On a recent trip to Brazil, I was reminded of what emerging markets are all about. Everywhere you look there are ample natural resources, opportunity for entrepreneurship, a lot of surprising creativity and innovation, and a tangible promise of economic growth, all of it consistently clouded – or stumped – by political and regulatory risk.

It’s like having the most beautiful sports car you’ve ever seen, but the speed limit everywhere is 30 miles an hour.

While there, I had the opportunity to chat with local economist and market strategist, Carlos Antonio Magalhaes, who’s been in markets for 50 years, and currently works with Sabe, a Brazilian market intelligence firm that works with asset managers and investors. Magalhaes, who lives in Rio de Janeiro, is a professed believer in fundamentals who has seen his share of different market cycles, inflationary environments, currency changes, and government action. To him, investing in Brazil (much like investing in emerging markets in general) requires an understanding of the global context and a healthy dose of cautious optimism.

The Brazilian economy is moving along, anchored on its status of commodities superpower, which it is. There’s another record corn crop expected this year and massive soybean and wheat output, according to USDA. It’s also projected to grow about 2% this year, and it’s accustomed to things we in the U.S. struggle to adjust to, like, 5% inflation – from an inflationary perspective, as Magalhaes points out, easy times there, historically speaking.

When you talk of recession, Brazil is relatively in good shape, according to local financial educator and data provider FinDocs. Economists are pegging chances of recession in Brazil in 2023 at 15% vs. 65% for the U.S. and 75% for the UK.

And yet, the reality on the ground is one of massive dispersion in access.

The Haves, Almost-Haves & Have Nots

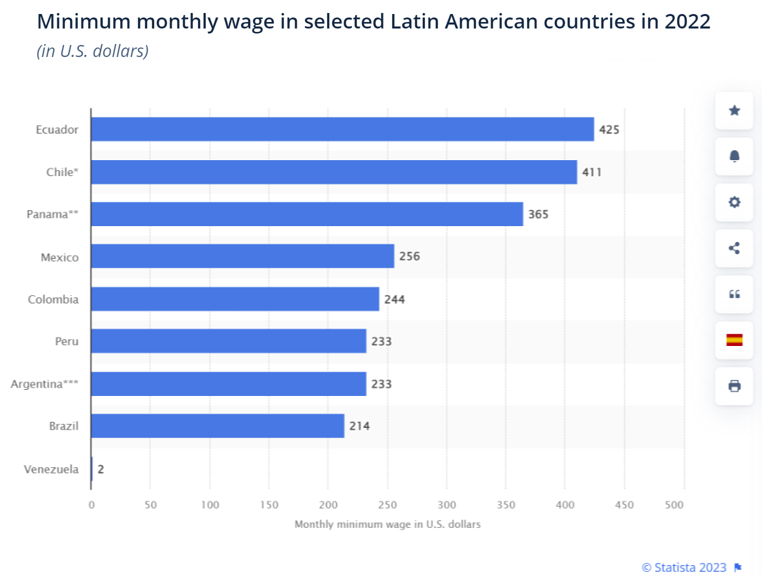

- Purchasing power is extremely uneven, with one of the lowest minimum wages in Latin America, according to Statista data. Brazil also has massive wealth concentrated in the hands of a few. Forbes reports the country has the highest number of billionaires in the region.

- The cost of goods is borderline shocking these days (I speak firsthand), and it’s not due to inflation as much as it’s due to high taxation of goods and difficult-for-business trade barriers, according to Magalhaes. As an example, an iPhone 14 in Brazil will cost you nearly $1,600 – 7,600 Brazilian real. That’s roughly twice the cost a consumer would pay in the U.S. (You can see these policies in detail here.)

- Capital is expensive with the Brazilian federal funds rate (the Selic) sitting at 13.75% – a multi-year-high the central bank has held steady since last September, but one that many (including Magalhaes) say is excessively high for market conditions and current levels of inflation.

- Official unemployment figures point to an 8% unemployment rate (near an 8-year low and well below the all-time high of 14.9%), but local economists estimate the real rate of unemployment is much higher, as high as 20-30% if you account for the Gig economy. And by gig, we mean autonomous creators of wealth whose biggest resource available to them is creativity. You see everything from “e-commerce innovators” (folks selling things online) to “entertainers” (folks performing soccer tricks at stop lights for a tip) to “entrepreneurs” (folks with a cooler in hand selling cheese door to door.)

- Estimates suggest about 20% of the population remains unbanked, and yet Brazilians are a highly digital society, with twice as many Brazilians said to own cryptocurrencies today as Americans, as a percentage of total population, according to data gathered by the World Population Review.

