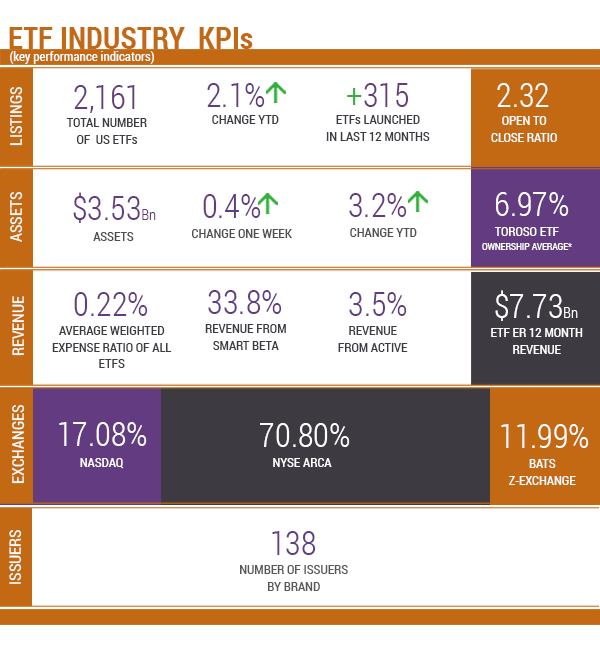

Source of KPIs: Toroso Investments Security Master, as of February 23, 2018

INDEX PERFORMANCE DATA

| 2/23/2018 | 1 Wk | 1 Mo | 3 Mo | 6 Mo | 1 Yr | QTD | YTD | Since Inception |

|---|---|---|---|---|---|---|---|---|

| Toroso ETF Industry Index | 0.24% | (0.10%) | 14.41% | 25.63% | 7.83% | 7.83% | 35.82% | |

| S&P Financial Select Sector Index | 0.40% | (2.33%) | 11.47% | 18.75% | 20.26% | 4.26% | 4.26% | 24.25% |

INDUSTRY BLOG: A NOTE ON EXCHANGE TRADED NOTES

As many of you know, on Monday, February 5th, just a few weeks ago, volatility rose sharply and funds such as XIV and SVXY plummeted in value after the market closed. Although XIV is an ETN and SVXY is an ETF, both funds declined over 90% regardless of structure. In response, we want to shed some light on the landscape of ETP structures with a renewed focus on ETFs versus ETNs.

Ultimately, XIV chose to close on February 20th while SVXY is still trading. Did XIV crash because it was an ETN? Have the investor’s outcomes been affected by the difference between an ETF and ETN? What are other structures considered Exchange Traded Products (ETPs)? First, let’s review the landscape of various ETP structures.

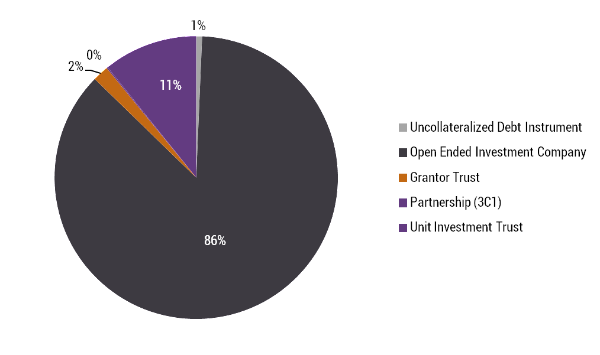

ETP LANDSCAPE BY ASSETS : ETP AUM

As you can see, traditional 40 Act Opened End Investment Company ETFs have captured 86% of the assets, followed by UITs at 11%. ETNs are under 1% of the assets, while Grantor Trust and Partnerships, which primarily focus on commodities, are about 3%.

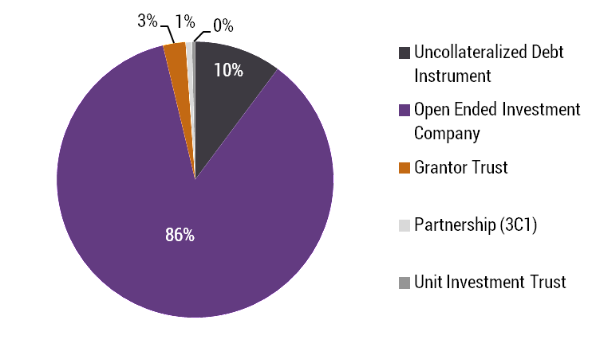

ETP LANDSCAPE BY PRODUCTS : TOTAL # OF ETPS

ETNs may be less than 1% of the assets, but they are more than 10% of the total products listed. Interestingly, the 11% of Unit Investment Trust Structure AUM (previous chart) is in only 8 ETFs including SPY, the largest and oldest ETF. See the list of UIT structured ETFs below. This original structure works but can be less tax efficient and restrictive than the more commonly used 40 Act structures.

