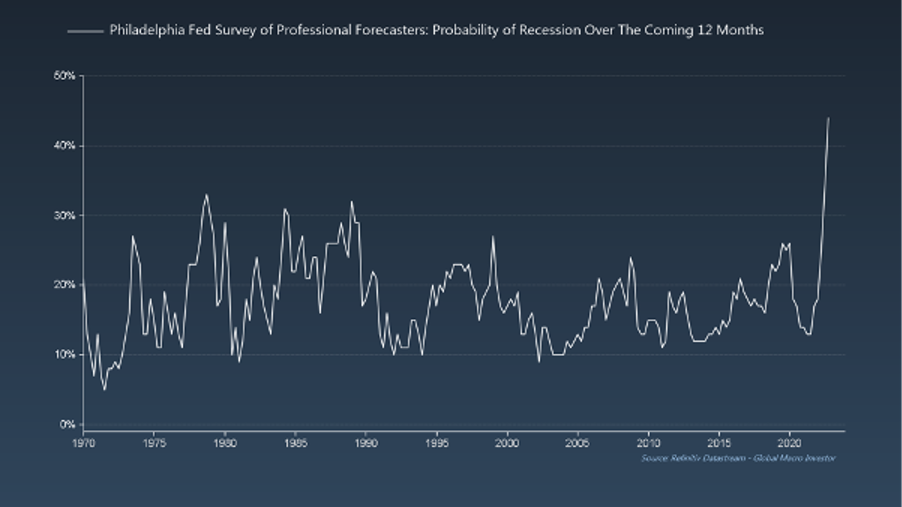

The Most Anticipated Recession on Record

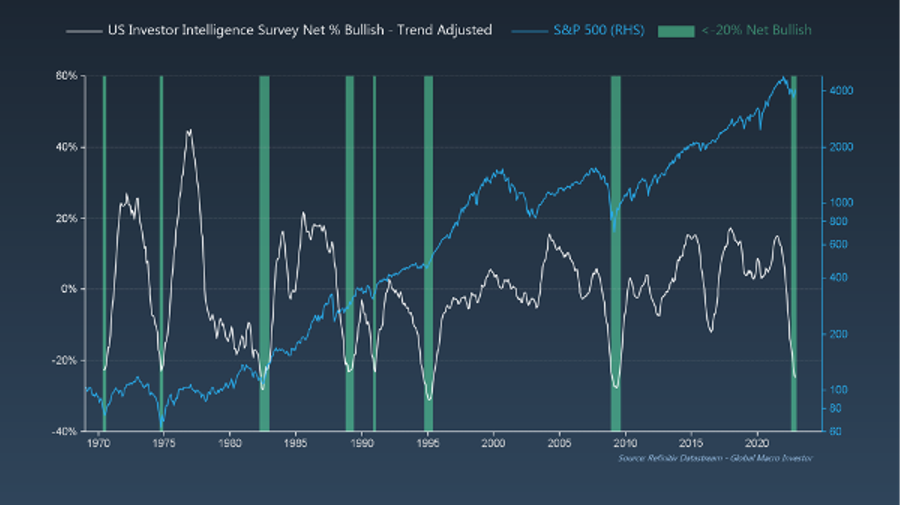

It is difficult to be optimistic about the investment outlook for 2023, but as Raoul Pal points out, this is the most anticipated recession on record. The list of risks and unknowns are high. To name a few in no particular order, (1) cost of capital is a function of interest rates and may stay high. (2) Inflation may come down, but to what level? (3) Layoffs may accelerate. (4) Signals like consumer debt rising and confidence declining reflect the probability of a recession, but will it be shallow, long, etc.? All of this highlights that investors and their financial advisors must be prepared for volatility. This is why we continue to believe that portfolio strategies structured to be uncorrelated to equities and bonds are even more important than in recent years. We include a healthy use of cash in that category, allocated to tactical strategies or the active use of ETFs in a tactical manner as a core part of their long-term strategy. Most importantly, while it has been easy over the past 5-10 years for investors to think long-term, present conditions should not change that outlook. This is why thematic investing will also remain essential for investors. If value outperforms growth in 2023, it may be because multiples (PEG, sales or earnings) do not expand in the overall growth factor. However, that does not mean that growth does not continue to disrupt and innovate. As such, by targeting a specific theme, an investor can earn outperformance over the broad growth factor. But don’t be discouraged – this is why we believe that the due diligence platform we offer to the ETF Think Tank community provides so much value.

Alternatives

Why buy an ETF that provides an “alternative to making money in bonds or equities?” Answer: Because conditions in 2023 could follow trends in 2022, and diversification can lower your risk. To learn more about alternatives, financial advisors should walk through this ETF list, but note that top dogs may also have worked because of inflation circumstances. Moreover, what has worked in 2022 should be reviewed closely in the context of potentially re-weighting. Commodities are almost never a straight-line trade. Long-short and equity market neutral trades, where low, single-digit returns can be earned in flat or declining markets, remain constructive recommendations. Almost 4 years ago, we highlighted the AGFiQ US Market Neutral Anti-Beta ETF (BTAL) in Street.com’s retirement website. Heads really turned on that recommendation.

Thematics

According to an article written by Isabelle Lee of Fortune, the $115 billion Thematics ETF category saw only about 1% of outflows in 2022 despite seeing a drawdown of about 30% on average – about twice the S&P 500. Among thematic funds, innovation and emerging markets technology were at the top of these driving inflows YTD, at $2.2 billion and $1.8 billion respectively. The article continues to emphasize that outflows were in tech/communications, cloud, and robotics at about $3.2 billion, 1.2 billion and $941 million, respectively.[i] We think the thematic category will continue to grow, because investors and financial advisors can understand how the potential return goals can be achieved and know when there are headwinds. Examples of mega themes that should offer opportunity for outsized returns in 2023 and beyond include (1) cyber security, (2) various ways to slice up trends involving electric vehicles, renewables, and batteries, and (3) targeted healthcare themes. Of course, we admit to having a bias towards investment in blockchain, which remains very much at an early stage of development. To learn more, please read the latest from McKinsey & Company, which states that by 2027, 10% of Global GDP could be associated with blockchain. As is the case with all thematic trends, we believe near-term sensibilities around earnings and real cash flow projections in 2023 are going to need to be emphasized over hyper growth and capital market access.

We have hosted a number of discussions on Twitters Spaces and on the ETF Think Tank YouTube Channel on specific themes and certain ETFs that work as broad thematic solutions. Feel free to inquire directly by reaching out. For your convenience, here is a link to read the thoughts of Blackrock’s Jay Jacobs. Of course, getting the theme right in terms of alpha over the broad growth index but not over the particular structure can be very frustrating. In many ways, this plays to the overall Structure Matters thesis, in that certain themes require active management while others, which are narrower, may be best fit to a passive strategy. Please do reach out to us when you are reviewing a thematic ETF; our tools offer helpful information around their value proposition in the context of their “active share,” as well as how they compare with the broad indexes and comparable alternatives.

A balance between alternatives which tend to emphasize growth makes sense, because much of the negativity might be built into the price, and a shallow recession could lead to a spring-board-like rebound. Truth is – we just don’t know. Regardless, tracking the progress of themes is easier based upon a narrower set of circumstances and evidence.

[i] https://fortune.com/2022/12/10/thematic-etf-boom-still-going-strong-despite-brutal-year/amp/ and https://www.bloomberg.com/news/articles/2022-12-10/the-115-billion-thematic-etf-boom-lives-on-even-as-losses-mount?leadSource=uverify%20wall

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).