Week of February 13, 2023 KPI Summary

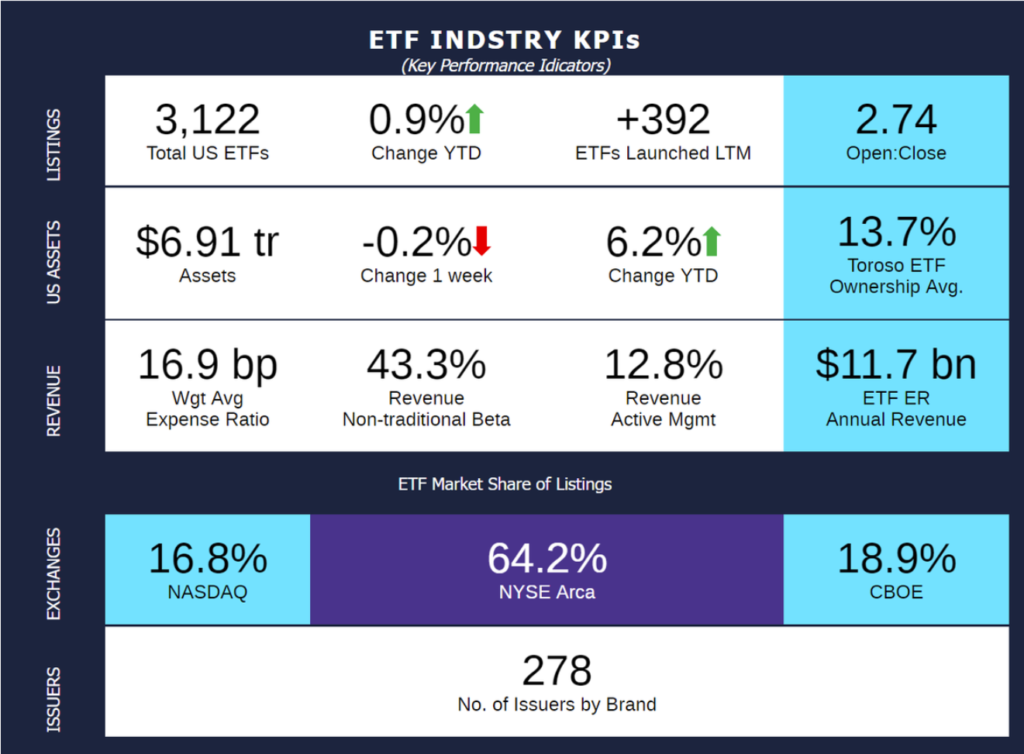

- This week, the industry experienced 5 ETF launches and 4 closures, shifting the 1-year Open-to-Close ratio to 2.74 and total US ETFs to 3,122.

- We hope everyone enjoyed President’s Day yesterday whether it was used for rest or productivity. This week let’s take a look at which ETF categories have been productive since President Biden took office (1/20/21) and which have been resting (data compares 1/19/2021 to 2/12/2023).

- The ETF industry has had some ups and downs in the past 109 weeks of Biden’s Presidency but has increased 23.1% overall.

- The largest increase in assets was Managed Futures with 512% increase from $0.23 B to $1.42 B, and a notable second place of Options with 218% increase with nearly double the Options funds now (from 117 to 207).

- The worst performing category was Volatility ETFs at -43.7% in the period.

- Since Equity and Fixed Income make up a combined 95.4% of assets, it would be irresponsible not to mention their progress. Equity has risen 23.36% while Fixed Income has nearly matched at 23.22%. For their varying performance week-to-week in the past 12 months, it was surprising to see them this close over the 25 period approximately.

- The ETF industry has had some ups and downs in the past 109 weeks of Biden’s Presidency but has increased 23.1% overall.

