As if high frequency traders didn’t have enough of a problem making money in these markets. Now they have also been targeted as a source of revenue by the government to potentially raising $800 Billion over 10 years. https://www.cnbc.com/video/2019/03/05/two-tax-experts-debate-the-impacts-of-a-trading-tax.html. I know high frequency traders do not draw many tears, but really they are people to and the ETF Ecosystem would be affected by this proposal.

Clearly this is less about the pajama traders and more about the true institutional trader, but the argument by proponents of the bill that a $1 tax for the privilege of trading $1,000 arguably is not a lot of money makes no sense. Trading commission right now have been squeezed down to $4.95, but a tax that effectively increases transaction costs by 20% cannot be treated as a rounding error.

Jared Bernstein calmly scoff at this issue during the TV debate as if a 20% increase is nothing. Maybe if the government could reduce waste by 20% we would all be better off?

More information about this proposal can be found at

- https://www.schatz.senate.gov/press-releases/sen-schatz-rep-defazio-introduce-new-legislation-to-tax-wall-street-address-economic-inequality

- https://www.foxbusiness.com/markets/ocasio-cortez-signs-on-to-tax-bill-targeting-stock-trades

With some irony, around 90 years after the October 1929 Stock Market Crash occurred we find ourselves debating many of the same issues. Fortunately, the success that so many have enjoyed has occurred from more than just growth in the stock market and capitalism in general. Our country has thrived in so many ways since that bleak 12 years that followed. Yet, we must be reminded and somehow deal with the disparity of wealth in this country. I don’t agree with the socialist practices proposed by so many. Socialism would not have led this country to thrive as it has or innovate to solve social and medical issues.

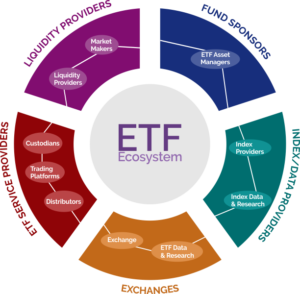

What does all this have to do with Structure Matters? Remember – the ETF Ecosystem includes trading, exchanges and service providers like the Nasdaq (NDAQ), Intercontinental Exchange (ICE), London Stock Exchange (LSE), Intercontinental Exchange (ICE), CME Group (CME) as well as trading companies like Flow Trades ( FLOW) and Virtus Investment Partners (VRTS). This is not meant to sound like a cheap plug so much as it is meant to highlight the implications of that $1 increase. https://www.torosoam.com/torosos-etf-industry-index.php.