Covered call ETFs have emerged in recent years as a popular strategy with investors seeking alternative sources of income outside of traditional bonds. The excitement – and relatively quick growth of this category – may feel new, but these ETFs have a long history marked by important milestones.

The pioneer in this space, the Invesco S&P 500 BuyWrite ETF (PBP), first launched in 2007, bringing to market access to a covered call strategy tied to the S&P 500 Index.

Anyone who was around the ETF market at that time remembers that regulatory appetite for options-based ETF investing was minimal and restrictive, with rules limiting the scope of what these types of strategies could do.

PBP had to be passively managed. It was the first-of-a-kind, but it was a simple, straight forward ETF tied to a well-known benchmark that didn’t do much to highlight the potential value of covered call strategies. The fund last reported a 12-month distribution rate of 3.35% (as of Dec. 27, 2023) – results it has delivered month in and month out since inception.

PBP’s launch, however, not only eased regulators’ concerns, it also opened the door for many others that would eventually follow.

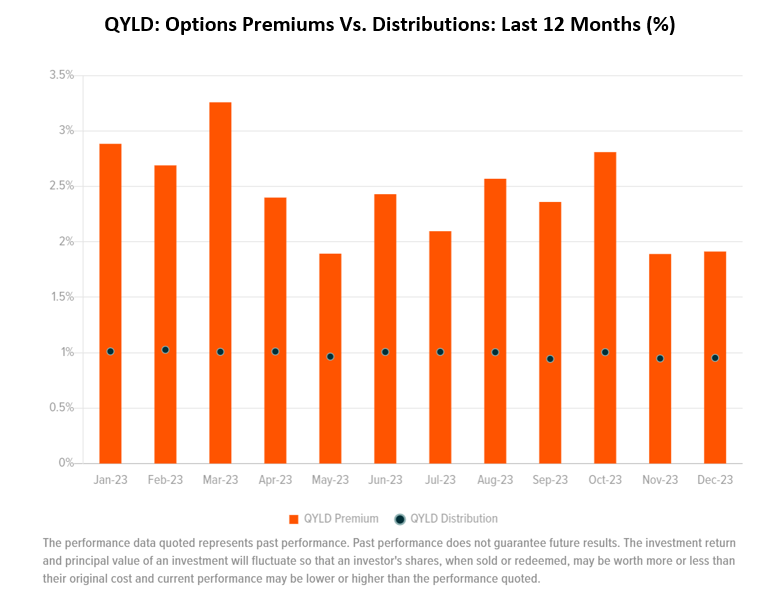

One of the next meaningful evolutions in this category came in 2013 with the launch of the Nasdaq 100 Covered Call ETF (QYLD), which didn’t start out as a Global X product, but today is thanks to corporate action over the years. At that time, the regulatory framework was more accepting of options-based strategies and allowed for more options premium to be harvested within a passive approach. QYLD delivered that – the funds reported a 12-month distribution yield of 12.27% (as of Dec. 27, 2023.)

But QYLD was hardly met by investor hype. While the fund is successful in assets today, QYLD sat somewhat dormant for a long time – a non-story. The fund’s trajectory reminded us that, in the ETF market, great ideas need to be accompanied by great timing. Alternative sources of income were hardly a priority in the mid-2010s. The market wasn’t looking for another form of yield, so attention into this product came slowly.

Fast forward to the arrival of Rule 6c-11, known as the “ETF Rule,” in late 2019, and regulatory restrictions on ETFs loosened significantly, with little limitations still left in place for product innovation. What followed was a wave of disruption in active management, which translated into a lot of interesting ideas in the covered call ETF space.

Among the funds that brought new approaches to the category was the Amplify CWP Enhanced Dividend Income ETF (DIVO), in which a portfolio of dividend growth stocks that’s sensitive to sector exposures was met by a tactical covered call overlay on single stocks, generating monthly yields.

