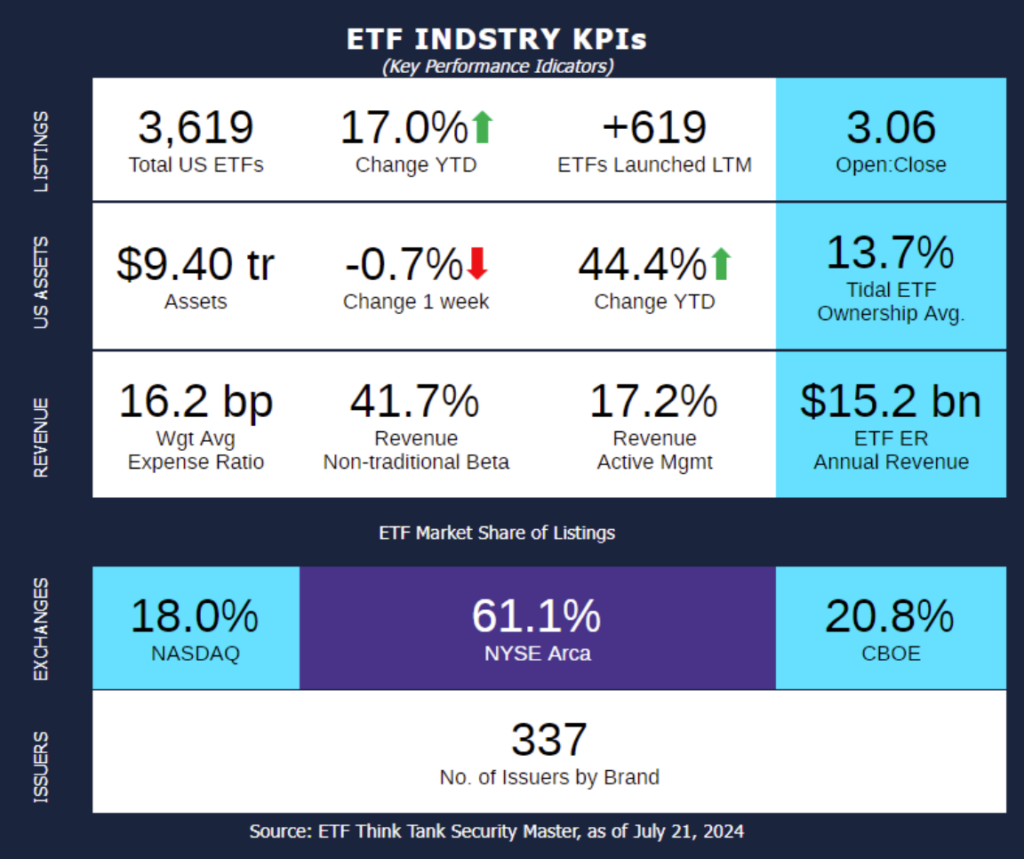

Week of July 15, 2024 KPI Summary

In the 3rd week of July, the ETF industry experienced 10 ETF launches, 1 Mutual Fund Conversion, and 1 closure.

- The 1 Year ETF Open-to-Close ratio continues to rise, reaching 3.06. Continuing the significant year-over-year increase from 2.12.

- Total US ETFs increased to 3,619, a +13.6% YoY Increase, and 7.2% YTD increase.

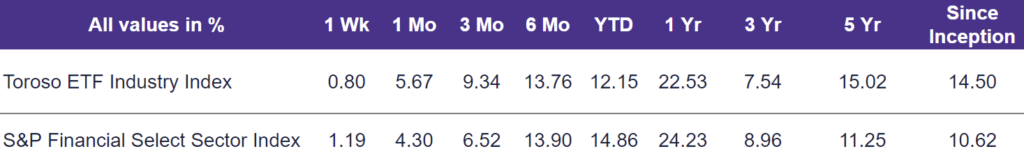

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 0.8% last week, underperforming the S&P Financial Select Sector Index, which rose by 1.19 %.

Top ETF launches from the past week include:

- Invesco Eyes Income: Invesco is expanding its active ETF platform by introducing the Invesco Income Advantage Suite, which adds an options income strategy to popular investment offerings. The new suite includes the Invesco QQQ Income Advantage ETF (QQA), Invesco S&P 500 Equal Weight Income Advantage ETF (RSPA), and Invesco MSCI EAFE Income Advantage ETF (EFIA). These ETFs offer investors a unique blend of market exposure, volatility mitigation, and regular income to some of the most popular indices on the market, Nasdaq 100, S&P 500 Equal Weight, and MSCI EAFE.

- Blackrock Gets Thematic: BlackRock has introduced the iShares U.S. Manufacturing ETF (MADE) ETF, a thematic fund designed to amplify investors’ exposure to the manufacturing space. MADE tracks the S&P U.S. Manufacturing Select Index, which is comprised of U.S.-based companies engaged in manufacturing, including consumer cyclicals, technology, auto makers, and defense contractors. MADE targets companies that are likely to gain from the potential shift of production back to the US and the expected increase in domestic manufacturing activity.

