lost decade of returns” (Like 1999 through 2009) at the point of expiration of the Vanguard patent? Purely coincidental – we are not suggesting any causation, but under conditions where investor returns remain stagnant for a decade, individuals would have to be smarter and do different things to make money in their traditional portfolios.

In the Absence of Value, Price Matters

We live in a world of incentives and biases. Anyone who has studied behavioral finance will agree that people allocate money according to their own perceived investment philosophy, past historic performance, and of course, fear and greed. There is no need to explore funds with high active share and/or high conviction when the low-cost model is working. Additionally, why seek to diversify in non-correlated strategies when the rising tide is floating all boats? However, if market dynamics have indeed shifted, it may be necessary for investors or their advisors to start thinking outside the box and beyond just price. Remember this saying: “In the absence of value, price matters.”

We in the ETF Think Tank have always been more excited by the access that ETFs bring to investors than the fee advantage. Our concern is that Vanguard’s strategy of removing pricing power from the ETF market creates a broad headwind for all issuers and ETF entrepreneurs. This is because it drives a higher entry barrier into the asset management industry. Therefore, we were pleased to see the progress that investors have made with their increased allocation to actively managed ETFs. According to the Wall Street Journal, “active funds currently represent approximately 6% of the net assets of the complete ETF market, however, they garnered nearly 30% of the total fund flows in 2023.” Approximately 1,000 actively managed ETFs are available in the U.S. and the top ten in terms of capital inflow in 2023 cumulatively attracted $15.42 billion. Actively managed funds today represent over 13% of the revenue for the ETF industry. (See our latest KPI data.) We think this climbing market share is a positive development as it demonstrates innovation is alive and well!

Like Thomas Edison’s patent for the light bulb, we understand why one could argue that the Vanguard patent and philosophy shined a light through savings and investing for millions of people. We also appreciate that Vanguard as a platform has made it easy for these same investors to run portfolios like the patents for the combustion engine and computer. The patent itself was innovative and disruptive for sure. However, our concern lies in the fact that it has created a higher barrier to entry for ETF Entrepreneurs, limiting their opportunities in the market.

Respondents – feel free to just say, “Suck it up ETF Professor!”

[i] Vanguard $1 billion goal https://advisors.vanguard.com/insights/article/howvanguardplanstoreturn1billiontoshareholdersby2025#:~:text=Through%20these%20channels%2C%20Vanguard%20has,to%20the%20%241%20billion%20goal.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).