- Fun Fact: President Biden has been President for 763 days, and in those days, the ETF Industry has an additional 797 total funds! How would you complete this: An ETF a day keeps the _______ away. A) Fees, B) Taxes, C) Hedge Funds, or D) All of the Above

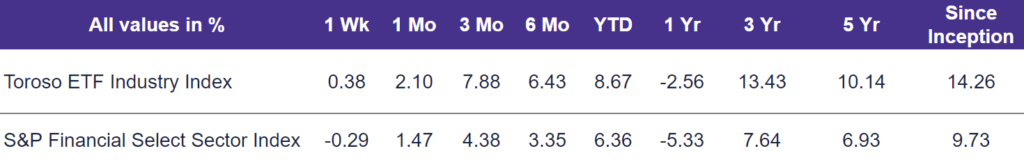

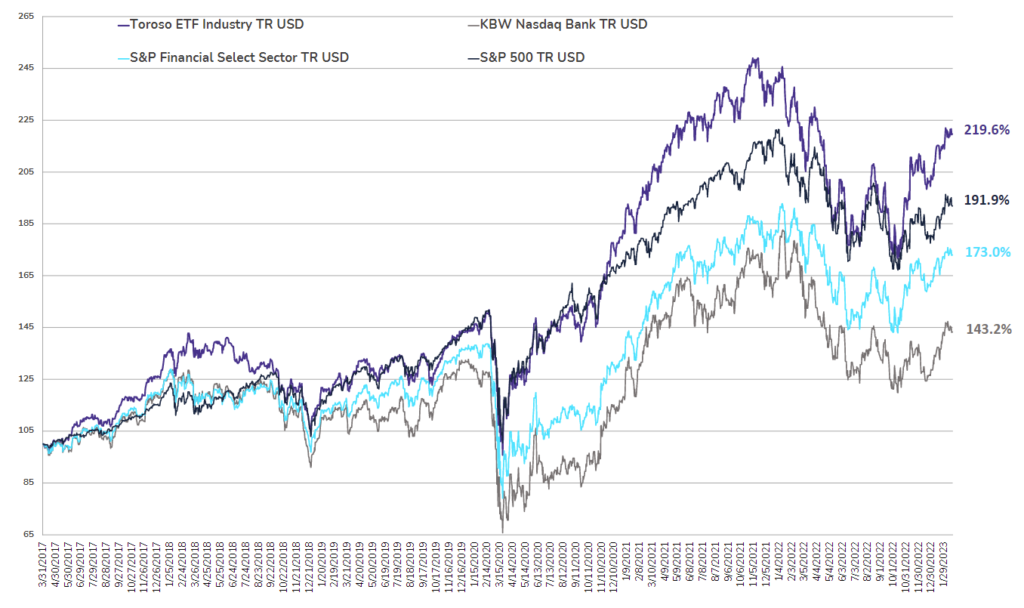

- The highlighted indexes experienced differing performance last week. The Toroso ETF Industry Index was up 0.38% while the S&P Financial Select Sector Index trailed at -0.29%.

ETF Launches

Cambiar Aggressive Value ETF (ticker: CAMX)

iShares Future Metaverse Tech and Communications ETF (ticker: IVRS)

Engine No. 1 Transform Supply Chain ETF (ticker: SUPP)

MicroSectors™ Energy -3X Inverse Leveraged ETN (ticker: WTID)

MicroSectors™ Energy 3X Leveraged ETN (ticker: WTIU)

ETF Closures

iPath® Shiller CAPE ETN (ticker: CAPD)

Barclays Return on Disability ETN (ticker: RODI)

Pacer® iPath® Gold Trendpilot ETN (ticker: PBUG)

Barclays Women in Leadership ETN (ticker: WIL)

Fund/Ticker Changes

Procure Disaster Recovery Strategy ETF (ticker: FEMA)

became Procure Disaster Recovery Strategy ETF (ticker: FIXT)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of February 17, 2023)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through February 17, 2023)

Source: Morningstar Direct

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.