Week of February 6, 2023 KPI Summary

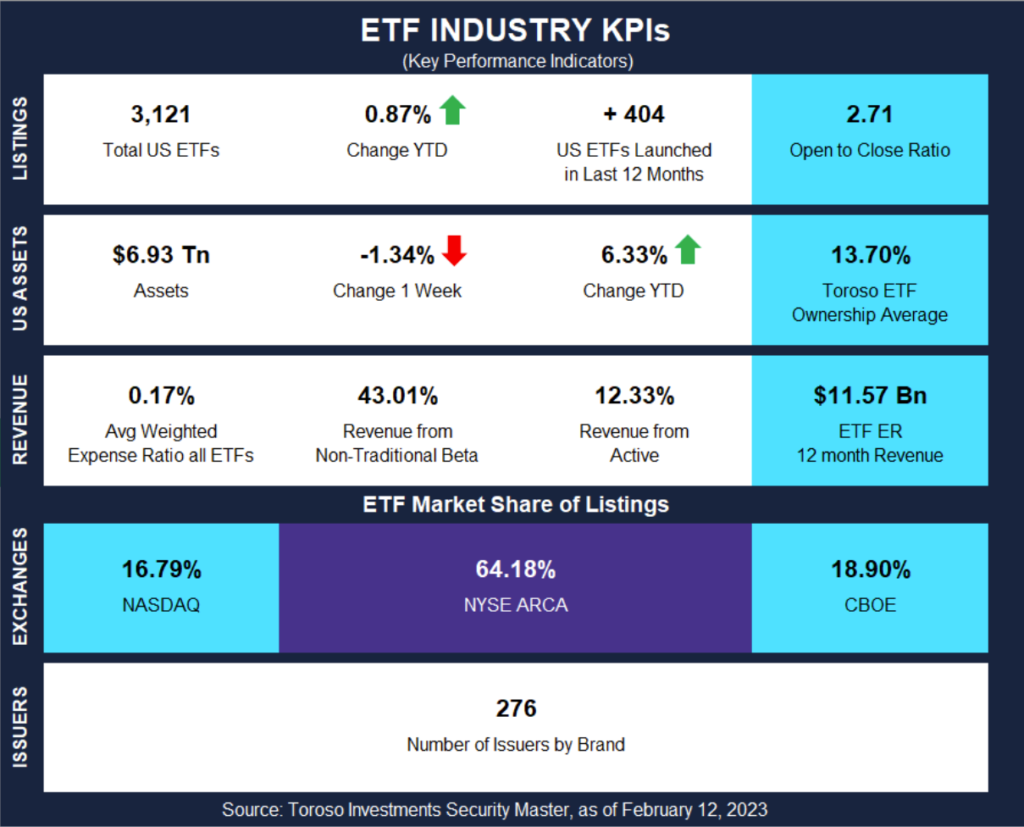

- This week, the industry experienced 6 ETF launches and 3 closures, shifting the 1-year Open-to-Close ratio to 2.71 and total US ETFs to 3,121.

- Now that Superbowl Sunday is behind us, it’s possible another American holiday has snuck up on some of us: Valentine’s Day. Last year, we wrote about Valentine’s Day near all-time high spending and expensive ETFs. With lovebird spending predicted to be up 8% from 2022 (according to Statista), let’s run this back and see where there is a trend or a change.

- Examining ETFs with expense ratios of 0.75 and higher (which make up approximately 20.7% of total US ETFs), they are returning 4.42% YTD on average, slightly underperforming the industry at 5.44%.

- In 2022, the 0.75 and higher ER ETFs made up 19% and outperformed the industry.

- The 648 ETFs that charge 75 bips or more make up approximately 2.21% of the industry (~$152 Billion), though it is top heavy with the largest 5 totaling $35.7 Billion in assets (23.5% of the $152 Billion).

- In 2022, the top 5 totaled $47.3 Billion (26.9% in comparison). This is due to these expensive ETFs underperforming the industry. While the industry is down -6.76% in 12-months, the 75 bips and up club is down -9.2%.

- Of those 648 ETFs, 29 were launched in the past 12-months with assets totaling $1.0 Billion.

- 13 of the 29 are Geared/Swaps by Direxion, many of which are single stock ETFs.