- Thematic ETFs can provide a more targeted and diversified exposure to a specific area of the market, by tracking a unique index that captures a broader range of related companies and industries compared to traditional sector ETFs.

- Direxion Adds 2 Crypto ETFs with Humorous Tickers: Direxion has launched two new ETFs that offer leveraged exposure to the crypto industry, the Daily Crypto Industry Bull 2X Shares (LMBO) and Daily Crypto Industry Bear 1X Shares (REKT). Both ETFs are tied to the Solactive Distributed Ledger and Decentralized Payment Tech Index, which tracks US-listed securities involved in digital assets, including Bitcoin mining, blockchain infrastructure, non-fungible tokens, and decentralized finance. The tickers have playful origins: LMBO is a nod to “Wen Lambo,” a phrase popular among crypto enthusiasts, while REKT is a slang term for a trade that “gets wrecked,” resulting in significant losses.

- AllianceBernstein Converts Mutual Fund: AllianceBernstein has expanded its ETF suite with the successful conversion of the AB International Low Volatility Equity portfolio from a mutual fund (ISRYX) to an ETF (ILOW). ILOW offers an actively managed portfolio of large-cap equities primarily outside the United States, seeking to deliver market-beating returns with reduced volatility. Launched nearly a decade ago, the fund has amassed approximately $804 million in assets. This milestone brings AllianceBernstein’s ETF family to 15 funds, collectively managing $4.5 billion in assets, with ILOW becoming the company’s second-largest ETF.

ETF Launches

American Century California Municipal Bond ETF (ticker: CATF)

BlackRock Enhanced Short-Term Bond ETF (ticker: CSHP)

iShares U.S. Manufacturing ETF (ticker: MADE)

Direxion Daily Crypto Industry Bull 2X Shares ETF (ticker: LMBO)

Direxion Daily Crypto Industry Bear 1X Shares ETF (ticker: REKT)

Invesco MSCI EAFE Income Advantage ETF (ticker: EFAA)

KraneShares Artificial Intelligence and Technology ETF (ticker: AGIX)

KraneShares Hedgeye Hedged Equity Index ETF (ticker: KSPY)

Invesco QQQ Income Advantage ETF (ticker: QQA)

Invesco S&P 500 Equity Weight Income Advantage ETF (ticker: RSPA)

ETF Closures

UBS AG FI Enhanced Large Cap Growth ETN (ticker: FBGX)

Fund/Ticker Changes

AB International Low Volatility Equity Portfolio (ticker: ISRYX)

became AB International Low Volatility Equity ETF (ticker: ILOW)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of July 19, 2024)

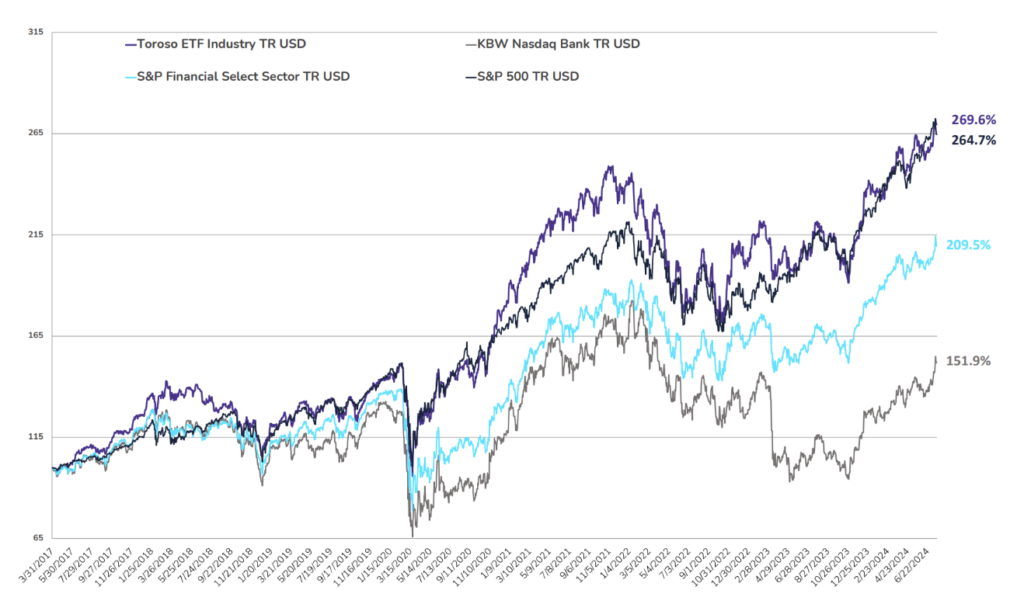

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through July 19, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.