8 Unit Investment Trust ETFs

| BLDRS Asia 50 ADR ETF | ADRA |

| BLDRS Developed Markets 100 ADR ETF | ADRD |

| BLDRS Emerging Markets 50 ADR ETF | ADRE |

| BLDRS Europe Select ADR ETF | ADRU |

| PowerShares QQQ ETF | QQQ |

| SPDR® Dow Jones Industrial Average ETF | DIA |

| SPDR® S&P MidCap 400 ETF | MDY |

| SPDR® S&P 500 ETF | SPY |

WHAT’S THE DIFFERENCE BETWEEN AN ETF AND ETN?

ETFs and ETNs are actually very similar in practice. They both are a low-cost option with low expense ratios, they track an underlying asset, and they both trade on exchanges like stocks. However, while ETFs are like stocks, ETNs are similar to bonds. ETFs get more attention and volume (as illustrated in the pie charts above) possibly because they are easier to understand like stocks, while ETNs can get complicated like bonds.

Barron’s said it well in their recent article Where Volatility Goes to Die, “An ETN is debt; the underwriter must repay the note in the amount the index has returned. In the case of the VelocityShares ETN (XIV), Credit Suisse’s promise was to deliver the opposite return of the VIX. The ProShares ETF (SVXY), however, actually owns the VIX futures.” Issuer credit default is the primary risk associated with ETNs. That said, even through the financial crisis of 2008, no US listed ETN has defaulted**.

In the end, the answer to our initial question is: No, XIV did not crash because it was an ETN. It happened to SVXY ETF as well. XIV closed because the ETN had an early termination clause and Credit Suisse elected to close. We believe this allows for more intelligent VIX related products to gain market share.

Though volatility finally returned and the market dropped severely for the first time in several quarters, the ETF industry continues to grow, being up $13B in assets this past week. The primary lesson is knowing what you own regardless of structure. As always, if you are looking to track this growth, look no further than TETFindex.

**We were actually corrected by a fellow ETF nerd that noted Lehman had 3 ETNs default and delist in 2008:

The Opta Lehman Brothers Commodity Pure Beta Total Return ETN (ticker: RAW)

The Opta Lehman Brothers Commodity Pure Beta Agriculture Total Return ETN (EOH)

The Opta S&P Listed Private Equity Net Return ETN (PPE)

ETF LAUNCHES

Volshares Large Cap ETF VSL

FT Nasdaq Artfcl Intllgnc and Rbtc ETF ROBT

ETF LAUNCH OF THE WEEK:

VSL Volshare US Large Cap: A new entrant with a focus on lower volatility. This appears to be another active manager embracing a passive execution.

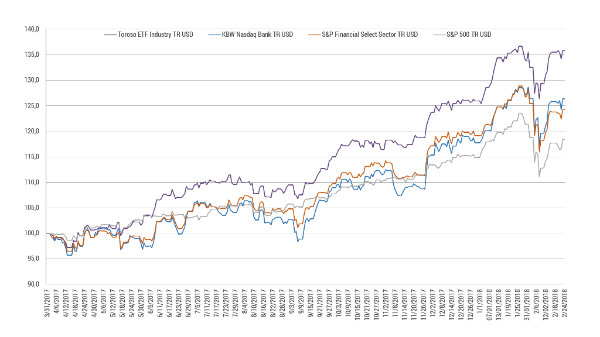

TETF INDEX PERFORMANCE Vs. LEADING FINANCIAL INDEXES

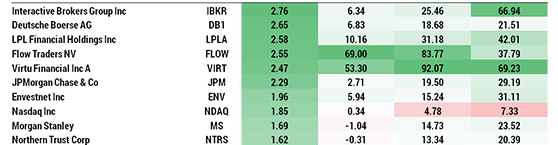

TOP 10 HOLDINGS PERFORMANCE

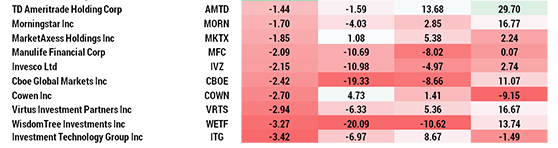

BOTTOM 10 HOLDINGS PERFORMANCE