Broad Market Commentary

Few understand the challenges of following a process of tactical signals that call for Risk-On and Risk-off as much as my colleague Michael Gayed. Experience tells us all that extreme conditions move investments to irrational prices, but behavioral finance tells us that taking action requires a framework for decision making. Yet, few have such a disciplined strategy in place. Usually, the smartest and best investment decisions are made during periods when prices are misaligned with upside or downside opportunity. The challenge, of course, is in identifying the “leading” triggers that are metrics that are followed by “lagging” investment outcomes? The problem, however, is that conditions and context are almost never the same or as predicted, but the loudest voices are still always the most confident. We saw this happen during the recent Bull run in 2020 and then the Bear run in 2022. All this points to the question about current conditions and red flags.

What do we know? Moments of “irrational exuberance” are easily measured when a few good stocks lead to performance anxiety for portfolio managers and short-term investors. The media talks about economic conditions that are “Goldilocks” scenarios (shallow recession or no recession). All this is to say that when periods of time reflect periods of easy linear returns with low volatility, tactical strategies are not set up well to add value. Tactical strategies need the right kind of volatility and an abrupt change in the perception of macroenvironments to cause a sudden and meaningful directional pivot in investor flows. While this may be obvious to many, it also means that financial advisors should monitor these strategies closely to manage risk, capture upside, and manage client expectations. A core-satellite approach is also worth highlighting. Rather than owning a static position in a tactical ETF, own a position that you dial up and down with changing conditions. These types of strategies provide a means to make decisions in advance and having an allocation can help capture the returns in the moment. Yes, we are biased, but regardless, when AGF US Market Neutral Anti-Beta ETF (BTAL) does well, it means that High Beta in the equity market is falling more than Low Beta is falling. Conversely, when BTAL is not doing well, it usually comes when a junk rally is driving market performance. Similarly, in fixed income, there are certain tactical strategies that are designed to capture or pivot around credit spreads. Tight credit spreads suggest easy money, and wide credit spreads signal a change in lending conditions that are a certain red flag for investors. Our message is this: don’t blame these ETFs when they are underperforming. Rather – treat them as signals and give them the respect they deserve. They are tools. Email us for a complete list at dweiskopf@tidalfg.com

Hidden Gems: Measuring Performance

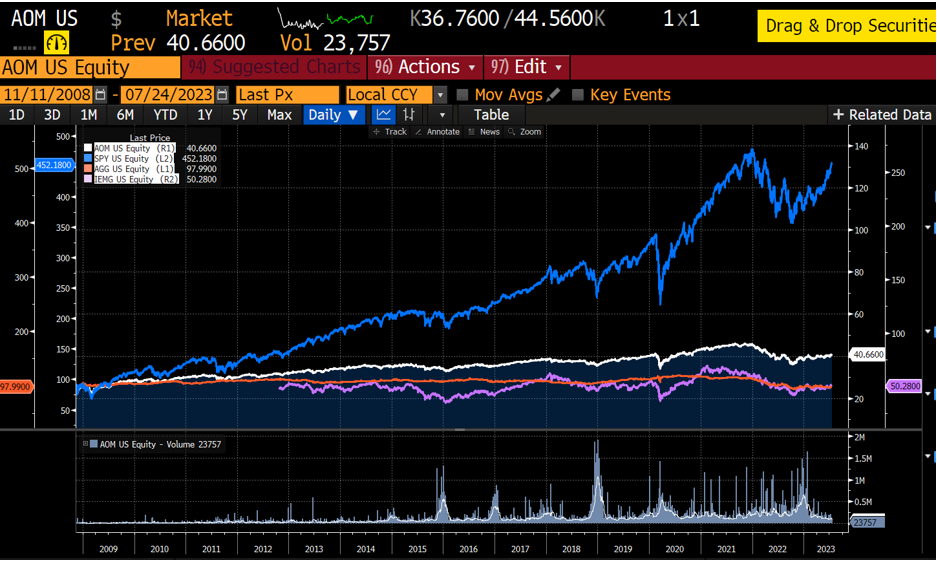

Risk-based strategies are often overlooked by financial advisors. The Blackrock iShares Moderate Allocation ETF (AOM), for example, only has $1.38 billion AUM after 15 years. Since its inception date of November 11, 2008, the performance at about 5.4% (See fact sheet) may be part of the reason, but we have long been a proponent that financial advisors should use such strategies as a benchmark for clients to know how they are doing. Afterall, if Blackrock is saying this is a portfolio for a moderately conservative investor, and you match that category according to your own risk profile, shouldn’t this be your expectation for your retirement returns? Why not set the table with the simplest and clearest solution? Note that this portfolio holds about 50% in bonds and its weighting to the U.S. may have lowered returns. It gives the FA an opportunity to demonstrate the investment decision value add that has been provided to their clients.

