Week of November 14, 2022 KPI Summary

- It’s Thanksgiving week, and in the ETF space, there’s a lot to be thankful for this year. Let’s take stock of where our industry sits today.

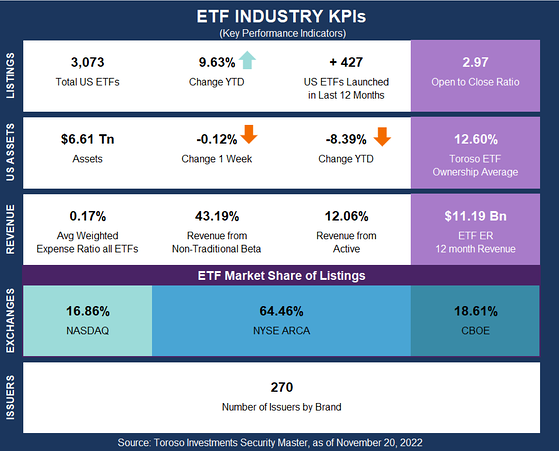

- This week, the ETF market welcomed 14 new ETF launches, and saw 1 single ETF close, keeping the open-to-close ratio at just under 3 for the week – roughly for every 3 ETFs that come to market, 1 fund closes.

- That’s a healthy pace of product launches and speaks to a maturing industry that’s continuously innovating in both market access and fees.

- The number of ETFs available to investors continues to grow, up 9.6% in the past 12 months, and net asset flows remain strongly positive this year.

- Asset growth, however, has been difficult in a challenging market environment for most asset classes. Despite net inflows, year-to-date, total U.S.-listed ETF assets are down 8.3% due to market action.

- Active managers are especially thankful this year. About 64% of all ETF launches in the past 12 months are actively managed ETFs, which now account for about 12% of the industry’s revenues.

- Sentiment towards active management and appetite for these strategies has been growing strong in an industry that has been predominantly passive since inception.

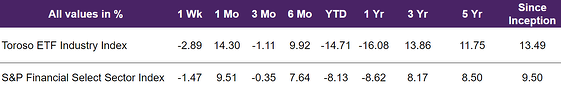

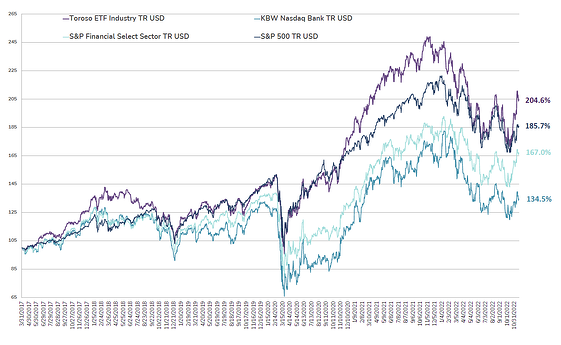

- The Toroso ETF Industry Index (TETF), our proprietary index of 20 names capturing the ETF ecosystem, was down 2.8% in the past week, lagging the S&P Financial Select Sector Index, which was down 1.5% in the same period.

- However, since inception in 2017, this benchmark of the ETF industry has outperformed XLF by roughly 4 percentage points, suggesting the ETF space has been a healthy, vital part of financial services.

ETF Launches

FT Energy Income Partners Strategy ETF (ticker: EIPX)

Strive 1000 Growth ETF (ticker: STXG)

Strive 1000 Value ETF (ticker: STXV)

Strive 2000 ETF (ticker: STXK)

Simplify Short Term Treasury Futures Strategy ETF (ticker: TUA)

US Treasury 12 Month Bill ETF (ticker: OBIL)

Dimensional Global Sustainability Fixed Income ETF (ticker: DFSB)

Federated Hermes US Strategic Dividend ETF (ticker: FDV)

iShares Environmentally Aware Real Estate ETF (ticker: ERET)

Alpha Architect High Inflation and Deflation ETF (ticker: HIDE)

Harbor Health Care ETF (ticker: MEDI)

Hartford Disciplined US Equity ETF (ticker: HDUS)

Innovator Gradient Tactical Rotation Strategy ETF (ticker: IGTR)

T. Rowe Price Floating Rate ETF (ticker: TFLR)

ETF Closures

AdvisorShares Q Portfolio Blended Allocation ETF (ticker: QPT)

Fund/Ticker Changes

Global X Interest Rate Hedge ETF (ticker: IRHG)

became Global X Interest Rate Hedge ETF (ticker: RATE)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of November 18, 2022)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through November 18, 2022)

Source: Morningstar Direct

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.

Topics: ETF Industry KPI’s