The major driver of ETF growth thus far in 2018 has been the client alignment growth factor of low fees. Most of the flows have been to low cost ETFs like iShares Core MSCI EAFE ETF (“IEFA”). There have also been many headlines about Fidelity and the expansion of their “no fee” mutual funds. The TETF.index team always seeks to provide research behind the headlines and illuminate the true winners in the so called “race to zero.”

Are Low Fees a Win/Win?

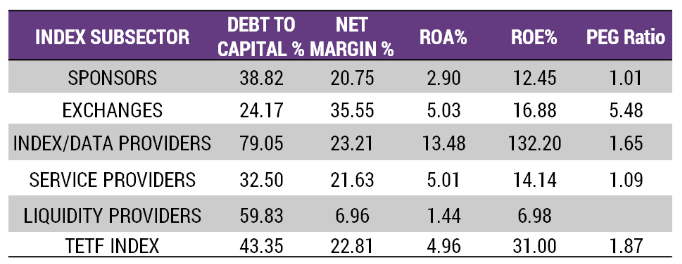

We believe that continually shrinking fees have been great for both investors and the ETF ecosystem. This year,according to Toroso research, the average weighted expense ratio for US ETFs has dropped from 0.22% to 0.21%. Although one basis point is significant, it does seem muted compared to the media frenzy about fees. However,during this time the projected revenue for ETF issuers has actually increased from $7.3B to $7.5B. This data truly shows the win/win nature of lower fees in ETFs. As we noted in previous updates, ETF sponsors have been able to maintain margins while increasing revenue. The chart below provides context to the margins of the ETF ecosystem.

Active Margin

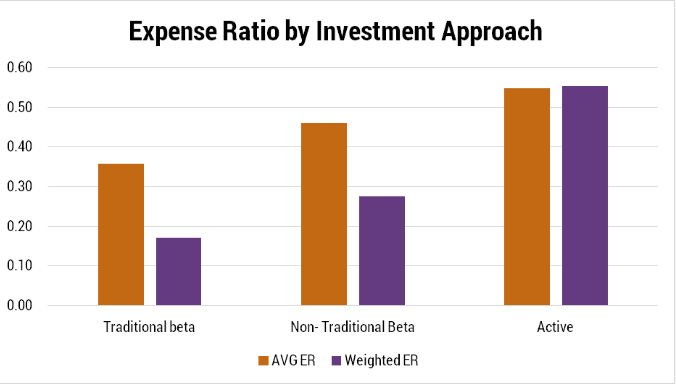

Despite the bulk of the flows moving toward low-cost beta, the overall breakdown of fees has remained constant across ETF categories this year. That said, the overall percentage of ETF revenue from active and non-traditional indexes has continued to grow. In January 2018, only about 3.6% of ETF revenue was from active ETFs; today that number is 4.7%.

Winning the Race

The race to zero makes for good headlines, but it is also great for investors and ETF ecosystem participants. We think of the ETF structure as a fintech evolution that simply provides better access than previous structures. This disruption is similar to Amazon versus Sears in the world of retail. Both offered lower and lower prices, but Amazon prospered through superior technology. It is our opinion that client alignment is a powerful growth factor that has allowed the ETF industry to become the Amazon of financial services; and therefore, leaving antiquated structures like mutual funds to a prolonged demise like Sears.