The category also welcomed big entrants like JP Morgan, which made a splash with strategies like JPMorgan Equity Premium Income ETF (JEPI) and JPMorgan Nasdaq Equity Premium Income ETF (JEPQ), which are often seen as covered call portfolios, but they introduced the use of equity-linked notes (ELNs) as a wrapper around options premiums for a better tax treatment of distributions.

The newest evolution of covered call ETFs came more recently, on the heels of Rule 18f-4, also known as the “Derivatives Rule.” This new regulatory framework opened the floodgates to all sorts of innovation in the use of derivatives in ETFs, including the advent of the single-security ETF phenomenon, which in the covered call space has meant the pursuit of options income tied to a single stock often using weekly – and sometimes daily – options contracts for higher yield potential.

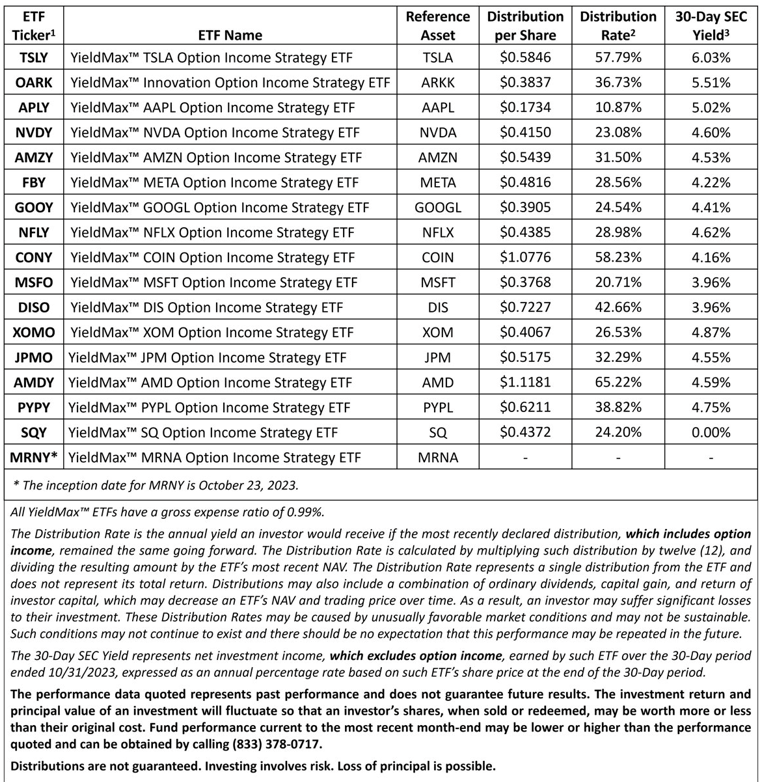

YieldMax ETFs pioneered this category with the first-of-a-kind YieldMax TSLA Option Income Strategy ETF (TSLY) launched in November 2022. Since then other product providers have followed, including BlackRock, Kraneshares, NEOS and Rex Shares, but YieldMax remains the category leader, now with more than a dozen ETFs commanding about $1.5 billion in total assets under management (as of Dec. 27, 2023.)

YieldMax ETFs at a Glance (Distributions as of Nov. 7, 2023)

These quickly growing funds, which have become known for generating high yields – “eye-popping,” as some have said – have both captivated and occasionally confused investors. And here’s why: The primary investment objective of YieldMax ETFs is to generate high yield through a covered call strategy. However, their single-stock nature – each of these ETFs is tied to a single stock ticker such as Tesla, Apple, Nvidia, etc. – has led some to benchmark these funds’ results to that of their respective underlying stock.

This benchmarking effort for a covered call strategy sometimes creates confusion, and almost always leads to disappointment. That’s because a covered call strategy isn’t just long an underlying security or an asset, it adds the selling of call options on that underlying security or asset in an effort to capture income.

In truth, when evaluating these ETFs, their path of returns, and their fit in a portfolio, consider 3 quick points:

- Yield and Return are two different things.

