The nominations for the 2023 ETF.com Awards are out, and the list of contenders for best ETF of the year fittingly capture the mood of the market in 2022 – it was a year of hunting for income and focusing on capital preservation in the face of an inflationary environment.

Among the ETFs running for the top prize is the J.P. Morgan Equity Premium Income ETF (JEPI).

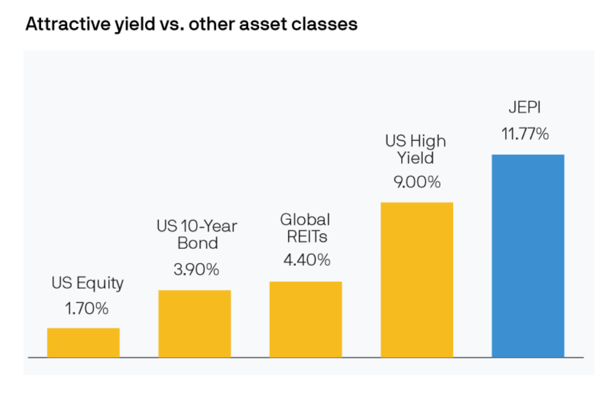

JEPIinvests in large-cap U.S. equities and uses an options overlay (it sells S&P 500 call options) to generate income in the form of options premium. That options premium is smartly wrapped in equity-linked notes (ELNs) so that it becomes bonafide income and is taxed as dividend income.

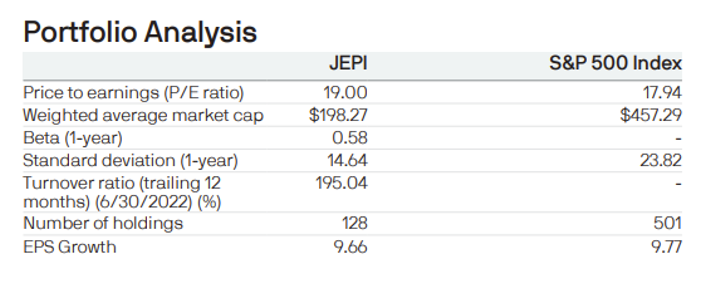

It’s a clever strategy that once was offered primarily to institutions in a mutual fund wrapper. J.P. Morgan Asset Management debuted it in ETF form in mid-2020. It’s been, by all accounts, a blockbuster success in the asset gathering race, probably because it comes from an institutional background first from a big-name brand and advisors like that. But, more importantly, because it has delivered on its design. JEPI offers some upside market participation with lower volatility (standard deviation) and high monthly income.

What About JEPI?

As we’ve watched JEPI grow, the question we’ve been wondering about is this: Could this ETF get too big to effectively manage its options position?

Why? Maybe it’s just a case of muscle memory, but our shared historical baggage in this industry includes stories like Good Harbor Financial.

If you recall, back in 2014, Good Harbor was a darling in the ETF strategist space, having nearly tripled in size in just two years to about $11 billion in assets. Just as we marveled at the firm’s quick growth, we watched it fall victim to its own success. Good Harbor’s trades became so massive and predictable, they landed on everyone’s calendars, and became easy to time, which ultimately impacted results. Good Harbor ended up losing more than 80% of its assets following a year of bad performance, according to news reports at the time.

While Good Harbor isn’t a direct parallel to JEPI – it’s barely a tangential anecdote at best – the concept is somewhat similar: Could rolling a large options position on a regular basis become a problem?

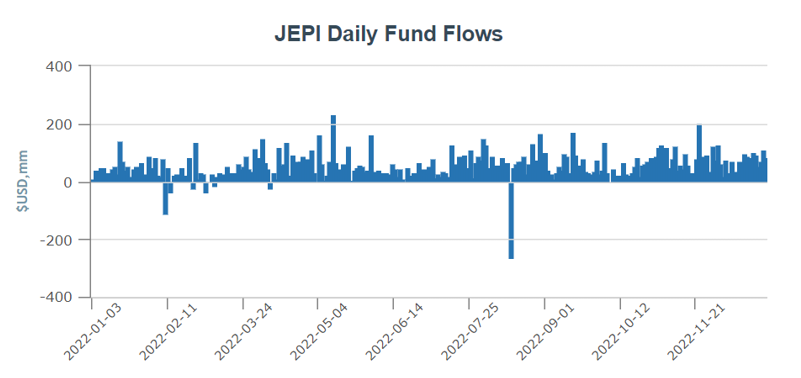

Consider JEPI’s asset growth. The fund took in nearly $13 billion in net creations in 2022 alone, and so far in 2023, hasn’t seen any redemptions, taking in another $4.6 billion in just over two months.

