China: How you invest in China is a tactical and structure matters decision, but there should be little question that a strategic allocation to the country is necessary. China is simply too important to ignore for a long-term investor.

- See “real time” population counter. http://www.worldometers.info/world-population/china-population/. Kind of reminds me of the debt counter…compounding can be both good and bad.

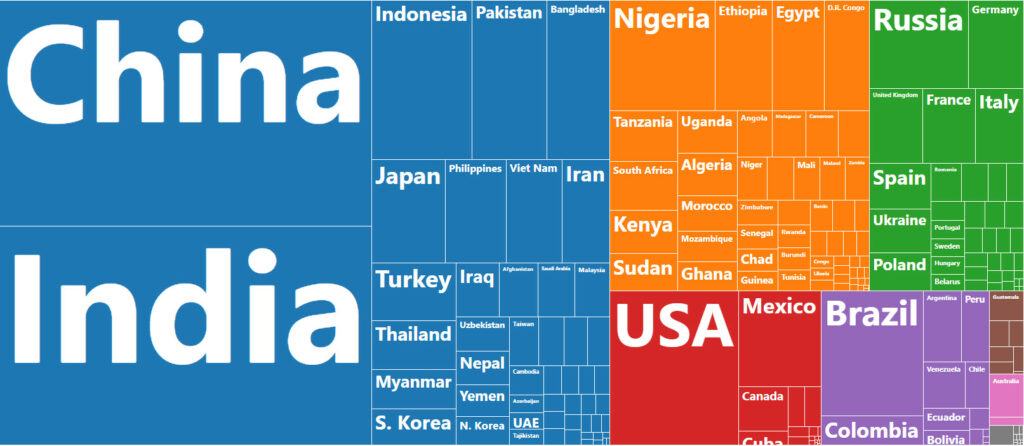

- Asia is 60% of the population with China representing 18.5% and India about 17.9%. http://www.worldometers.info/world-population/china-population/

- Fun animation about global economic growth. Think about what this means for your portfolio? https://www.visualcapitalist.com/animation-the-biggest-economies-in-2030/

In the Tank we are having ongoing discussions about international investing. Complacency and a natural home bias has made U.S. investors under allocated towards this area of the world. With some irony, the U.S. population is only 4.3% of the global population and while population is not an investment factor it will ultimately have an impact on the global economy.

As a fiduciary, what’s your strategy for investing in China?