- The primary use case for these ETFs is alternative income, not price performance of underlying.

- Reinvest the distributions for growth.

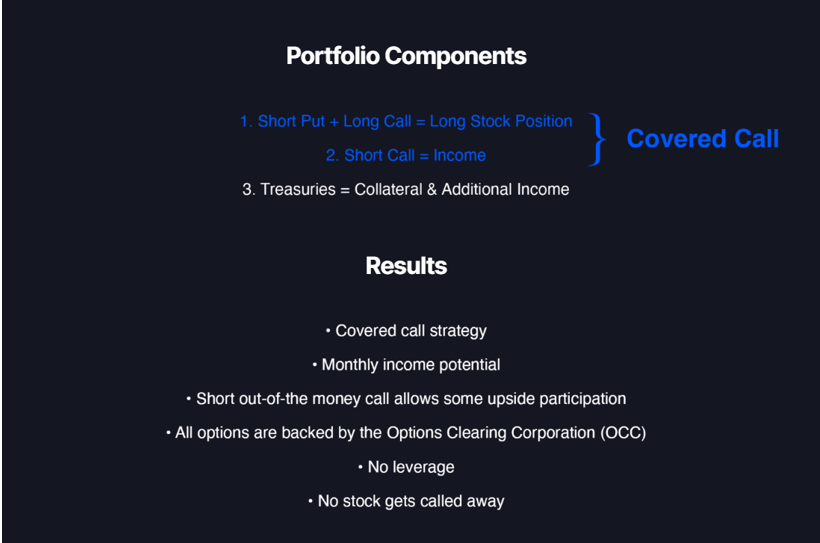

How YieldMax ETFs Work

- Yield vs. Return

YieldMax ETFs advertise their pursuit of high yields. They don’t advertise their pursuit to high stock price returns. Often, the two things get confused, and that’s probably because we like to evaluate ETFs based on benchmarks.

For a YieldMax ETF, the obvious comparison for returns is the underlying stock each of these portfolios is tied to. How is TSLY performing vs. Tesla, the stock? The problem with that is that YieldMax ETFs set out to generate high yields through a covered call strategy, which by design, means giving up on stock price upside capture. That’s the nature of a covered call strategy.

These ETFs are selling calls and getting paid option premium in exchange for giving up some of the upside on the underlying stock, which they don’t actually own – they have synthetic exposure to it through options contracts. The primary objective is capturing massive yields, and that they do.

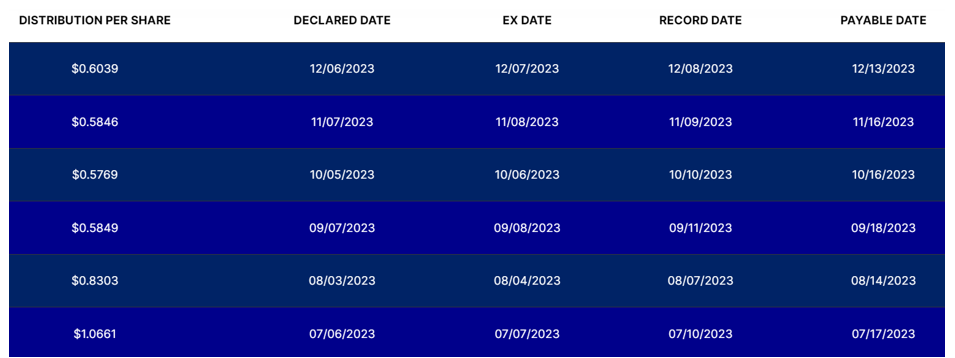

For example, TSLY, the largest YieldMax with about $845 million in assets, has an annual distribution yield of 60.5%, as of Dec. 26, 2023 (that’s a rate that assumes the most recent distribution remains unchanged going forward), according to YieldMax.

