Show Me the Money

The ETF Think Tank was founded because of our belief in the value of innovation. We have often discussed that the continued growth of ETFs can be attributed to two primary factors: client alignment and innovation. Each factor is defined by certain characteristics.

Client Alignment = Tax efficiency, Transparency, Liquidity, Lower cost

Innovation = Access, Leverage, etc.

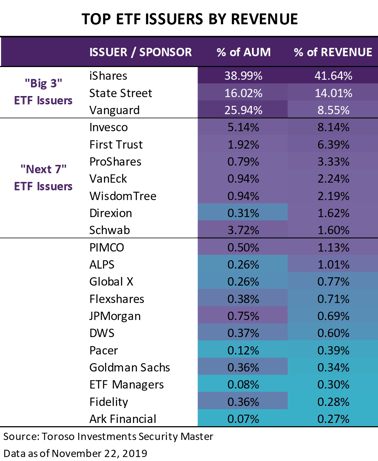

We were inspired to revisit innovation based on the chart below which was presented on Twitter by fellow ETF Nerd Nate Geraci. And as we analyzed the revenue vs. AUM of the top ETF issuers, we were happy to see that innovation could be the key to helping lesser known ETF issuers capture more assets.

The Big 3

The innovation phenomenon is less present in the 3 largest ETF issuers (the “Big 3”), which appear to garner the bulk of their success from being the first to offer liquidity and low cost. Although, it is fair to say that 20 years ago these client alignment factors were innovations.

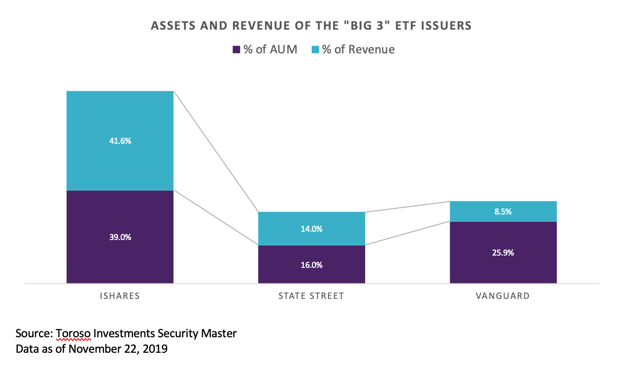

The chart above shows that iShares, State Street and Vanguard have about 80% of all US ETF assets but only about 60% of ETF revenue. We believe the revenue disparity provides opportunity to new sponsors and advisors who are willing to innovate. iShares is the only big player that commands a larger share of the revenue than assets, most likely because they have continued to either innovate or imitate new issuers. State Street has fewer assets than Vanguard, but almost double the revenue, primarily due to the incumbent liquidity protecting State Street’s pricing power. Finally, although Vanguard has over 25% of US ETF assets, their focus on low cost, results in a revenue share of only 8.55%, just slightly above Invesco.

The Wild Card Race

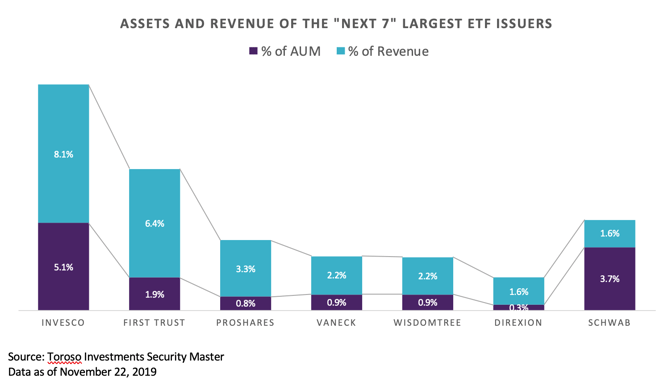

As we look at the next 7 largest ETF sponsors by share of ETF revenue, the pricing power of innovation becomes self-evident. Schwab is the 5th largest ETF issuer by assets, but commands less direct ETF revenue than the other six. Schwab is also the only sponsor in the chart below that has a larger share of assets than revenue. The other 6 issuers all focus on innovation and acquisition to provide premium ETFs to investors. They are pioneers in smart beta, leverage, commodities, volatility and active ETFs. In our view, these are the characteristics most empowering for advisors. Sponsors willing to enter the ETF industry with a focus on innovation rather than joining the race to zero on commoditized beta have an edge.

The Future is Still Bright

The ETF industry has changed how advisors service investors. This growth and change was predicated on client alignment factors like liquidity and tax efficiency, which allowed the big 3 to capture 80% of the ETF assets. The benefits have become commoditized and are now priced as such. Advisors embracing the ETF structure today should look to innovation to capture the remaining 40% of the ETF revenue not flowing to the big 3.

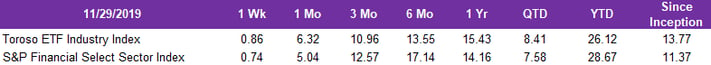

| TETF.Index Performance |

| Returns as of November 29, 2019. Inception Date: April 4, 2017.Index performance is for informational purposes only and does not represent any ETF. Indexes are unmanaged and one cannot invest directly in an index. Past performance is NOT indicative of future results, which can vary. |

| TETF.Index Performance vs. Leading Financial Indexes |

| Click here for information on the Index following the ETF industry |