- On the regulatory front, the government is currently working through massive tax reform that would shift tax burden on goods, consolidate various taxes into fewer line items, change how states compete to attract new businesses, and impact generational transfers of wealth through taxation, all to reportedly streamline an overly complex system. While simplicity is welcomed, some express concern that the proposed overhaul could jeopardize key sectors’ competitiveness, such as technology.

Magalhaes summarizes the big picture this way: “The reality is that economic growth in Brazil is difficult with an impoverished consumer, and unemployment being one of the biggest problems – about 26% of people under 30 doesn’t study or work. Taxation is another big problem. Taxes are very high on individuals and on companies, and while the government collects a lot, it spends very poorly. But there are many ‘Brazils’ within Brazil, with big centers of wealth and development throughout the country, and an agricultural muscle that’s difficult to match globally.”

Investing Implications

So, what does that mean when it comes to investing? It means a discerning eye for opportunity, according to Magalhaes.

On a Friday morning (when we spoke), he cited various data points catching his attention:

- Latest Brazilian unemployment rate – “it’s around 8%, but in reality, it’s much higher.”

- U.S. inflation rate – “Came out within expectations, so we expect the latest Fed rate hike to be the last one this year.”

- Germany’s GDP – “it’s showing zero growth, which is not good for Europe.”

- Commodities prices – “they were hit in early trade (that day), which is always bad news for Brazil.”

The mixed bag of data informs the macro outlook, which is a mixed bag in itself. On one side, recessionary risk in the U.S. and concerns about European growth can bode well for the Brazilian market because investors look outside those developed markets for opportunity. Asset inflows into Brazil have grown, he said, and stock prices have gone up.

On the other side, weak growth among key partners such as the U.S. and Europe impact trade balances and trade activity for Brazil, which relies heavily on exports.

“The Brazilian stock market is up about 20% in the past 3 months thanks largely to U.S. investors and the weakening of the U.S. dollar. Brazil remains very cheap for foreign investors. But when the U.S. and European economies suffer, trade balances suffer. Brazil may benefit on the financial market side, but it’s hurt on the commercial trade side. It’s the classic dichotomy of an emerging market,” Magalhaes said.

Right now, he’s focusing on commodities players, such as producers and export leaders in everything from agricultural goods to livestock to materials to mining giants. He’s also keen on technology companies empowering the commodities segment as well as those leading innovation across industries.

The key, he says, is to look for fundamentally strong companies he deems “companies of the world, profitable regardless of the government,” meaning those whose products and services are needed irrespective of policy changes – things like petrochemical giants, mining, transportation playe and key suppliers.

ETFs & Access

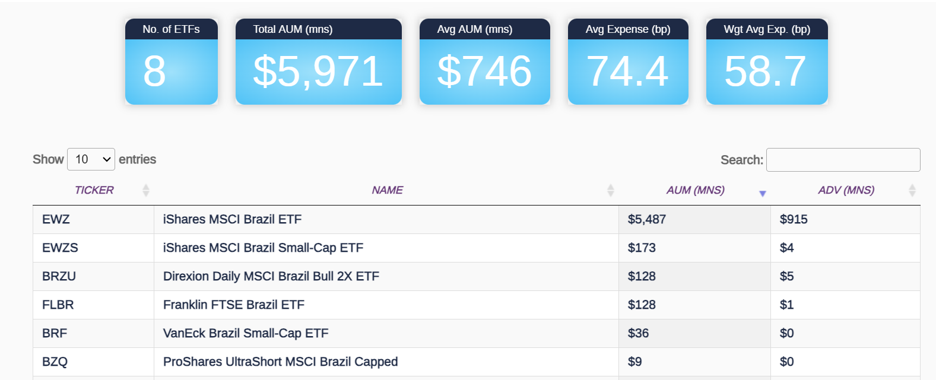

About a year ago, we wrote about Brazil-focused ETFs – a lineup that remains relevant today consisting of broad and more narrowly focused strategies. It’s a segment that commands nearly $6 billion in total assets spread across 8 funds, most of which sits on the broad-based iShares EWZ.

In the last 3 months, EWZ has picked up about $70 million in fresh net assets while its small-cap counterpart, EWZS, has seen net inflows of more than $180 million, reversing earlier-year asset losses.

Going forward, for Brazilians, eyes will remain on Brazil’s economic growth, which Magalhaes hopes will exceed 2% this year. The looming recessionary threat across key developed markets, and government policy curveballs should continue to shape the opportunity set – a reality that rings true across many emerging markets offering today attractive value but ample risk.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).