TSLY Distributions

That 60.5% may be impressive, but it must not be confused with returns. That’s the yield. YieldMax ETFs don’t set out to beat the performance of their underlying stocks. TSLY has never set out to beat the performance of Tesla. It would, in fact, be extremely rare for any covered call strategy to beat their underlying stock unless that stock is going down consistently over time.

TSLY Price (white) vs. TSLY Total Return with Reinvested Distributions (orange)

It’s interesting to note that YieldMax ETFs navigate in out-of-the-money calls. That means there’s room for some upside stock price performance capture, which TSLY’s prospectus (as an example) specifies a range between 0-15% above stock price. That’s not always the case with covered call strategies.

Were these funds using at-the-money calls, as many popular option income ETFs do today, they would have zero stock upside capture.

What’s more, these ETFs are transacting in weekly calls – not monthly – to boost yield generation. Most of the time decay in options happens in the last week to last day of a contract, and YieldMax ETFs pursue higher premium potential and possibly more upside by maximizing that time decay with weekly contracts.

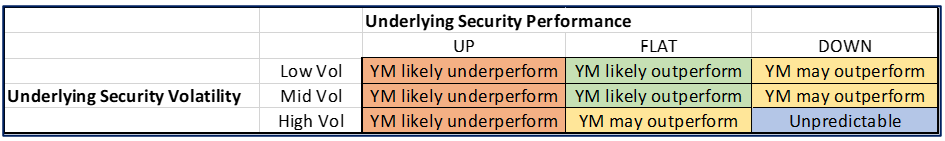

Another wrinkle to these ETFs is that they benefit from stock volatility. The more volatile the underlying stock, the better because the covered call strategy is a play on implied volatility. The more volatile the market expects a stock to behave, the higher the price of the options, and the higher the payout potential. It doesn’t matter if that implied volatility is ever realized – these funds capture premium on the expectation of sharp price movements.

However, while volatility will likely increase the yield, it can have a negative effect on the fund’s performance:

Again, it’s crucial to understand that these ETFs are seeking to deliver very high yields, not very high returns relative to the underlying stock. These yields are a component of total return, and without taking them into account, results will look underwhelming relative to the underlying stock performance. Benchmark accordingly.

So, why own these ETFs?

- Primary Use Case for These ETFs is Alternative Income

If you are looking to have exposure to, say, Tesla, you should own Tesla stock. TSLY is not a pure substitute for that. The performance of Tesla will impact the yield and performance of TSLY, but path and volatility of Tesla’s performance matter more than the total return.

Traditionally, covered call strategies done directly in options markets are popular with investors who are looking to create income on a stock position they may already own and/or plan to own for a long time. These are positions that may have built capital gains over time, and are just sitting in a portfolio, parked. Covered calls are a way to turn these long-term holdings into cash generators – make some money on a position by selling covered calls.

YieldMax ETFs have essentially packaged that concept in an ETF ticker, popularizing a well-trodden options market approach and broadening its access for ETF investors everywhere. That’s the beauty of the ETF wrapper, as we know it.

Their application in the context of a broader portfolio can vary, but it’s centered on the idea of generating an alternative income stream, income that’s not directly correlated to stocks or bonds. It’s an alternative allocation where the yield generated stands on its own – it doesn’t come from dividends, it’s not linked to P/E ratios (price-to-earnings ratio is a measure of a company’s valuation), it’s not dependent on interest rates, it’s not correlated to markets in any meaningful way. It’s simply options yield.

That non-correlated, standalone nature of the yield makes these ETFs an alternative income generator that’s also an asset allocation diversifier.

The interesting catch is that these ETFs do bring to the table single stock risk given their synthetic exposure to their respective underlying stocks. If, say, Tesla goes down 20%, TSLY will go down with it minus the yield generated. These ETFs are a great diversifier, and yet a great source of single stock concentration and risk, and who wants single stock risk in their pursuit of income?