- Lastly, Active funds combine for 57.1% of these expensive ETFs while making up 33.6% of the current ETF fund total. In comparison, last year’s active funds were 49.8% of expensive ETFs while Active ETFs were 28.1% of the industry. Active ETFs do have the highest average expense ratio at 0.52 compared to Non-Traditional (0.41) and Traditional (0.35) ETFs.

- As Valentine’s Day is getting more expensive for Americans, the ETF industry has become slightly more costly over the past 12-months, as well. Though the average expense ratio is up from 0.41 to 0.43, the weight average is down from 0.27 to 0.24.

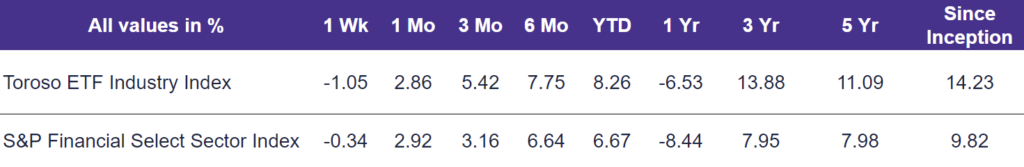

- The highlighted indexes experienced similar performance last week. The Toroso ETF Industry Index was down -1.05% while the S&P Financial Select Sector Index led at -0.34%.

ETF Launches

Calamos Antetokounmpo Global Sustainable Equities ETF (ticker: SROI)

WisdomTree Voya Yield Enhanced USD Universal Bond Fund (ticker: UNIY)

Unusual Whales Subversive Democratic Trading ETF (ticker: NANC)

Unusual Whales Subversive Republican Trading ETF (ticker: KRUZ)

Simplify Propel Opportunities ETF (ticker: SURI)

Return Stacked Bonds & Managed Futures ETF (ticker: RSBT)

ETF Closures

AXS De-SPAC ETF (ticker: DSPC)

KFA Large Cap Quality Dividend ETF (ticker: KLCD)

KFA Small Cap Quality Dividend ETF (ticker: KSCD)

Fund/Ticker Changes

Goldman Sachs Defensive Equity Fund (ticker: GDEIX)

became Goldman Sachs Defensive Equity ETF (ticker: GDEF)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of February 10, 2023)

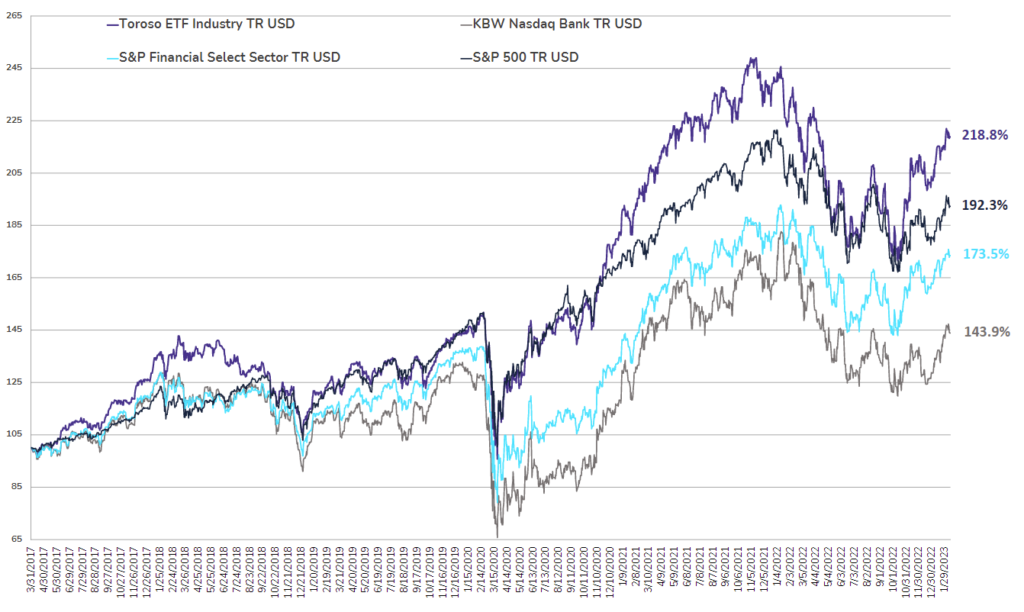

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through February 10, 2023)

Source: Morningstar Direct

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.