Asset Growth in Pictures

- 2022 Calendar Year Net Flows: +$12.7 Billion:

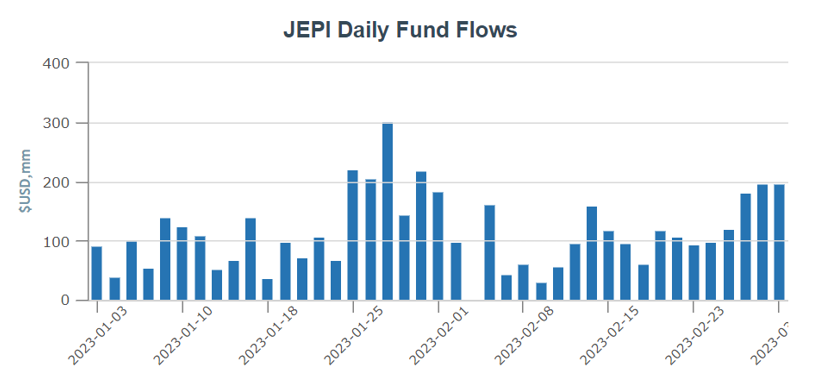

- 2023-To-Date Net Flows (Through March 3): +$4.6 Billion:

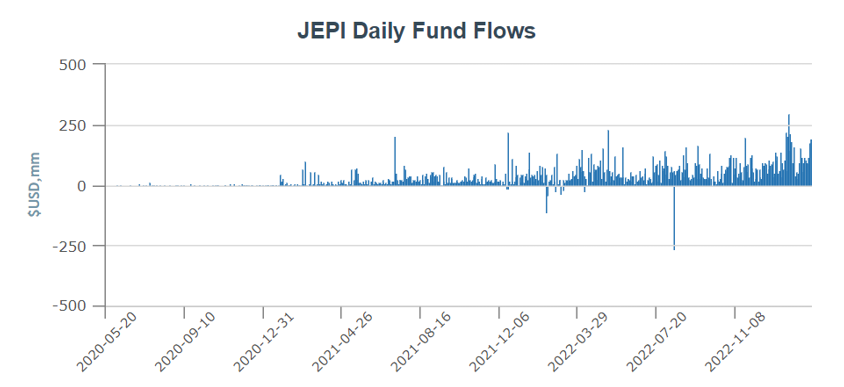

- Inception-To-Date Net Flows (May 20, 2020 through March 3, 2023): +$23 Billion – Note the acceleration in asset gathering since inception roughly 2 ½ years in:

These charts show a fund that’s not only attracting a lot of assets, but has seen its asset growth accelerate.

At roughly $22 billion in total assets today (as of March 3, 2023), JEPI now holds roughly $3.3 billion in ELNs (the options positions that requires monthly rolling as they expire), or about 15.6% of its portfolio. That’s a big position.

Should we worry about capacity?

Why JEPI Works Well

According to J.P. Morgan Asset Management’s Hamilton Reiner, portfolio manager and head of U.S. Equity Derivatives at the firm, the rolling of JEPI’s large options position is unlikely to become an issue. Should you watch it? Always, he says. Should you worry about it? Probably not, in his opinion.

There are 3 good reasons why that may very well be the case.

- First, because of the depth of the S&P 500 options markets, which is roughly a $1 trillion market today.

The pool where JEPI is swimming is deep, really deep. Depth of market – or liquidity of the underlying market – is a key consideration when looking at an options-based strategy because it impacts how easily you can transact in and out of that space. (This is something we should all remember as we evaluate options-based ETFs.)

What’s a $3 billion position in a $1 trillion market? Certainly, liquidity was a consideration in the design of this product, which, had it been tied to something other than S&P 500 options, might be a little more worried regarding the execution on options trading.

“Given the S&P 500 index options trade $1 trillion per day, I’m comfortable I’m trading in an asset class that’s the most liquid, largest equity in the world,” Reiner said. “I can’t tell you I ignore it, but for anyone that trades a strategy, having the S&P 500 index options as the backdrop and large cap equities, that’s a good place to start to feel comfortable from a capacity perspective.”

- Second, JEPI ladders and staggers its options positions so that the rolling of these contracts, averaging monthly duration, doesn’t happen at once.

There’s no single big trade, so to speak, in this Fund. “We have the ability to trade multiple times per week, multiple times per month,” Reiner said.

It’s a disciplined approach consisting of several smaller, regular trades in a process that’s systematic. Moreover, the Fund relies on several counterparties (how many no one knows exactly) to execute in the options market, making predicting a trade very difficult if not entirely impossible.

- Finally, the process of managing the options position is systematic, but it’s veiled in opacity.

No one really knows what options contracts are coming and going, or who the counterparty is on these transactions (in the outside world.) You could argue JEPI is a transparent ETF that’s not fully transparent in the details. And that’s ok.

A certain level of opacity in the active management of a large – and growing – ETF that relies on a large – and growing – options position has enabled this Fund to operate effectively, delivering solid monthly income (30-day SEC yield currently sits at 11.15%) and strong upside market capture with lower volatility, as designed.

Transparency may be one of the celebrated traits of ETFs, but JEPI is a good example where giving up a little visibility may not be all that bad in pursuit of a better, more effective outcome. That said, JEPI is still growing, so it’s probably good practice to keep an eye on how this Fund continues to handle its success.

And we’ll be watching come May to see if JEPI takes the year’s top prize. Congratulations on the nomination!

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).