The good news is that, today, there are multiple single-stock YieldMax ETFs in the market, so allocating across multiple tickers at once is easily done. That could potentially mitigate single stock concentration and risk. The firm has also put in registration with the SEC a fund-of-funds portfolio that would implement multiple YieldMax ETFs into a single ticker, making it even simpler to cross allocate.

We don’t often associate income generation with elevated single stock risk, but here we are. The bottom line is that however you choose to tackle that risk, just remember it’s there.

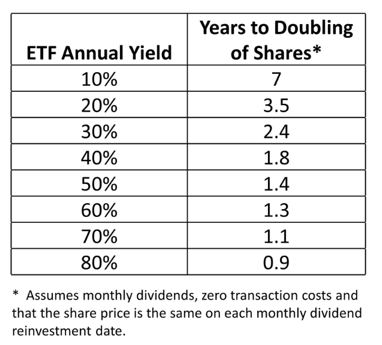

- Reinvest Distributions for Growth

YieldMax ETFs are an alternative source of potential income. Cashing out those high yield distributions on a regular basis is certainly within the purview of any investor, and if you own YieldMax ETFs as a cash generator for immediate expense needs, you may very well be doing that.

That doesn’t make owning these ETFs a losing proposition because without reinvestment of distribution, the ETF net asset value (NAV) may look disappointing relative to the underlying stock.

However, reinvesting the distributions isn’t just about making those total return numbers look better. It’s about putting cash back to work, capturing growth over time. Talk to any financial advisor, and you will probably hear the same call for reinvestment, because reallocating cash translates into growth of share position, and potentially higher yields down the line.

In truth, we spend a lot of time in the ETF world talking about the importance of diversification. Alternatives – those low- to no-correlation assets to stocks and bonds – are a big part of that story. Investing and reinvesting into your alternative sleeve, whether that’s putting money to work in a YieldMax ETF or into something else, is a call to action on that effort to diversify. When you don’t reinvest, you lower your exposure to your alternative asset allocation, which could impact your growth.

Learn More

YieldMax ETFs have disrupted the way ETF investors pursue high yields, and they have delivered on their primary objective of generating income. But investing is never without risk, and it’s certainly not to be done without some homework.

For more information on YieldMax ETFs, visit https://www.yieldmaxetfs.com/

Important Information

This document must be preceded or accompanied by the prospectus. Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. Please read the prospectuses carefully before you invest.

Investments involve risk. Principal loss is possible. Shareholders of the funds are not entitled to any dividends paid out by the underlying stock.

The funds do not invest directly in the underlying stock or ETF.

Investing in the funds involves a high degree of risk.

Single Issuer Risk. Issuer-specific attributes may cause an investment in the fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the Fund, which focuses on an individual security, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole.

THE FUND, TRUST, AND SUB-ADVISER ARE NOT AFFILIATED WITH THE UNDERLYING STOCK OR ETF.

Due to the Funds’ investment strategies, the Funds’ investment exposures are concentrated in the same industries that are assigned to the underlying stock or ETF. As with any investment, there is a risk you could lose all or part of your investment in the Fund. Some or all of these risks may adversely affect the Funds’ net asset value (“NAV”) per share, trading prices, yields, total returns, and/or ability to meet their objective.

Shares of any ETF are bought and sold at market price (not NAV) and may trade ad a discount or premium to NAV. Shares are not individually redeemable from the Fund and may only be acquired or redeemed from the fund in creation units. Brokerage commissions will reduce returns.

Indirect investment risk. The underlying companies are not affiliated with the Trust, the Fund, the Adviser, the Sub-Adviser, or their respective affiliates and is not involved with this offering in any way and has no obligation to consider your Shares in taking any corporate action that might affect the value of Shares. Investors in the Funds will not have voting rights and will not be able to influence management of the underlying company but will be exposed to the performance of the underlying company’s stock or ETF. Investors in the Funds will not have rights to receive dividends or other distributions or any other rights with respect to the underlying stock or ETF, but will be subject to declines in the performance of the underlying stock.

