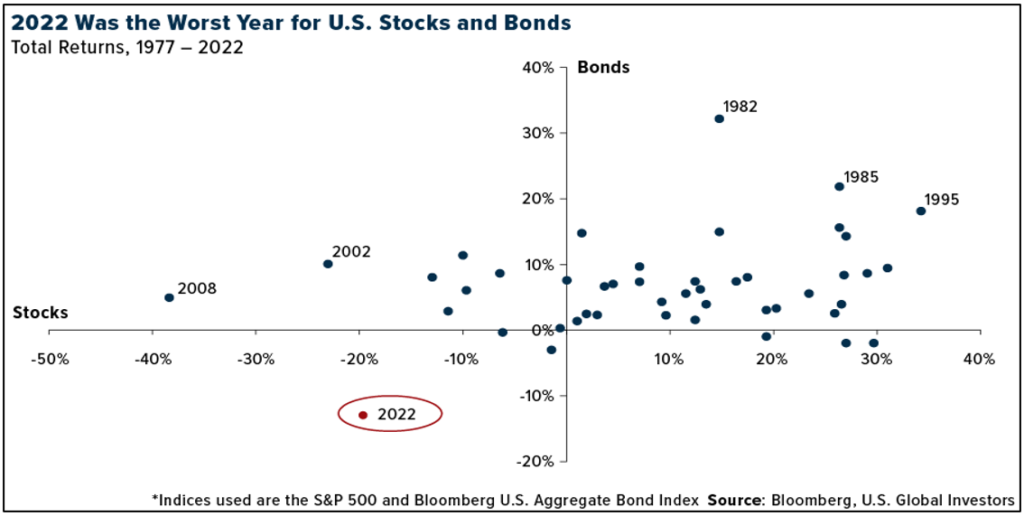

Last year was the worst year for U.S stocks and bonds in over 45 years, which should entice active investors to rethink the 60/40 and consider adding alternative ETFs, especially since there are so many risks still lingering. Conversely, as Frank Holmes highlights with the below chart in his article “Is The 60/40 Portfolio A Thing Of The Past? Not So fast….” Of course, such an outcome presumes that recent 2023 risk-on conditions continue, and persistent volatility in the bond market is not in fact telegraphing future Blackswans. How can investors feel confident that past performance trends of these two asset classes will again be restored? Complacency? After all, shouldn’t investors be looking for non-correlated asset classes for continued protection against drawdowns? A wise financial advisor member recently reminded me that diversification and risk management are parts of the fiduciary responsibilities of a financial advisor. To this point, note that even as an advocate for the 60/40 model, Frank still highlights the “10% Golden Rule” – the idea that an allocation of 10% exposure to gold bullion and gold mining stocks can lower volatility.

Investment Conditions in 2023 will be Volatile

In the initial write up from January 9, 2023, Structure Matters: Losses of $18 Trillion in Stocks Favor Alternatives we make the case that in 2023, investors will use ETFs as benchmarks for hedge fund performance. As a specific example, take the New York Life IQ Hedge Multi-Strategy Tracker ETF (QAI). With so many indices available to choose from, why not choose an investible solution over one which is purely academic in nature? To be clear – we respect the academic work that is provided and have no ax to grind against HFR Indices or the Credit Suisse family of indices. The issue is that returns are not transparent, not based upon after-fee and tax returns, and the reality is that that most investors don’t have access to all these funds (don’t get us started on issues of leverage and gates). Further to the point, the use case for alternatives can be different depending upon whether an investor is looking to directly control volatility themselves or wrap alternatives as a strategic allocation. Back in January 2014, Mike Venuto and David Dziekanski made the point that alternatives are a great tool, but as an Alternative to What? In truth, the answer today may be somewhat different from 2014, because market conditions looking forward are very much different. Even more exciting is the fact that the tools wrapped as ETFs are robust solutions. Today, we also have many more tools that can provide defense for investors than way back when. Thank goodness for those brave ETF Nerd entrepreneurs who continue to innovate.

All this is to say that while innovation continues to thrive, it is nice that the ETF Think Tank has had a role in highlighting foundational strategies like SPDR SSgA Multi-Asset Real Return (RLY), AGFIQ US Market Neutral Anti-Beta (BTAL),and the Core Alternatives ETF (CCOR). RLY was launched September 13, 2011, BTAL on April 26, 2012, and CCOR on May 24, 2017. Each ETF was an idea ahead of its time. Investors sometimes needed to be patient as market conditions evolve.

