Macro: China Trade policy vs the Semi-Conductor Index ($SOXX)

- Bell Ringing Ceremonies are pivotal historic moments; like an index replacement

- When iShares upgraded the index for their Semi-Conductor ETF they swapped for the correct engine to drive the performance of the ETF

- There are no victims in capital market allocation just opportunities and risk

For me markets are about how capital returns are earned and sometime reflect a personal experience. Maybe this is about my age (now about 54 young) or my outlook on life, but when I look at what is happening with the U.S. China Trade Wars I look back at the moment in time where I was fortunate to participate in Bell Ringing events, insightful debates and even a couple of market crashes. As an example, as an outsider I was fortunate to be invited to the Nasdaq Bell Ringing for the iShares PHLX SOX Semi-Conductor ETF ($SOXX) on October 15, 2010.

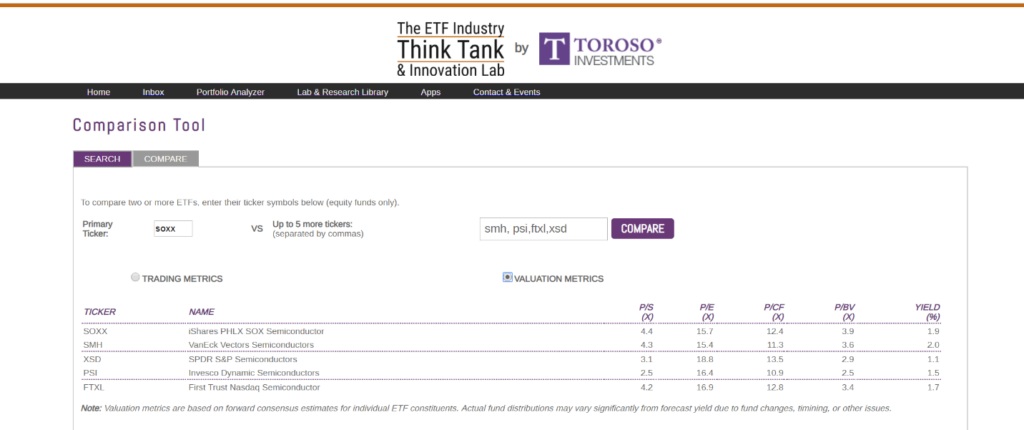

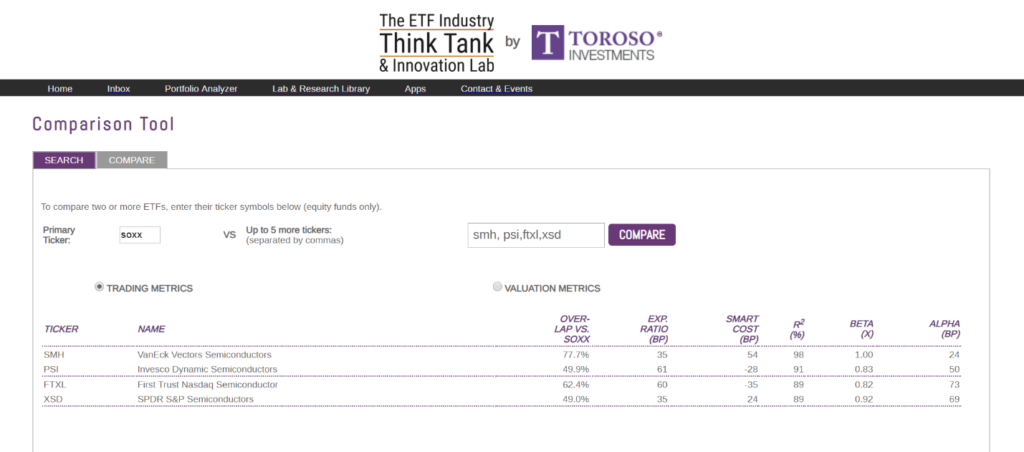

Okay, I have to say it Structure Matters – the Bell Ringing was really about how – iShares was aligning investors in the ETF with the Semi -Conductor index that experts and analysts used as the benchmark for performance. In history, it felt like a real moment and in reality – now over $1 billion in AUM I think it proved to be a smart move. AUM is now at about $1.2 Billion and the fee is solid at 47 Bps. In total there are 5 Semiconductor ETFs industry focused ETFs: First Trust Semi – Conductor ETF ($FTXL) at 60 Bps or VanEck’s Semi-Conductor ETF ($SMH) at $.35 Bps, the Invesco Dynamic Semiconductors Portfolio (PSI) and the SPDR Semiconductor ETF (XSD), but the overlap of their holdings will surprise most investors and thus so might the investment outcome. See below ETF Think Tank Comparison Tools.

Where does this take us in terms of Trade Talks… Trade Wars?

I totally agree that the trade relationship with China needs a reset! However, from a capital markets stand point we should be reminded that certain U.S. industries have also thrived during this period of time. For all the complaining about companies that have been hurt by the China trade policies certain companies have also thrived. It cannot be a coincidence that $QCOM, $MU, $TXN, $MRVL each generate revenues in the range of 65% down to 40% from China. Noteworthy is also the fact that $INTC, $SKWS, and $NVDA each generate about 24% of revenues from china. My point is that these companies chose to allocate resources towards the risk of doing business in China and according to stock prices their shareholders have been handsomely rewarded. Currently, these 7 companies represent about 40% of the holdings in the iShares Semi-Conductor Index (SOXX) and their fair share of the success of the capital appreciation in ETF’s outperformance.

I am not saying that the Semi-Conductor industry or technology has NOT been taken advantage of by weak Chinese Intellectual Property enforcement. This is a complicated issue and not one that I will address in this report. My point is that proudly I say that U.S. ingenuity and innovation thrived during this period despite those challenges. Also, there are no victims in capital market allocations just opportunities and risks. These are investor choices that they make and are reflected by flows. To that point, and to make an additional point, I have included two other iShares ETFs in the above chart for comparison purposes: the iShares China ETF (FXI) and the Emerging Market (EEM). Under the belief that capital markets are efficient during this almost 10 year period it seems evident that investors in these other two ETF simply did not do well and I am not sure those investors should blame china US trade.

Enjoy the Tank. Let us know how we are helping you fight the Market Battle.

Dan @ETFProfessor

http://ir.nasdaq.com/news-releases/news-release-details/ishares-ring-nasdaq-stock-market-opening-bell