Trade Talk Will Not Stop Trends in Robotic and AI (ROBO vs BOTZ)

- A common focus, but two very different strategies.

- Thematic exposure to Japan may be better than the other 26 ½ ways to invest in Japanese equities?

We want to go on record that one of the most fascinating ETF structural battles for Assets Under Management (AUM) in ETF flows is between Robo Global (ROBO) and Global X (BOTZ). In 2026, whitepapers will be written about the 10-year outcome of this opportunity and we are quite excited about having a stake in the ground in this opportunity. Meaning – We favor ROBO, but out of respect to our readers the below is an attempt to be balanced in our review.

A Common Focus, BUT A Different Strategy?

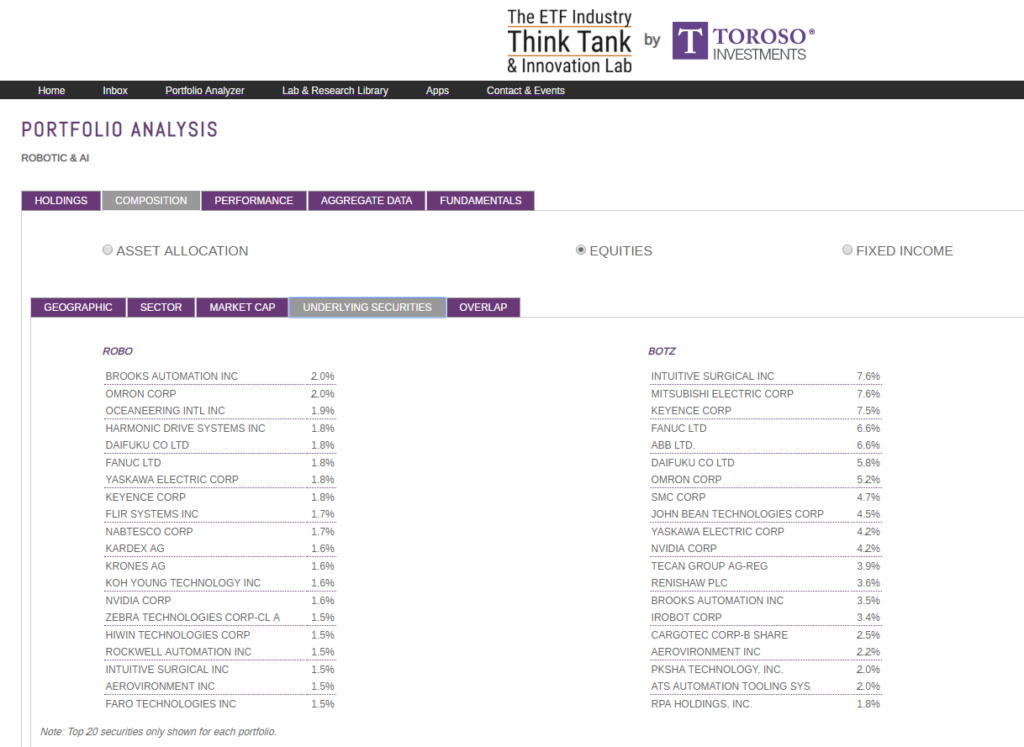

Winning mind share that leads to AUM share can be a function of Alpha, Cost vs. expertise, and distribution. I will try to be objective in writing this piece, but let me be clear on a couple of disclosures. Looking to save 27 Bps (fee 68 Bps vs 95 Bps) may focus on what an investor can control, but is it the reason to take on more volatility? Know what you own and seek out the strategy that best fits your portfolio strategy: Concentration can have benefits over diversification, but we advise investors to know the differences in the strategies. Not only does it have a 55% rating, which means that its concentration is high, but this risk is additionally high because it rebalances only once a year.

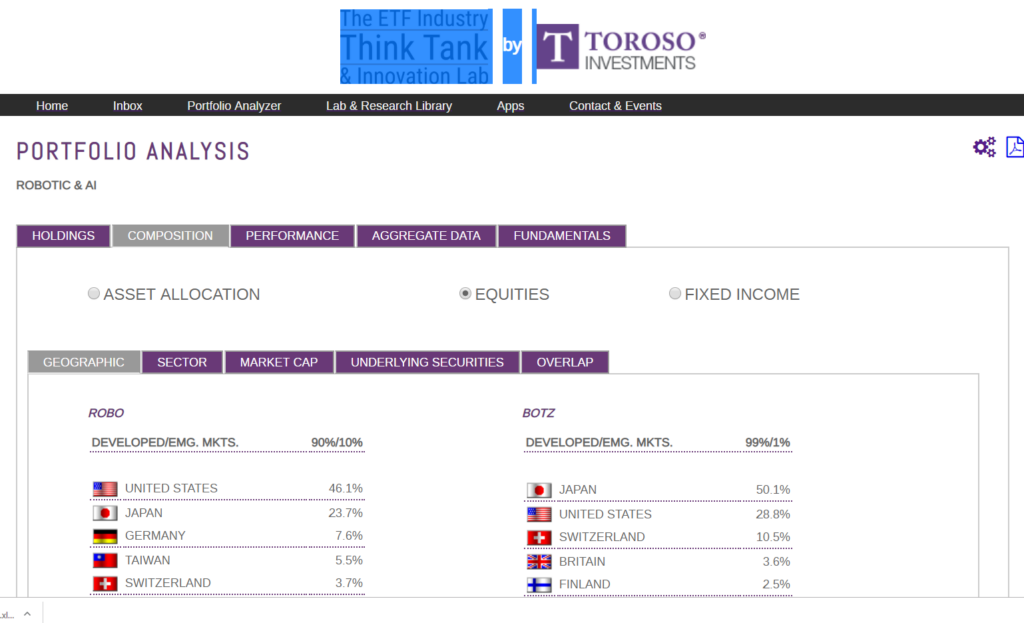

There are 26 ½ ways to invest in Japan using U.S. based ETFs

Trade wars have highlighted the need to isolate country exposures in a portfolio and japan is viewed as a friendly Trump country. Perhaps this means that Investors carrying excess exposure to Japan is safe; especially since the Bank of Japan is such an aggressive supporter of its equity market. https://www.zerohedge.com/news/2015-03-25/bank-japans-10-trillion-equity-portfolio-not-large-says-bank-japan

Investors should always know what they own and how an ETF portfolio fits with an overall portfolio strategy. There are 26 ½ different ways to invest in Japan using U.S. based ETFs and arguably gaining exposure across a theme may deliver on the advantages while not making the tilt towards the country exposure obvious. Excess geographic exposure to Japan may be a great thing, but how this exposure skews with an overall international portfolio is the question.

There is a 28% overlap between the two funds which means that aberration of performance will occur and we have highlighted an attribution analysis during some of our ETF Think Tank due diligence calls. . The variability of winners and losers is quite large, so concentration risk could catch an investor off guard. Noteworthy is the fact that ROBO rebalances quarterly while BOTZ, only rebalances once a year.

Summary:

A brief comparison between ROBO and BOTZ highlights concentration risk, geographic risk, and rebalance risk, but if the common focus may get you there at a cheaper price. ETF Think Tank due diligence calls on ROBO are encouraged because the devil is in the details, but we have tried to be fair an balanced in the report.