There are more than 3,400 different ETFs listed across U.S. exchanges. In 2023, 543 new funds came to market. This past February alone, we welcomed another 17. You may be asking yourself, ‘do we need any more ETFs?’

We’d venture that the short answer is ‘yes’ if the industry’s track record of broadening and improving market access through product innovation is any guide.

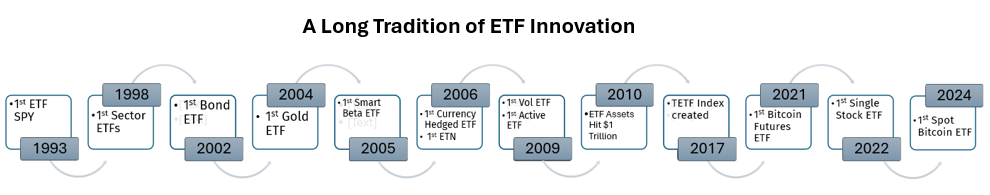

So far in 2024, we’ve watched the arrival of spot bitcoin ETFs with an enthusiasm that had been building up for a decade. Single-stock ETFs are just now flourishing; derivatives-based strategies, multi-asset products, trend following portfolios – it turns out innovation is still surprising us even as the number of products and market participants grow.

And every time a new product goes where none had gone before in an ETF wrapper, the story of market access wins, as investors add another tool to their tool kit.

As we take stock of where the ETF market sits today, what can we say about how much room for more still exists?

It’s widely accepted that the territory for plain passive beta is pretty much claimed. Industry veteran Dave Nadig, in his recent piece titled ETFs in 2024: Prediction Time!, argued that open space will center on what he calls “packaged trades” (i.e. “single ticker solutions that make a multi-leg trade into a single leg-trade”) and “packaged portfolios” where an ETF is an entire portfolio solution in itself in a future where “new ETF innovation comes mostly from packaging up things folks could otherwise do on their own.”

Some of the conversations on our side of the world (from the perspective of Tidal’s white label business) suggest that strategies that dabble in new types – mostly active types – of income generating securities, in real assets, in the many types of options strategies, in crypto 2.0, and in the all-in-one solutions space have barely started to scratch the surface.

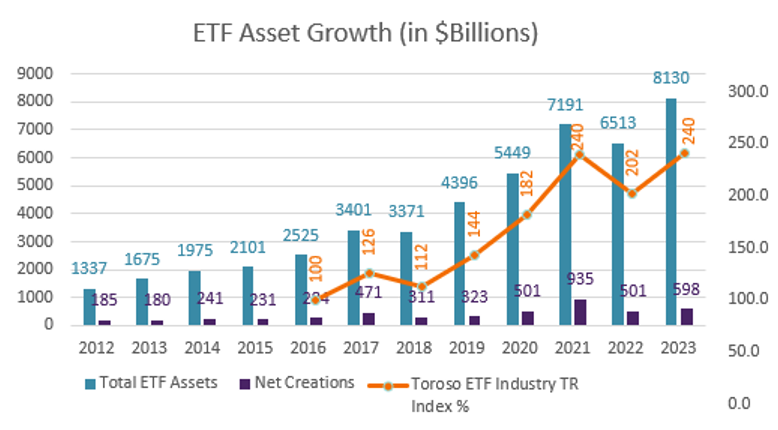

And investors continue to turn to ETFs for portfolio solutions, the data shows:

What was true in the past and remains true for the future of ETF product development is that new products need to meet what we call “necessary conditions” to find success. That’s increasingly true in a constantly growing universe of products.

They are:

- The product must be right – Is the ETF a timely solution to a problem?

- The capital support needs to be there – Does the ETF have enough seed capital?

- The infrastructure must be in place – Does the ETF have strong partners to deliver excellence in execution?

Finding White Space

The case for more “room” in the ETF space is directly linked to a fund’s ability to solve an investor problem.

Solving that problem for the very first time can be especially powerful.

Time and time again we’ve seen over the years the market leadership that stems simply from being the first to a new idea. As the market grows, that type of original untouched space gets harder and harder to find. It’s important to remember that innovation doesn’t come only from being first. It can come from being more cost competitive, or for delivering better execution, or bringing unique expertise no one else has.

