Exchange-traded funds (ETFs) have burst on to the scene in the late 2000s and early 2010s, raking in hundreds of billions of dollars in assets and prompting a major shift towards indexing strategies in the process. ETFs have empowered financial advisors (FAs), registered investment advisors (RIAs), Chief Financial Officers (CFOs), money managers, and retail investors to take greater control over their portfolios, pushing down fees and maxing out tax efficiency in the process.

Source: ETFdb.com

While ETFs appear quite simple on the surface, these securities can be quite complex. In order to get the most out of ETFs, there’s a lot that investors need to know about the structure, opportunities, and limitations of these securities.

Below we outline just about everything you need to know about ETFs, from the basics to the more sophisticated aspects of these financial products.

1. ETFs Are Tax Efficient

One of the biggest advantages of ETFs is their tax-efficient structure; exchange-traded products generally maintain lower capital gains distributions than mutual funds thanks to the nuances of the underlying creation/redemption mechanism. Many mutual funds often trigger tax events when shares are redeemed–meaning that the remaining investors experience a tax event because someone else decided to sell their shares. When redemptions occur in ETFs they are done so “in-kind” and aren’t considered sales. As such, these transactions don’t trigger a taxable event.

It’s important to note that the tax-efficient features of ETFs don’t allow investors to skip out on their obligations; gains on positions in exchange-traded products will ultimately be taxed at the applicable rate. But the ETF wrapper gives investors more control over their tax situations, since most ETFs avoid incurring capital gains during the normal course of their operations.

Bottom Line: ETFs won’t help you skip out on taxes, but they do give you more control over your obligations.

2. UITs vs. ETFs: Structure Matters

The exchange-traded product (ETP) umbrella includes a number of product structures, ranging from exchange-traded notes to true ETFs to grantor trusts and unit investment trusts (UITs). Many of the “first generation” ETPs are actually UITs–a structure that has a couple of peculiarities. First, UITs must fully replicate their underlying index, and they are prevented from lending out shares (which can be a source of additional income for ETFs). Second, UITs won’t reinvest any dividends received by component companies–an activity that true ETFs can accomplish.

The S&P 500 SPDR (SPY A) is a UIT, whereas the iShares S&P 500 Index Fund (IVV A) and Vanguard S&P 500 ETF (VOO A) are true ETFs. Because of the differences surrounding dividend reinvestment, SPY will generally lag slightly behind the true ETFs in bull markets and perform a bit better in bear markets. In other words, in some instances products such as IVV and VOO, which are true ETFs, might have some advantages over the ultra-popular SPY, which is actually a UIT.

Take a look at the annual returns of both SPY and IVV in but both bullish and bearish periods:

| ETF | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|

| SPY | -36.70% | 26.31% | 15.04% | 1.80% | 15.99% |

| IVV | -36.92% | 26.43% | 15.11% | 1.86% | 16.06% |

Bottom Line: Pay attention to the boring details such as structure–they might have a big impact on returns.

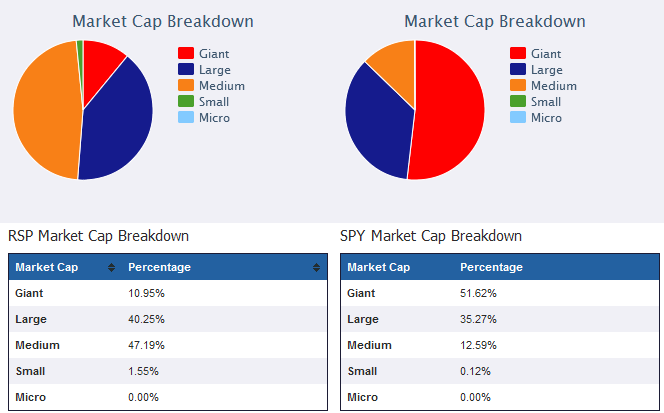

3. Equal Weight ETFs Are Tilted Towards Small Cap

Linked to indexes that assign equivalent weightings to all component securities, equal weight ETFs have become increasingly popular as an alternative to market cap weighting. Proponents of equal weight strategies note that this methodology delivers better balance and can eliminate the tendency to overweight overvalued stocks that is built into cap-weighting. It is difficult to argue with the results of equal weighting; the S&P Equal Weight ETF (RSP B+) has consistently outperformed SPY from 2008 to 2012. But it is important to acknowledge some of the biases in equal weight ETFs, and understand how those biases can impact performance in different environments.

