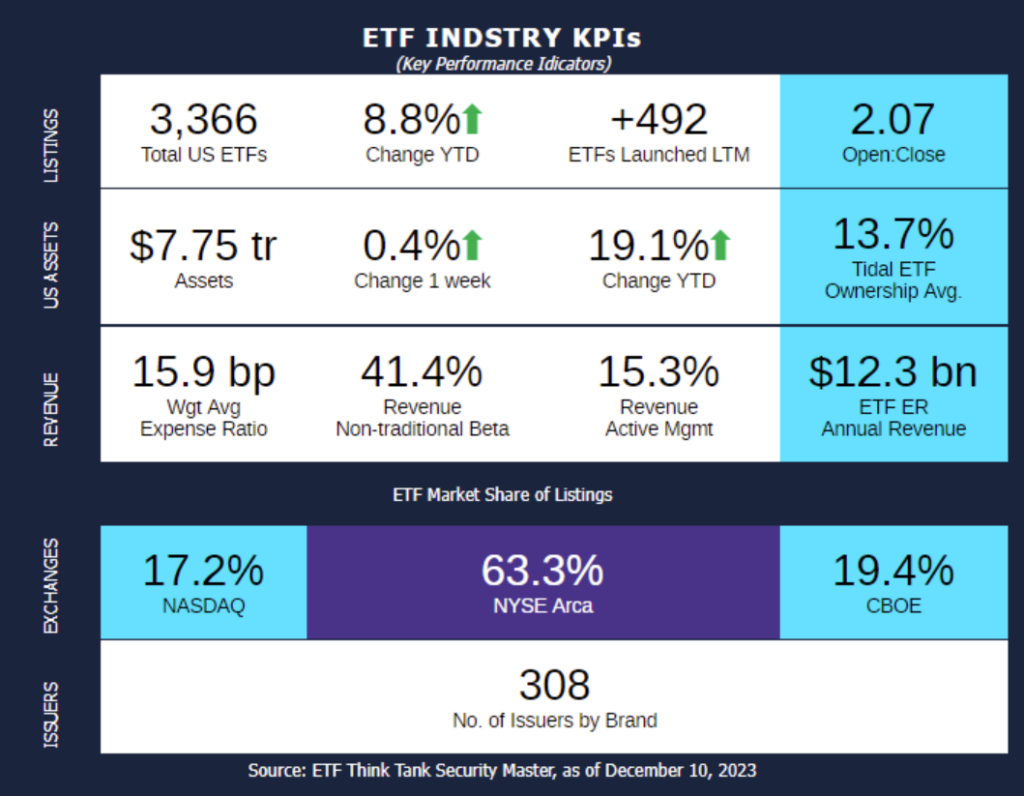

Week of December 4, 2023 KPI Summary

- This week, the industry experienced 14 ETF launches and 1 closure, shifting the 1-year Open-to-Close ratio to 2.07 and total US ETFs to 3,366.

- It’s that time of year again. While everything should be merry and bright, everyone is either coming off a cold or heading into one. Accurately placed on the calendar, tomorrow, December 12 is “National Universal Health Coverage Day” and it’s time for the annual check-up on our Healthcare ETFs.

- The 46 ETFs our ETF Security Master categorizes as healthcare combines for $90.3 Billion.

- Down from $105 Billion one year ago, or -14.3%.

- The largest Healthcare ETF by far is XLV (Health Care Select Sector SPDR ETF) at $37.3 Billion, with VHT (Vanguard Health Care ETF) next in line at $16.1 Billion.

- XLV and VHT combined for $60.2 Billion one year ago; they are -11.3% down in total AUM.

- The top ETF in total revenue YTD is MEDI, Harbor Health Care ETF, with 18.1% growth.

- In fact, only 7 of the 46 Healthcare related ETFs have positive asset performance in 2023 YTD. The largest of these is PPH, VanEck Pharmaceutical ETF, with $415 Million AUM and 2.7% increase YTD.

- Although the category has taken a dive in the last year in assets, the average expense ratio has risen from approximately 54 bps to 56.6.

- 20 different issuers have a Healthcare related ETF.

- iShares has the most with 7.

- The newest ETF to the category is Subversive Mental Health ETF (SANE) which launched in December 2022.

- The 46 ETFs our ETF Security Master categorizes as healthcare combines for $90.3 Billion.

