Which sounds like a more appealing fee structure? Twenty basis points (0.2%) or two-and-twenty (2% of assets + 20% of profits).

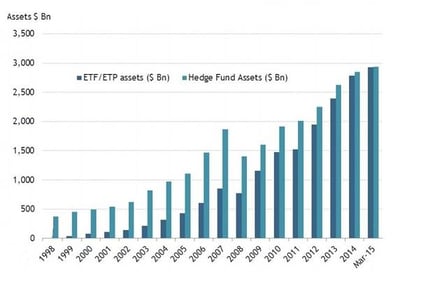

Investors have been voting with their dollars for lower costs and tax efficiency: total assets held by exchange-traded funds globally are about to eclipse those held by hedge funds.

Research firm ETFGI this month reported that ETFs assets worldwide, now at $2.998 trillion, are just about ready to surpass estimates for hedge fund holdings — hedge funds held about $2.939 trillion at the end of the first quarter, according to HFR.

ETFs are likely to overtake hedge funds this quarter. For sure, the rise of indexing and low-cost, passive investing plays a huge role in explaining the shift. But so does a proliferation of ETFs that offer strategies that used to be available mostly in hedge funds.

Mike Venuto, co-founder and chief investment officer at Toroso Investments, outlines a handful of ways that ETFs are replacing hedge funds n a post on ETF.com:

“QAI led to a whole set of hedge fund-like products that I call the cherry-pickers. Today there are six ETFs that seek exposure to the top ideas of hedge fund managers. The goal of these products is not to replicate returns but to capture the alpha. For the most part, they have worked and produced excess returns above traditional indexes.”

Venuto outlines how IndexIQ, which was recently bought by New York Life Insurance, deserves credit as a pioneer in hedge-fund replication pioneer with its $1 billion IQ Hedge Multi-Strategy Tracker ETF (QAI).

“QAI led to a whole set of hedge fund-like products that I call the cherry-pickers. Today there are six ETFs that seek exposure to the top ideas of hedge fund managers. The goal of these products is not to replicate returns but to capture the alpha. For the most part, they have worked and produced excess returns above traditional indexes.”

Others include the AlphaClone Alternative Alpha (ALFA), Direxion iBillionaire (IBLN),Global X GURU (GURU), Global X GURU International (GURI) and the Global X Guru Small Cap (GURX).

Another fast-growing corner within ETFs used to be mostly reserved for hedge funds: currency-hedging. With ETFs, investors can now sidestep hedge funds in order to get exposure to local currency moves, including the WisdomTree Europe Hedged Equity ETF (HEDJ) and theAdvisorShaares Gartman Gold/Euro ETF (GEUR).

The ETF market lacks many means to directly invest in publicly traded hedge funds, such asIcahn Enterprises (IEP). Venuto notes that many of these publicly traded funds are precluded from index-tracking ETFs because their mostly insider ownership presents difficulty for indexers. One beguilingly named exchange-traded note does offer broad expsoure to these firms: Etracs Wells Fargo MLP Ex-Energy exchange-traded notes (FMLP). (Remember that ETNs are structured much differently than an ETF: they are debt instruments underwritten by banks and mirror returns of certain assets but don’t actually own them.)

FMLP offers heavy exposure to Carlyle Group (CG), Blackstone (BX), Icahn and Apollo Global Management (APO), among others.