Broad Markets

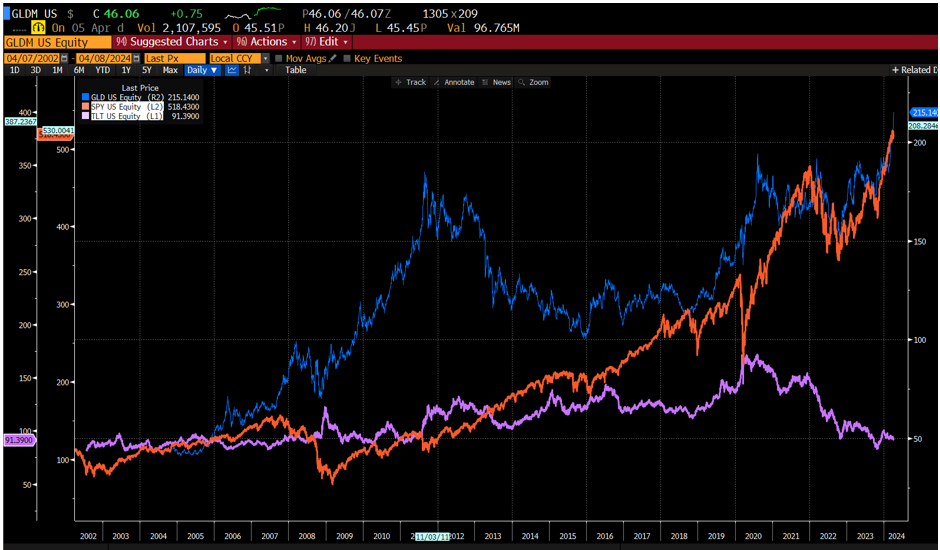

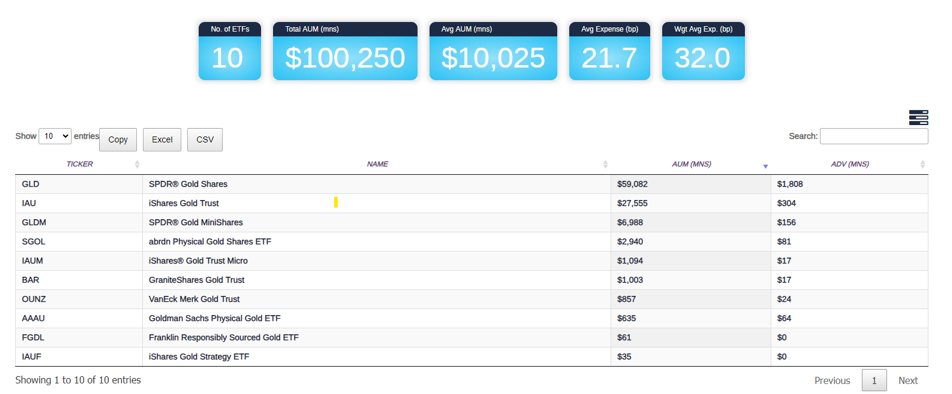

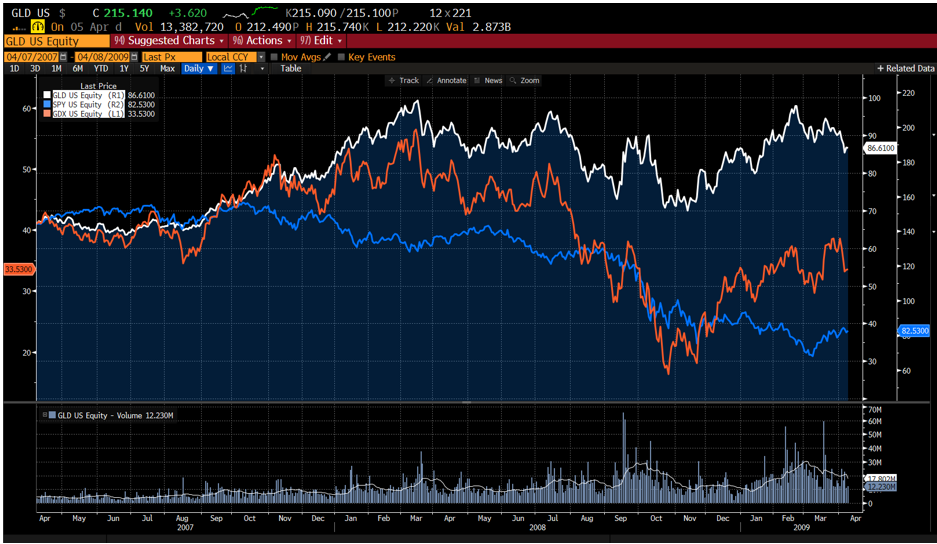

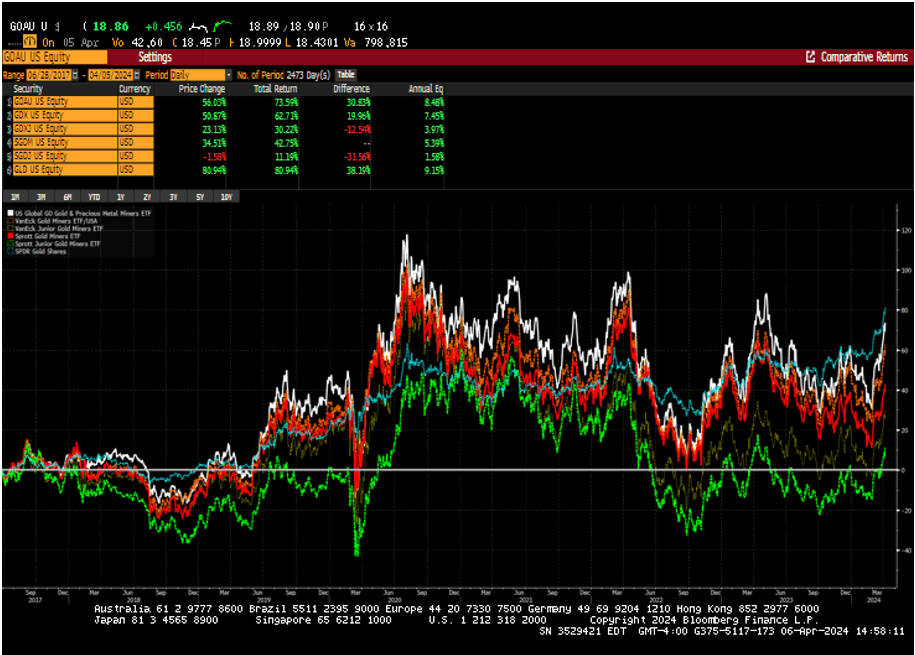

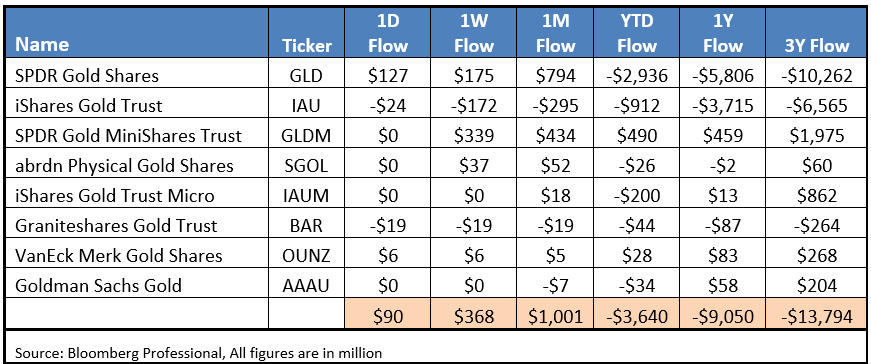

Investors appear to be underweight in gold, even as its price has finally moved well and has been hitting records. Skeptics, clearly the asset class is anything but dead! Moreover, we would argue that the recent price rally could be a classic risk-off signal and anyone just looking at bitcoin as the better asset class is simply myopic. There is room for both, and the fact is that for decades gold bugs have had the same reasoning for owning gold as bitcoin maximalists have for owning bitcoin. This is why we have always emphasized that although there is room for both, because blockchain companies are also driven by the adoption of bitcoin and crypto, we believe they should be overweighted over gold. Gold does not typically have the same disruptive potential as crypto in general. Nevertheless, given the move, we thought it was timely to respect gold’s importance as an asset class that has correctly signaled caution for decades. For example, as the two Bloomberg charts demonstrate, owning some gold in a portfolio can provide the power of diversification (note we highlight GLD in the chart since that ETF has the longest track record. Other similar alternatives include GLDM, IAU and BAR at 10 Bps, 17.5 Bps, and 25 Bps versus 40 Bps for GLD).

The Miners vs Spot Gold

Given the importance of investor diversification, and the observed weakness in long term U.S. Treasuries, it is reasonable to consider that concerns around inflation, the dollar, and overall money printing will accelerate gold’s move to new highs. This month may be just the beginning. If so, we would look to gold miners to play catch up. This might occur despite the group’s own struggles keeping up with operating input cost rising, like the cost of cement, equipment, and labor. Essentially, it could be a mean reversion trade opportunity.

But first, let’s highlight some of the challenges that have caused miners to historically underperform, as explained in a Sprott insight piece written last July 2023 by John Hathaway and Shree Kargutkar:

- The industry is capital intensive and at times share issuance has been undisciplined.