Chart 1

Hidden Gems: ETFs Worth a Second Look

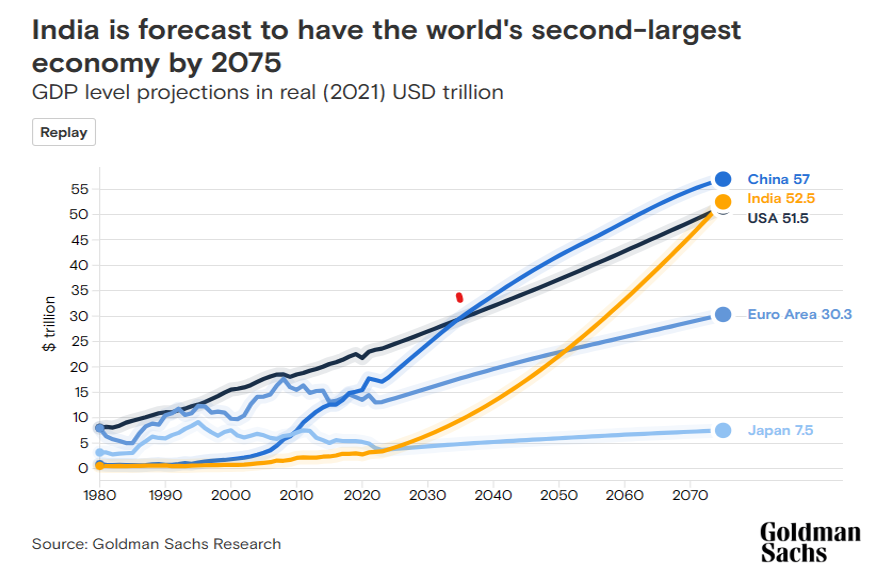

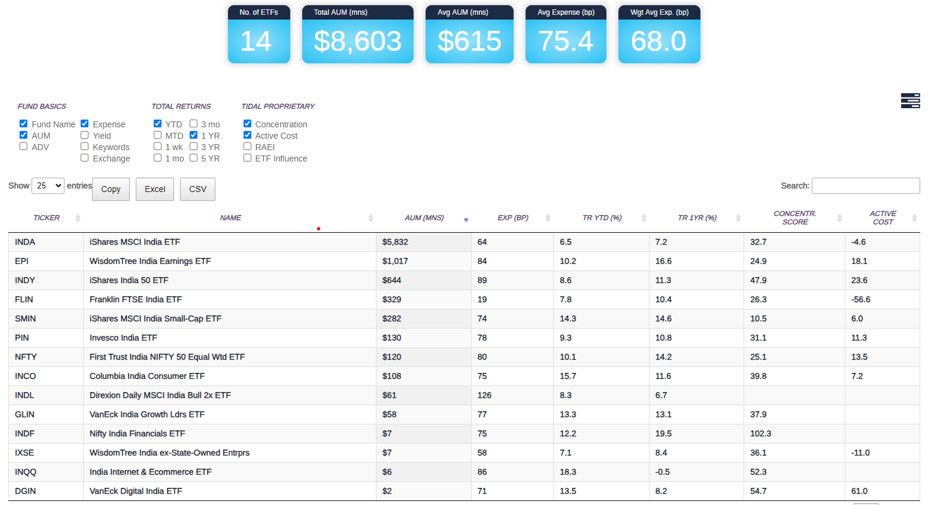

Risk based models will typically have a moderate exposure to the emerging markets, and AOM is no different at 4%. However, while in the past this may have been a good decision, the question becomes more about the future. Furthermore, let’s face it: emerging markets exposure is where a financial advisor can really stand out in the way of attribution of returns, as well as in the way of principles. Not every client feels the same way about China, yet most FAs will agree that India is going to be an important country to focus on for a host of reasons: population, demographics, innovation, GDP, and politics. Goldman Sachs is on record as saying India will become the world’s second-largest economy by 2075. (Remember – for many, retirement is still a 50-year plan! Don’t discount what will happen between now and the year 2075!)