US Obligations Risk: The Funds may invest in securities issued by the U.S. government or its agencies or instrumentalities. U.S. Government obligations include securities issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, such as the U.S. Treasury. Payment of principal and interest on U.S. Government obligations may be backed by the full faith and credit of the United States or may be backed solely by the issuing or guaranteeing agency or instrumentality itself. In the latter case, the investor must look principally to the agency or instrumentality issuing or guaranteeing the obligation for ultimate repayment, which agency or instrumentality may be privately owned. There can be no assurance that the U.S. Government would provide financial support to its agencies or instrumentalities (including government sponsored enterprises) where it is not obligated to do so.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with underlying investments or the Fund’s other portfolio holdings, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions.

Currency Risk. The Fund is exposed to currency risk indirectly due to the underlying ETF’s investments. The underlying ETF’s net asset value is determined on the basis of the U.S. dollar, therefore, the underlying ETF may lose value if the local currency of a foreign market depreciates against the U.S. dollar, even if the local currency value of the underlying ETF’s holdings go up.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility or the reference asset, the time remaining until the expiration of the option contract and economic events.

Price Participation Risk. The Fund employs an investment strategy that includes the sale of call option contracts, which limits the degree to which the Fund will participate in increases in value experienced by the underlying stock or ETF over the Call Period. This means that if the underlying stock or ETF experiences an increase in value above the strike price of the sold call options during a Call Period, the Fund will likely not experience that increase to the same extent and may significantly underperform the underlying stock or ETF over the Call Period. Additionally, because the Fund is limited in the degree to which it will participate in increases in value experienced by the underlying stock or ETF over each Call Period, but has full exposure to any decreases in value experienced by the underlying stock or ETF over the Call Period, the NAV of the Fund may decrease over any given time period.

Distribution Risk. As part of the Fund’s investment objective, the Fund seeks to provide current monthly income. There is no assurance that the Fund will make a distribution in any given month. If the Fund does make distributions, the amounts of such distributions will likely vary greatly from one distribution to the next.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

Launch & Structure partner: Tidal ETF Services

The funds are distributed by Foreside Fund Services, LLC. Foreside is not affiliated with YieldMax or Tidal.

Comparison Information

| For more information, a prospectus and standardized performance, click the fund name. | Invesco S&P 500 BuyWrite ETF (PBP) | Global X Nasdaq 100 Covered Call ETF (QYLD) | Amplify CWP Enhanced Dividend Income ETF (DIVO) | JPMorgan Equity Premium Income ETF (JEPI) | JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) |

| Objective | The Invesco S&P 500 BuyWrite ETF seeks to track the investment results (before fees and expenses) of the CBOE S&P 500 BuyWrite Index SM. | The Global X NASDAQ 100® Covered Call ETF seeks to provide investment results that closely correspond, before fees and expenses, generally to the price and yield performance of the CBOE NASDAQ-100® BuyWrite V2 Index. | The Amplify CWP Enhanced Dividend Income ETF seeks to provide current income as its primary investment objective and to provide capital appreciation as its secondary investment objective. | The Fund seeks current income while maintaining prospects for capital appreciation. | The Fund seeks current income while maintaining prospects for capital appreciation. |

| 30-Day SEC Yield (Subsidized) | 1.06% | 0.27% | 2.04% | 7.04% | 9.21% |

| 30-Day SEC Yield (Unsubsidized) | – | – | – | 7.04% | 9.21% |

| Gross Expense Ratio | 0.49% | 0.60% | 0.55% | 0.35% | 0.35% |

| Assets Under Management | $92.03 million | $7.64 billion | $2.98 billion | $30.48 billion | $8.33 billion |

| Inception Date | 12/20/2007 | 12/11/2013 | 12/14/2016 | 05/20/2020 | 05/03/2022 |

30-Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows for fairer comparisons among bond funds. It is based on the most recent month end. This figure reflects the income earned from dividends – excluding option income – during the period after deducting the Fund’s expenses for the period.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.