- Subpar Returns on Equity (ROE) have led to a disappointing Return on Invested Capital (ROIC) that isn’t consistent and or feels like a boom-and-bust cycle.

- Jurisdictional risks associated with nationalism have increased political concerns and led to increased demand in stable locations as well as increased M&A activity.

- Margin erosion from increased input costs has been recognized by investors who are concerned about cap costs and higher breakeven levels.

Hidden Gems: Massive Dispersion of Outcomes

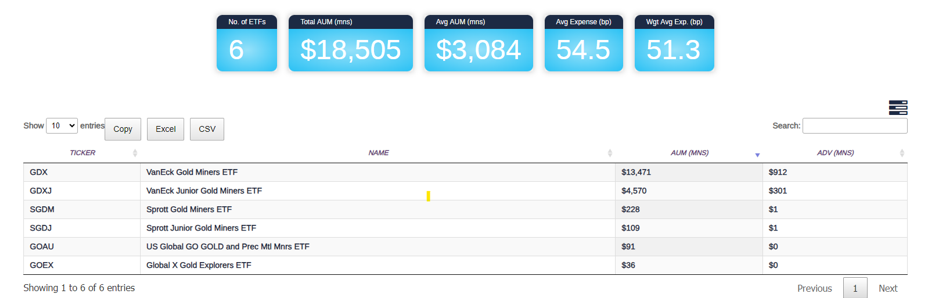

Investors may be surprised to find that there is a very low overlap between gold miner ETFs. The range is typically about 15-25%. It’s common, especially when there are only a few, for there to be a massive concentration of assets in one or two funds. In this category, VanEck Global dominates with the VaneEck Gold Miners ETF (GDX) and the VanEck Junior Miners ETF (GDXJ).[i] VanEck Global, of course, is very well known in the gold mining sector, so it should be no surprise that these two funds represent 99% of the AUM. However, we would encourage investors to review the difference that U.S. Global Investors’ U.S. Global Go Gold and Precious Metals Miners ETF (GOAU) brings to the table. In this ETF, the top weighted companies include royalty or production stream companies like Wheaton Precious Metals Corp (WPM), Royalty Gold (RGLD), and Franco-Nevada Corp (FNV). As companies that lend to the miners, these are relatively asset-light types of companies that earn revenues through a preferred carry on the mining business of others. Those who are familiar with Frank Holmes and his expertise in the gold industry probably know this ETF, but most financial advisors are probably unaware of the strategy and will focus on the larger funds. Again, bigger is not always better in the structure of an ETF. GOAU is one of the newer funds in the group, but still has a relatively long operating history dating back to June 2017 (note: the chart above dates to the inception of GOAU, but the index goes back much further and can be viewed on Bloomberg).

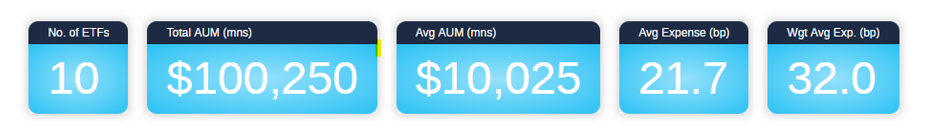

Perhaps the most amazing KPI in the U.S. market for Gold Spot is that it is just at $100 billion. Bitcoin already represents about 56% of that size ($56 billion), but let’s not digress. The point of this article is just to highlight gold. To that point, while we think this breakout in gold is something to watch, we would highlight that $1 billion in monthly inflows is a good start for the asset class. The aggregate net flows YTD remains negative, down $3.64 billion on the year, and over $9 billion for the last 12 months. Our point is “Gold Bugs” have a long way to go to regain momentum that offsets nearly $14 billion of outflows in 3 years.

Summary

While it appears that many investors have not paid attention to gold for years, we believe it remains a classic force and a signal to be reckoned with, so positive inflows – even just for a month in – are something we think investors should be paying attention to. The question is, will this end up being a false signal? We kind of hope so, since what is good for gold is often bad for equity markets. However, as the saying goes, “HOPE IS NOT A STRATEGY!” Also, if you believe capital markets are on good footing, a solution to simply buying the gold spot ETFs is an investment in gold miners. The group offers a compelling valuation at approximately 5x to 7x EV/EBITDA[ii] that could treat the equities as a springboard if gold rallies further. Just don’t think too narrowly about the obvious ETFs. In the ETF Think Tank we are all about education and due diligence! Do your due diligence! Remember, structure matters!!!

[i] 2015 Weiskopf’s Interview with Jonathan Foster, PM at Van Eck’s GDX and GDXJ https://www.etf.com/sections/features-and-news/structure-matters-factors-drive-gold-miners

[ii] https://etfthinktank.tidalfinancialgroup.com/2024/04/03/etf-tax-efficiency-cool-but-complicated/

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).