ETF Nerd Challenge

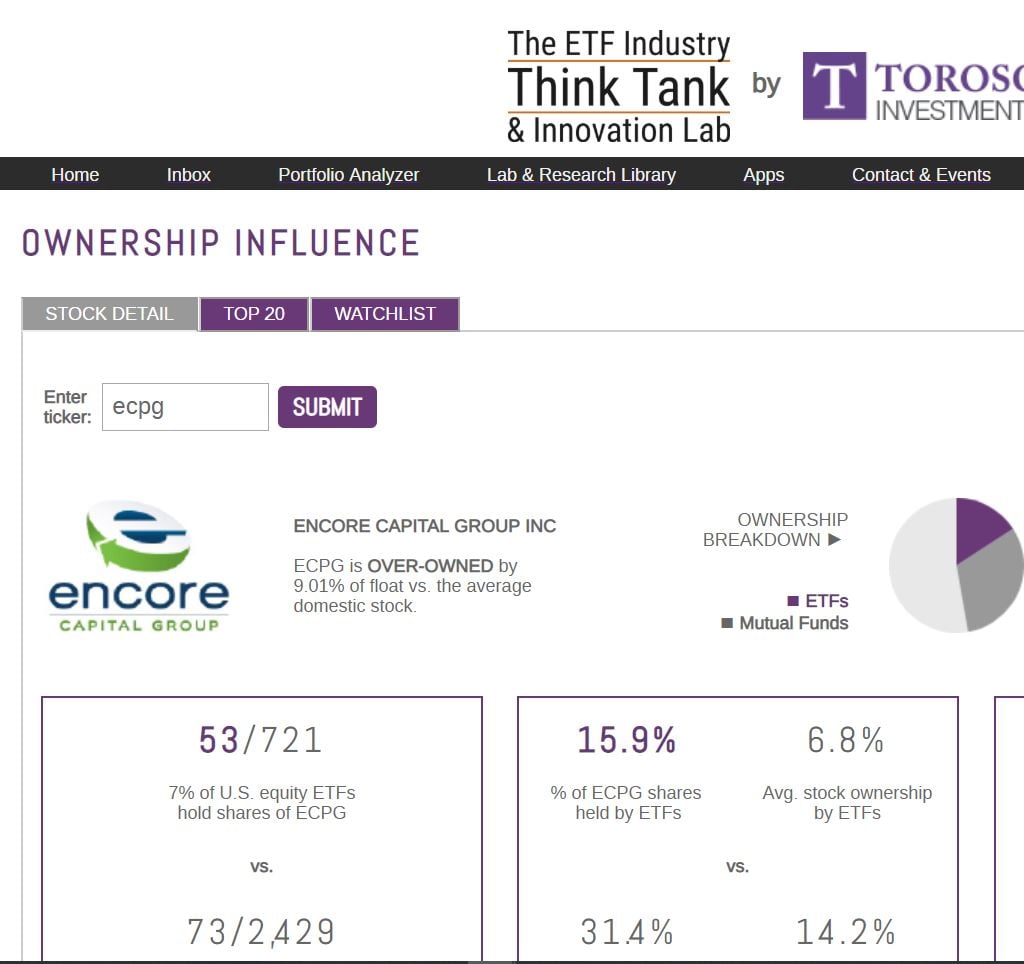

What Stock is 46% owned by ETFs and Mutual funds? Why do we care about this high percentage ownership? First, let me be clear, please don’t blame the ETF market. ETF may own about 15.9% of this $1 Billion market cap, but mutual funds own almost twice as much as 31.4%.

Using the ETF Think Tool: Answer: Encore Capital ( ECPG)

Now the main question. Why do you care? Please entertain me. I am an ETF Nerd! Some trivia just make makes me cool! This obscure little company is “overowned” by ETFs by as much as 9%. Join the ETF Think Tank to learn what this threshold means. Hint: At 16% that is a lot of stock owned by ETFs. However, with these holdings so diversified across 60 ETF is the ownership a bad or good thing? We measure this in our “Ownership Influence Tool” (See above)

Does it matter that 31% is owned by mutual funds? It should be presumed that some portion of this ownership is owned by active funds. While a majority of the ETF ownership is within passive funds, the former hedge fund in me asks the question… why is short interest in Encore so high? In fact – according to Bloomberg, the percentage short interest in ECPG is over 20% and the SI Rati is about 35.7 days. Yes, you are reading correctly. Hedge funds are betting this stock is going down.

Good news for ETF investors?

No single ETF has exposure to this company greater than 1%. Ironically as big believers of active share arguably this means the ETF market is working efficiently in managing through this controversial stock. However, from an actionable stand point the reason we focus on this stock is to highlight the question that Columbia Threadneedle asks “Is Rising Consumer Debt Cause for Concern?”

Surprise: If you are an ETF owner. The answer in the case of ECPG is that maybe you don’t care. However, what is is important is that the information provided from the ETF issuers is meaningful and well constructed. People so often don’t pay attention to the research coming out of ETF issuers and this is a reflection of broader complacency.

P.S. I worked for a debt collection agency one summer when I was in college. IT taught me a great deal about life, sales and the real world.