- Healthcare ETFs have certainly been bleeding in the last 12 months. However, in a 1-month view, fund assets are up 5.4% on average, unsurprising with our record-breaking month of November. This small sector of our ETF industry makes up 1.2% of the total assets, but every bit as vital as the remaining 98.8%.

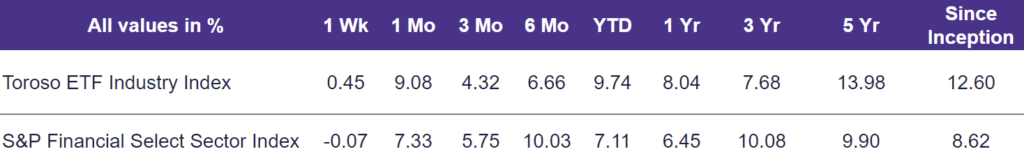

- The tracked indexes experienced similar performance last week. The Toroso ETF Industry Index was up 0.45% while the S&P Financial Select Sector Index trailed at -0.07%.

ETF Launches

Themes Airlines ETF (ticker: AIRL)

Themes Cybersecurity ETF (ticker: SPAM)

Themes Generative Artificial Intelligence ETF (ticker: WISE)

CastleArk Large Growth ETF (ticker: CARK)

Invesco S&P 500 Hi Dividend Growers ETF (ticker: DIVG)

Invesco Nasdaq Free CA Flow Achievers ETF (ticker: QOWZ)

Hartford US Quality Growth ETF (ticker: HQGO)

Hartford US Value ETF (ticker: VMAX)

Harbor Long-Short Equity ETF (ticker: LSEQ)

National Security Emerging Markets Index ETF (ticker: NSI)

Return Stacked Global Stocks & Bonds ETF (ticker: RSSB)

ALPS | Smith Core Plus Bond ETF (ticker: SMTH)

Vert Global Sustainable Real Estate ETF (ticker: VGSR)

Vanguard Core-Plus Bond ETF (ticker: VPLS)

ETF Closures

iShares® iBonds® December 2023 Term Muni Bond ETF (ticker: IBML)

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of December 8, 2023)

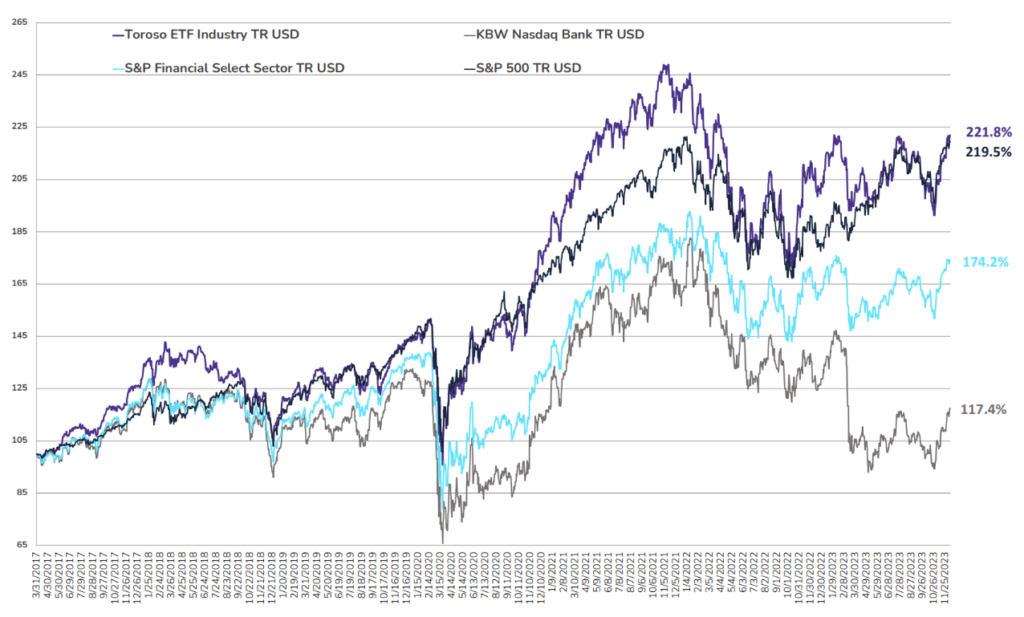

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through December 8, 2023)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.