According to Investopedia website, an investment that is not one of the three traditional asset types (stocks, bonds and cash) is considered an alternative investment. “Most alternative investment assets are held by institutional investors or accredited, high-net-worth individuals because of their complex nature, limited regulations and relative lack of liquidity. Alternative investments include hedge funds, managed futures, real estate, commodities and derivatives contracts… Many alternative investments also have high minimum investments and fee structures when compared to mutual funds and ETFs… Alternative investments are favored mainly because their returns have a low correlation with those of standard asset classes.”

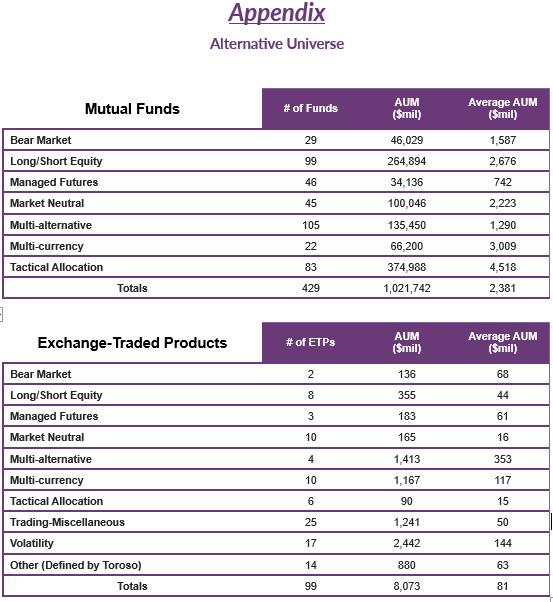

The world of alternative investing has experienced massive expansion in the past few years through new mutual funds and Exchange-Traded Products (ETPs). Until now, this is a part of the investment universe that has been relatively opaque and inaccessible to the average investor, as evidenced by the above excerpt from Investopedia website. However, recent Morningstar data suggests that the alternative mutual fund landscape now accounts for about $1 trillion dollars, mostly in tactical allocation funds, risk parity funds, and funds using futures and long/short strategies, which is quite different from the landscape of alternative Exchange-Traded Products (ETPs), which is a mere $8.1 billion and heavily dominated by volatility-focused products. In this commentary, Toroso will try to define the alternative ETP landscape and conclude with one method of using these types of ETPs to improve portfolios.

Size of the Market

According to Toroso Investments (see the Appendix), there are 99 alternative ETPs, and 429 alternative mutual funds. While ETPs comprise 18.75% of the available investment options in the alternative space, they only make up 0.78% of the total assets. Of the 99 alternative ETPs, only 20 have more than $100 million in assets, and only 40 have more than $25 million. To put this in perspective, the average asset level of an alternative ETP is just above $81 million, while the median is just shy of $14 million, which displays how top heavy the assets are within this category. It is safe to say the alternative ETP asset class is still in its infancy stage and we should expect many more products and developments in this area.

Structural Differences

Some of the issues have been with structure. Most ETPs display their holdings on a daily basis in order to link together the goals of trading ease (from the investor’s point of view) and complete transparency. This, however, results in a structure that makes it difficult for alternative ETPs to outperform their mutual fund counterparts. This happens because the ETP manager needs to limit the number of illiquid holdings to a minimum and maintain a higher number of securities that can be sold at a moment’s notice. The advantage is to the alternative mutual fund manager because that portfolio is more opaque and lends itself to slower trading by the investor. Slower trading reduces the need for the alternative mutual fund to purchase or liquidate underlying securities, which can reduce trading-related costs and increase the manager’s ability to capture better performance.

Another interesting difference is that volatility and multicurrency investments are much more prevalent within the alternative ETP space, while long/short and tactical investments are much more popular in the alternative mutual fund space. Reasons for the difference can be attributed to investor preference, marketability, payout structure for the sales team, and most importantly the trading needs of the strategy. For example, the semi-passive nature of volatility and multicurrency investments seems to make more sense in a low cost structure like an ETP, while a strategy that can potentially have high levels of turnover, such as tactical investments, can be challenging or cost prohibitive.