First-to-market is no replacement for best in class. A strong value proposition that powers up a solution is the ultimate necessary condition.

Power of Capital

It’s also very important to have capital backing a new product. You could argue significant seed capital could shade first-to-market in a hand-to-hand combat given the importance investors assign to assets under management.

Few want to be the first investors to a new product. Even fewer want to touch anything with high closure risk because the asset base is so low. And many would like to avoid being a fund’s biggest percentage of total assets – it feels too risky. Big capital right away alleviates those issues. Capital also can open doors to distribution platforms, many of which have minimum-AUM thresholds for new products.

Age Matters

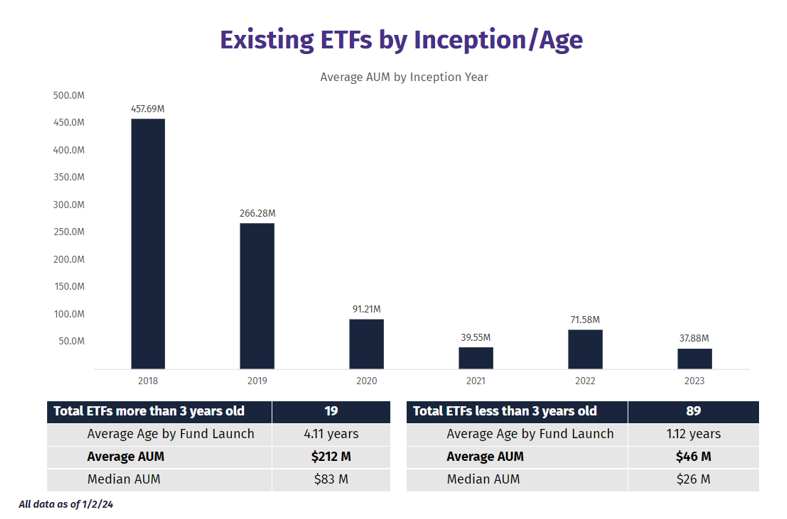

One interesting feature of the ETF marketplace when it comes to an ETF’s asset base is that, often, growth doesn’t hit its stride until after year 3.

If you look at the universe of ETFs brought to market through Tidal Financial Group as a sample size, ETFs with 3 years or more in the market have significantly higher average asset totals than those younger than 3. Why? After 3 years, ETFs hit the radars like Morningstar’s rating system and key distributor platforms with deep reach into the advisory and institutional channels.

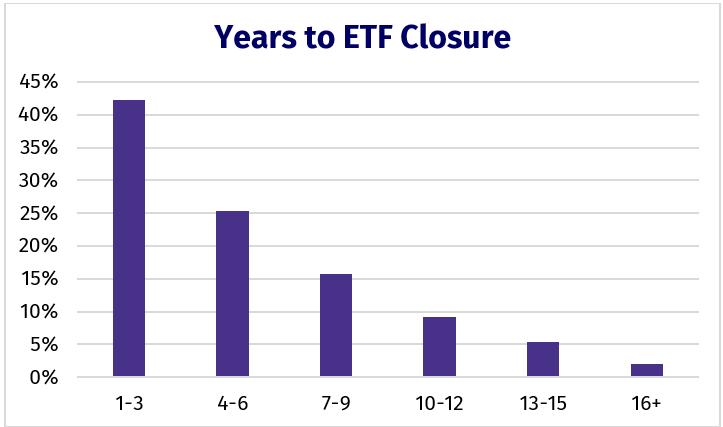

By the end of year 3, ETFs are seen as battle-tested with long live track records. Consider that most ETFs that don’t survive, close in their first 3 years – ETF closure rate drops dramatically after year 3. As another anecdote to the importance of time in the market, consider that regulatory compliance doesn’t allow a new ETF to market year-to-date (partial) performance in a factsheet in its first year – it must be a complete calendar year before it can make it onto the factsheet as year 1 – building a live track record takes time.

If Not Now, Soon?

While there’s no knowing exactly where the next product development innovation will erupt, this industry’s long track record of delivering solutions to investors tells us that investors win – and assets follow – when there’s an alignment between a strong value proposition, excellence in execution, and capital support.

That first-to-market opportunity is looking harder and harder to find – and it can be magical to witness – but we can’t wait to see where ETF product innovation takes us next. We’re here for it, watching closely.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).