In person events are a great way to put your finger on the pulse of an industry, and to get a sense of the latest state of things. The Wealth Management EDGE/Inside ETFs conference, where more than 1,500 people – almost 60% of them financial advisors – got together last week in Florida delivered exactly that.

For ETF enthusiasts, alternatives, active management, and artificial intelligence dominated conversations at the event. The “triple A” of ETF themes in 2023, if you will.

The Power of Alternatives

Finding uncorrelated return streams in challenging markets remains top of mind for advisors everywhere. Whether that means turning to physical and digital assets, derivatives-heavy and options-based strategies, long/short portfolios, and things like private equity, never have we heard the word “diversification” thrown around so much as the only way forward.

As an industry, we seem to be in a must-manage-risk-first mandate even as markets deliver relatively strong results this year. The call of the day is to diversify in the face of so much uncertainty, especially now that correlations between equities and bonds have made a traditional 60/40 portfolio riskier than before.

One thing is for sure, as one asset manager put it, “No one is getting paid to sit on cash.” Diversification is key, but so is participating in the market. Stay invested. And alternatives allow you to do that.

Interestingly, part of this diversification story is the growing adoption of actively managed ETFs. Think of it as implementing manager diversification in the pursuit of a little extra return where possible.

The Value-Add of Active ETFs

We’ve seen active ETFs dominate product innovation, representing more than 60% of ETF launches in the past year, and so far in 2023, they have attracted about 30% of new asset flows – that’s about 2x the pace of asset gathering the category saw in 2022.

“Active ETFs are one of the industry’s megatrends of growth,” one asset manager said.

As we know, actively managed ETFs come in many flavors, with some offering barely more than closet indexing, some delivering rules-based active management, and some offering completely unconstrained strategies. Manager due diligence remains a big challenge for advisors – some told us the biggest hurdle to implementation is figuring out how to go about evaluating these active approaches.

One of the ways to begin tackling this task is by looking at active share, ChangeBridge’s Vince Lorusso offered – the metric that’s directly linked to the value-add of an active manager.

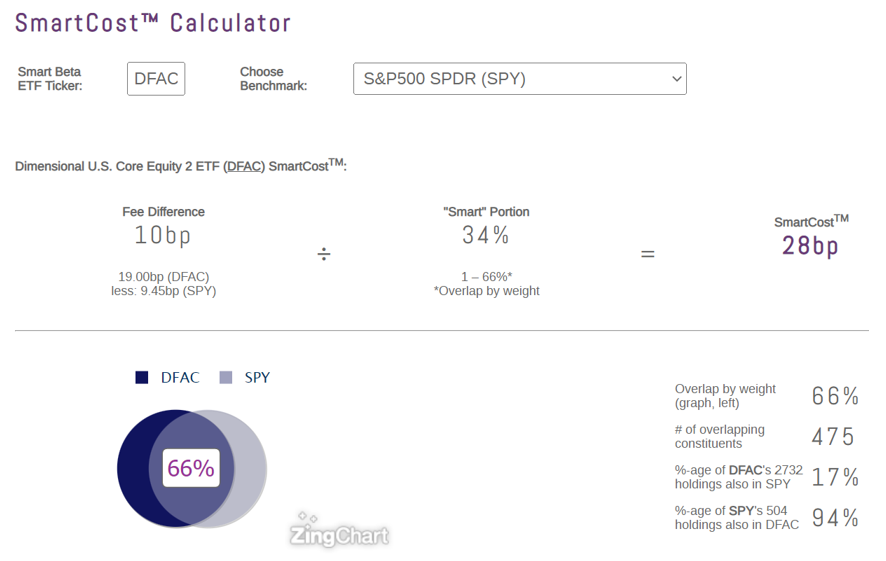

At the ETF Think Tank, we can help with that due diligence. For example, one of our tools, “smart cost”, calculates the overlap between an ETF and a benchmark in an effort to understand what you are paying for (and getting) for the “smart” or alpha-seeking part of an ETF. See example below:

Data is your friend in evaluating active managers, but it’s interesting to note that product proliferation – and success in asset gathering – isn’t necessarily tied to a portfolio manager who has become a household name and found a loyal following – think the Cathie Woods or Peter Lynch-es of the world.

Today, active management is just as much about a household brand where portfolio managers themselves aren’t immediately known, or they have an existing track record in the mutual fund space. In this case, it’s the firm’s investment philosophy and/or reputation that’s the selling point behind the value proposition of active management. Think firms like J.P. Morgan, Dimensional, T. Rowe Price, Capital Group – they now run some of the biggest active ETFs in the market.

The Lessons of AI

Tangentially related to active management is the rise of artificial intelligence in the ETF industry. AI has been one of the hottest themes in the market this year, but in the ETF space, it’s a two-pronged conversation.

On one side, AI could change the way ETFs are built. To that extent, AI is “old news” having long been a tool in the smart beta and fundamental investing space. As Bloomberg’s Eric Balchunas put it, “I don’t see AI taking over everything. It’s going to be a lane within smart beta.”

And as a lane, it so far has had a mixed history of success. Consider AIEQ, a pioneer in this space as an ETF that relies entirely on IBM Watson (AI) to select stocks from a universe of “1,000 research analysts, traders and quants working around the clock.” (See fund details here)

Since inception, AIEQ has lagged the S&P 500 significantly and consistently. Why? Because turnover is massive on this strategy – turnover equals trading costs.

“Someone needs to teach the computer to do nothing,” Balchunas said. “If IBM Watson learned from its mistakes, it would stop trading so much. AI needs to meet Vanguard halfway.”

Still, as a portfolio construction tool, AI could lead to fee compression in the active space if it turns out AI solutions end up replacing or disrupting the value proposition of an active manager. The threat of “there’s an AI for that” should at least keep active managers on their toes, and fees in check. AI could also, as one industry participant put it, ultimately “democratize alpha.”

The other side of AI in ETFs is as an investment theme – a flavor of the burgeoning segment of thematic ETFs. Here, it’s still early days with few pureplay companies to pick from, but plenty of product innovation and thematic funds emerging in this space. “Right now, the supply side of AI funds is way ahead of demand,” a portfolio manager noted.

The hype around AI is real, but it may be a little ahead of itself for now.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).