The payout structure to the sales team is an interesting phenomenon here, as many of these alternative investments are complex in nature and not easily understood. This requires a heavy allocation of resources to a sales force to help the investment world understand the product. The low fee nature of ETPs can make this educational barrier a difficult one to breach compared to alternative mutual funds which generally charge higher fees and have greater resources to allocate to marketing and distribution.

Better Classification

Alternatives have always been a difficult asset class to categorize, mainly because the label has been applied to so many different types of investments over the years. Anything that is not a traditional stock or bond investment has likely, at one point in time, been tagged as an alternative investment. REITs, for example, are simply equity pass through vehicles that have traditionally been considered an alternative but are now a part of the overall market as they have been included in the S&P 500 Index (for more on our REIT outlook refer to Toroso’s May 2013 commentary). For our purposes we are going to split the alternative group into two universes; return enhancers and portfolio insurance.

Return enhancers can be described as those investments primarily selected to grow the portfolio with little emphasis on the volatility of the expected returns. On the other hand, portfolio insurance can be understood as an investment that strives to minimize the downside in unfavorable markets. As you can see already, this simple distinction can dramatically impact your investment thesis and which ETP you select.

Focusing on “Portfolio Insurance”

As wide a universe as alternatives is, the true definition of alternative would infer that the investment not only fit the bill of being non-traditional, but also one that provides an alternative return stream; a return stream that differs from traditional equity and bond returns. While this can do wonders for a portfolio’s nominal returns and risk-adjusted returns over a full market cycle, it can be painful during strong equity markets. Since the market lows in 2009, “portfolio insurance” alternatives have been a drag on investor returns. This is not a new phenomenon and has traditionally been the case during many equity rallies.

A famous Warren Buffet quote “Be fearful when others are greedy and greedy when others are fearful” is appropriate here. While the cost of insurance (owning portfolio insurance alternatives) has detracted from performance over the past few years, this may be because of the portfolio’s misallocation more than product failure. If you are going to maintain a position(s) in portfolio insurance alternatives, your market exposure should be allocated to investments that potentially generate excess returns compared to the market, even if they produce higher volatility. This can help pay the cost of maintaining your insurance allocation during strong equity markets while offsetting the higher beta through asset allocation and portfolio insurance.

For Example

At this point we will highlight two funds, one mutual fund and one ETP that are commonly used as portfolio insurance.

- PIMCO All Asset All Authority Fund is a $29 billion dollar fund managed by Rob Arnott. The objective of the fund “seeks strong after-inflation returns for long-term investors, the fund targets solid real returns; its secondary benchmark is CPI +6.5% over a full market cycle,” basically providing some market exposure while offering protection against inflationary regimes.

- The SPDR® SSgA Multi-Asset Real Return ETF “seeks to achieve real return consisting of capital appreciation and current income,” offering similar exposure as the PIMCO offering.

Many investors of these products were surprised by the negative performance of these investments. In 2013, the S&P 500 returned 32.4%; PIMCO All Asset All Authority Fund returned -5.90%, and SPDR® SSgA Multi-Asset Real Return ETF returned -3.07%.

This is a classic example of investors purchasing funds based on their name and (in the case of PIMCO) historical track records without fully looking under the hood. The true focus of these funds, when all is said and done, is to protect against inflation. And this focus on inflation protection was lost to most allocators, wide-eyed by the strong historical performance in PIMCO’s case. While we believe both funds properly express investments for an inflationary regime, this is a classic case of misguided expectations. The key here is not the negative performance in 2013; it is how these strategies fit within the rest of your portfolio, and properly evaluating their investment philosophy and holdings.

In Conclusion

In summary, Toroso believes the ever expanding world of alternatives in ETPs and mutual funds offer many opportunities, but just as many misconceptions or pitfalls. Investors must understand how these products work, how they fit in their portfolio, and have proper expectations. That said, with the use of “portfolio insurance” alternatives, there is a potential need for higher beta risk allocations to offset the defensive nature of many of these investments.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).