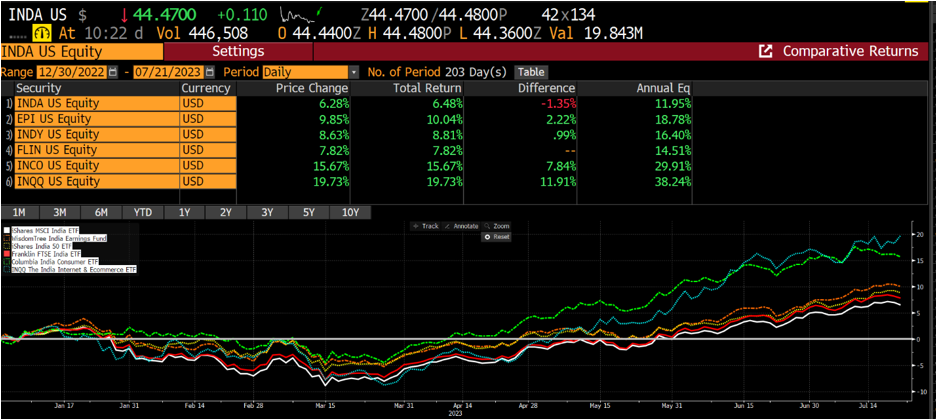

A word of warning: The dispersion among the returns of ETFs in India is very volatile. This can be seen in the short term in Chart 1, which highlights what has happened in 2023, but also over a longer period dating back to 2018 as well. Nevertheless, when things are strong, they are very strong, which takes us back to how a broad allocation to Emerging markets and the contribution to India can be diluted. For those looking at EM broad, the Vanguard FTSE EM Equity ETF (VWO) has a weighting in India at 17.5%, versus the Blackrock MSCI Core Equity ETF (IEMG) at 15.89 and Blackrock MSCI EM Equity ETF (EEM) at about 14.6%. Circling back to the Risk Moderate Conservative ETF, we would note that this allocation to India is mostly irrelevant due to its 4.35% allocation to IEMG.

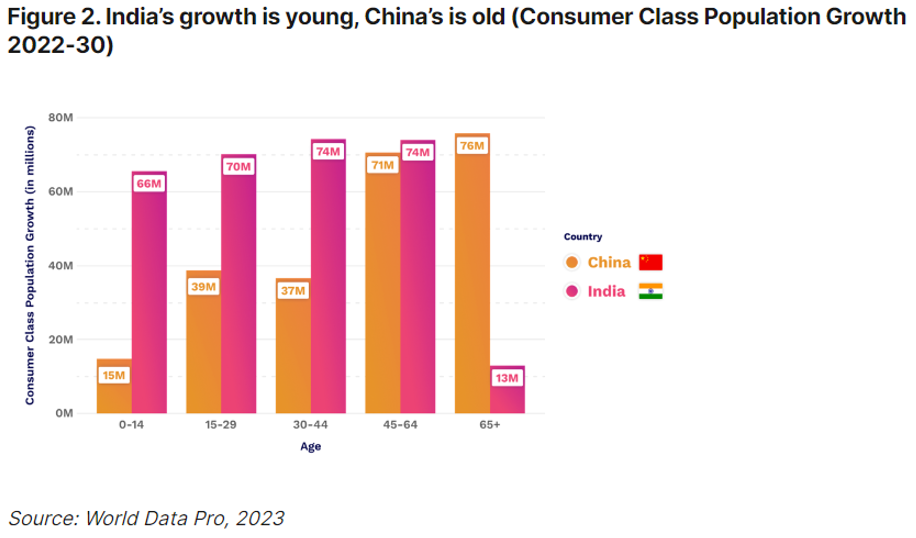

- Already, India has overtaken China in terms of population, with a staggering 1,425,775,850 lives (1.4 billion people). It also leads in terms of innovation in many ways.

- Here are two research pieces for those looking to do meaningful research around the investment opportunity: Goldman Sachs July 6, 2023 report and an April 14, 2023 Brookings Institution article.

Chart 2

Chart 3

Real Life Tank Battle Ground Stories

Inquiry:

A client calls up a financial advisor and says: “Reduce the number of positions in my portfolio from 13 to 5, and let’s focus on your “best Ideas.” The client’s point was, “why do we need so many positions?” The problem? Cherry picking the best ideas is always an FA’s nightmare!!

Answers:

- We reviewed the weightings and asset allocation of the underlying portfolio strategy in the context of the strategic ETF allocation. Using the Tank tools, we determined that the client was a moderately conservative investor.

- We then matched such a risk profile to an iShares risk-based model ETF, and then allocated 90% of the portfolio in 1 ETF.

- Then we identified the two thematic winning ETFs, which the client was already long through the FA, and were able to highlight how the FA had really added value. Now the portfolio was down to 3 holdings. Peeling back the onion further, the question became “do you want to add two more ETFs as additional satellites?” Of course, the core-satellite approach is not new news for most FAs, but this is an example of how a small client could gain more India exposure.

Summary

We hope you like this new format for the Structure Matters series. We believe providing more examples around the framework will help define the value add we provide in the ETF Think Tank. Bottom line, we made three points in this piece. First, tactical strategies have value, both as signals and investments. Ignoring them removes an obvious investment tool for financial advisors. Second, investors are underweighted emerging markets, and particularly a targeted allocation to India. We think historically this may have made sense but should be reviewed on a go-forward basis. Regardless, however, since structure matters, how it is done is a value add opportunity for financial advisors. Third, the new section “Real Life Tank Battle Ground Stories” will be a regular section in this report that highlights how our members don’t have to think alone. We are a solution provider to financial advisors. Bring your problems to us so we can be your fixer!

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).