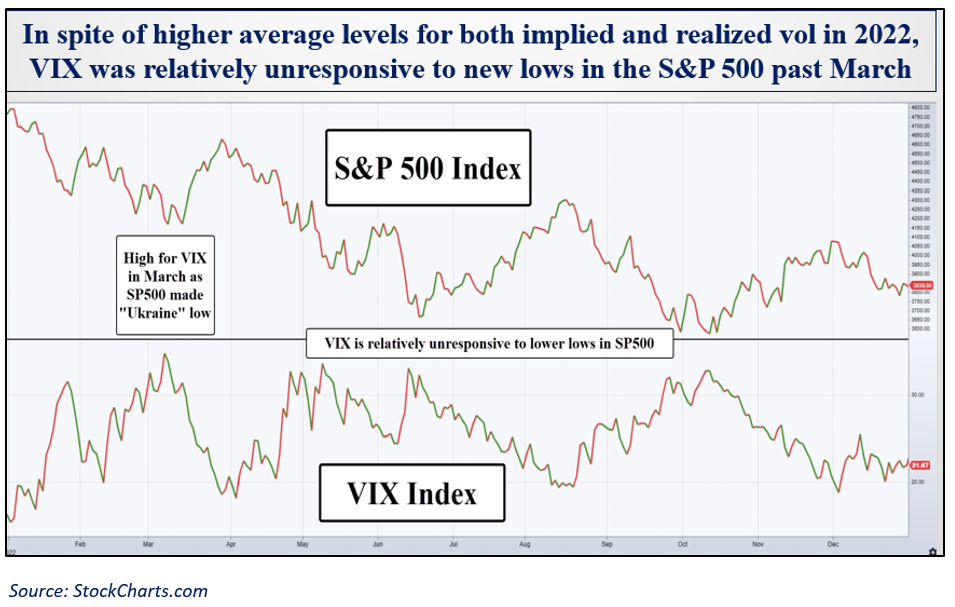

In 2023, we continue to view markets as vulnerable to volatility and investor complacency. We believe this for many reasons – most of which are obvious, but it is the long-term effects of Blackswan events that we fear! This is where Jim Carroll, our resident Vixologist plays a role. Do follow him on Twitter @Vixologist for wonderful details about trends in the VIX index.

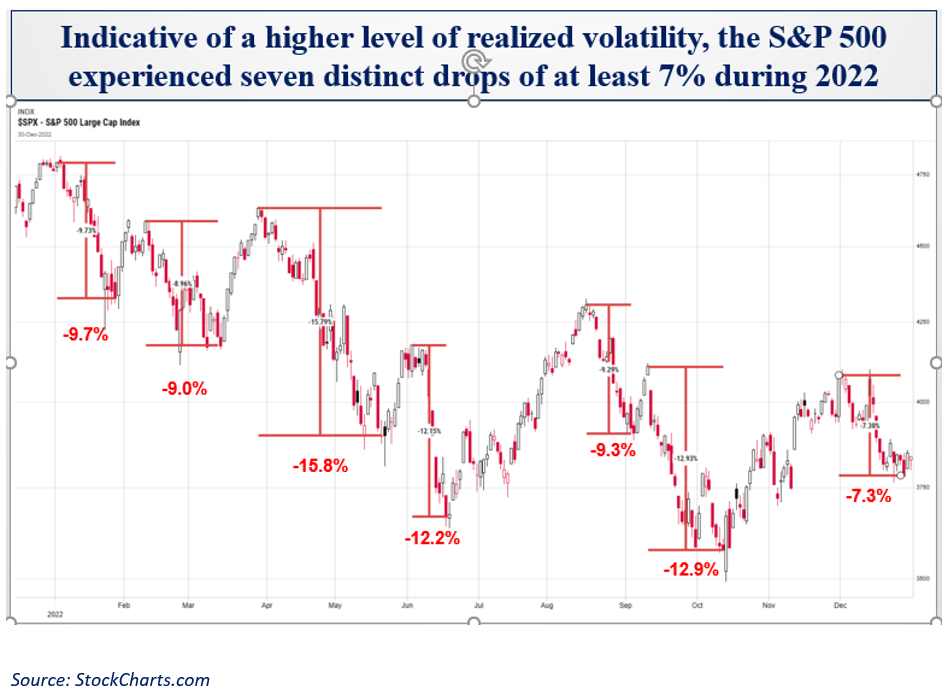

Volatility, if you are not prepared for it, can eat into investor behavior and lead to portfolio mistakes. In this regard, the Vixologist teased us recently with some index analysis, reminding investors that bear market rallies can be sharp.

All this is to say that while 2022 was rough for many, 2023 could be equally challenging, so why not look to broad alternatives.? Two weeks ago, we highlighted the need to measure returns, not against index benchmarks that are not investible, but rather ETFs which follow a specific process. In the context of investing in Global Broad Hedge Funds we suggested that the New York Life IQ Hedge Multi-Strategy Fund (QAI) be use instead of the HFRGL. Others may use Credit Suisse, but regardless, the point is the same. QAI has been around since 2009 and is investible. You can’t own the basket of funds in the other indices, so what is the point?

Summary

You heard it from your friends in the ETF Think Tank “first,” “last” and “many times!” Volatility will persist in 2023, so look to alternatives for a more stable portfolio that holds diversified assets and hedges. There are some 60-100 ETFs structured as alternatives and we expect the tax efficiency of the ETF wrapper to attract even more ETF Entrepreneurs. Let us know how we can help!

Disclosures

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).