Compared to a market cap weighting approach, equal weight translates into a tilt towards small cap and mid cap stocks. Doing so can increase overall volatility, which can be a positive in bull markets and a negative in bear markets. Equal weight can also have an “anti-momentum” bias resulting from the rebalancings, when the best performing components are sold off and the proceeds are used to purchase those stocks that have lagged behind recently. This delivers something of a contrarian strategy.

Bottom Line: Be sure to understand the biases introduced by alternative weighting strategies.

4. “Dividend ETFs” Don’t Always Deliver Big Dividend Yields

Many investors have embraced ETFs as efficient tools for implementing a dividend-oriented investing strategy; the exchange-traded wrapper allows for cheap, low maintenance implementation of a rules-based dividend screen. With dozens of dividend-focused ETFs available to investors, there is no shortage of choices for buyers. It is important to note that not all “dividend ETFs” offer significant dividend yields, largely as a result of how these dividend ETFs are constructed and maintained.

Many dividend-focused ETFs prioritize consistency of payouts over magnitude of dividend yield. The Vanguard Dividend Appreciation ETF (VIG A), for example, includes only companies that have increased their dividend for at least ten consecutive years. So component companies can have paltry dividend yields as long as the absolute dollar payout has been steadily increasing. There’s nothing wrong with that approach, but it might not be appropriate for those looking to maximize current returns. It’s important to look under the hood and fully understand the investment objective before piling in.

Bottom Line: There are many kinds of dividend ETFs out there; be sure to take a long, hard look at their inclusion criteria.

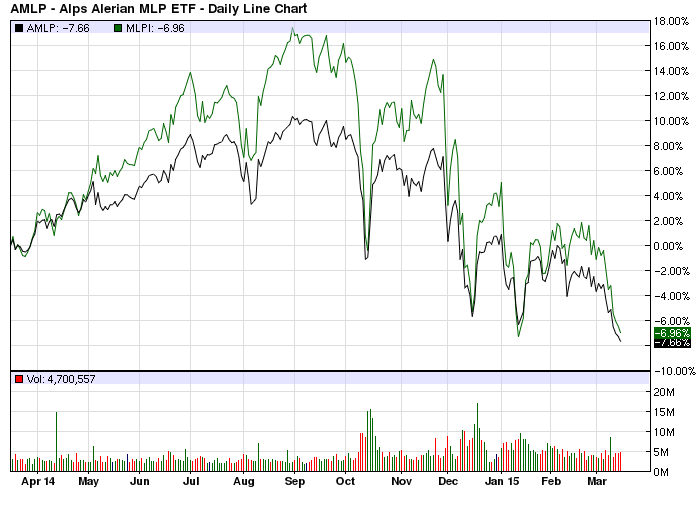

5. MLP ETFs Are A Bit Bizarre When It Comes To Taxes

Exchange-traded products (ETPs), a term that covers ETFs, ETNs, and other similar securities, have become tools for accessing a wide range of asset classes and investment strategies. One growing corner of the market targets Master Limited Partnerships (“MLPs”), an interesting section of the domestic energy market that has the potential to offer both stability and significant current returns.

Investors considering any of these products as a way to tap into this market should do their homework, as there are some aspects to the combination of ETPs and MLPs that are somewhat confusing. Specifically, the structure used can end up having a big impact on the tax treatment of returns, meaning that the choice between ETF and ETN is in this instance a particularly important one. The details can be overwhelming, so here’s a high level summary: Registered Investment Companies can have more than 25% of their portfolio in MLPs, so MLP ETFs are forced to make a C-corp election.

The result is that products such as AMLP and MLPA accrue a deferred tax liability as the component securities appreciate, which can eat into returns over the long run. ETNs such as MLPI don’t face that issue, though distributions made by MLP ETNs might be taxed at a higher rate than distributions from similar ETFs.

Bottom Line: When it comes to MLPs, ETFs may not give you the desired exposure.