Charlie Munger has famously said: “there is only three ways a smart person can go broke: liquor, ladies and leverage.”

Widely known for his witty humor, the Berkshire Hathaway legend has shared many investing gems over the years, and there’s no argument here that liquor and leverage, especially if combined, can lead to investor pain.

But it turns out the ladies – at least those sitting in corporate leadership roles of companies you invest in – can have a positive impact on returns.

It’s an intriguing notion. Data is still young in this space, but early attempts at measuring and quantifying what value women bring to a company’s bottom line have shown interesting findings, and we’ve seen ETFs come to market looking to provide access to this theme.

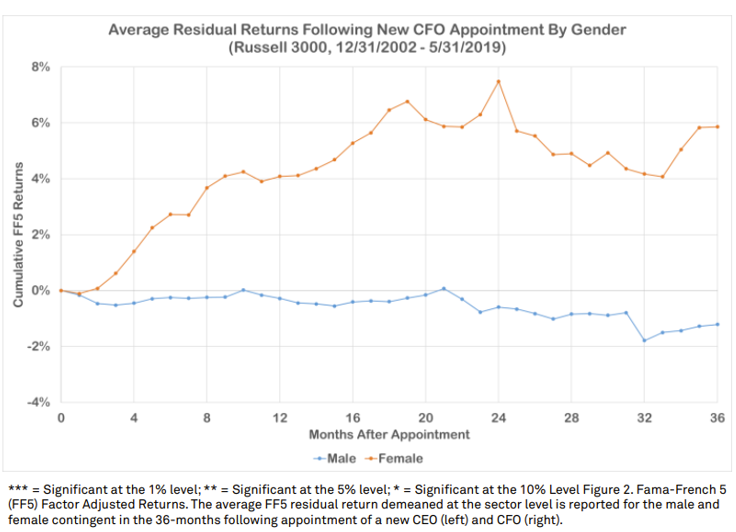

Consider the S&P Global Market Intelligence study “When Women Lead, Firms Win” – a pioneering look at the impact of women in leadership first published in October 2019. (The study, led by Daniel Sandberg and the firm’s Quantamental Research team, is about to release its fourth white paper this fall.)

The study found that within the Russell 3000 universe, companies that placed women in the board room or hired them in CEO/CFO positions have, on average, increased profitability by 6% within 24 months of those appointments. Stock prices of these companies improved 8%. It also found that companies with women CFOs generated $1.8 trillion in excess profits in that time frame.

This study looked at 86,000 executive positions across 7,300 firms for a period of more than 15 years. It covered as much ground as it could to account for concerns over causation vs. correlation and idiosyncrasies of the companies themselves that could explain returns.

“This was an inaugural study, and the first time you study anything that relates to people or behavior, you need a lot of observations to draw the right conclusions. The breadth of the study was unprecedented, and it allowed us to disambiguate what’s real from what’s noise. All the results we presented were statistically significant – they were not generated randomly,” Sandberg told us.

The methodology also put the data in context by considering company results relative to sectors and segments as well as relative to themselves pre-inclusion of women in leadership roles. The findings showed that firms with gender diversity at the top had better economic outcomes.

Lessons In Language

A separate look at the drivers of success as they relate to gender helped confirm that women in leadership roles tend to impact companies positively.

The study used a natural language processing algo to look at the language used in the biographies of company executives that were considered successful – success being measured by stock price performance. It found that traits we typically link with success (accomplishments and that sort of thing) aren’t tied to gender, but they are more often found among bios of women executives than men.

The conclusion: Women in leadership tend to have more success-driving traits because the bar of entry is higher for them at high corporate levels.

“Historically, companies have been more willing to take a chance on a man than on a woman at that level,” Sandberg said. “We found that talent is equally distributed across genders, but because there’s been a bias to hire a man over a woman [for higher corporate levels], the contingent of male executive talent is relatively overfished relative to female.”

ETF Access

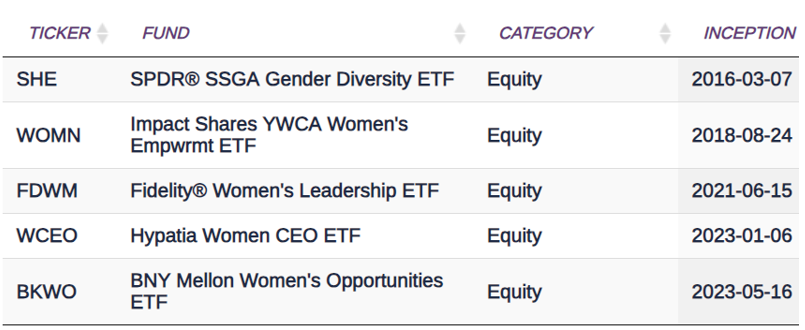

Accessing this theme, or pursuing the “women factor” is easy to do with ETFs. As is often the case, the ETF market has kept up with this theme, welcoming this year its 5th women-focused ETF.

The strategies in this space offer slightly different takes on the theme, but they are all anchored on the idea that companies that support and promote women – or are led by them – are better positioned relative to their peers and respective segments.

Funds at a glance:

- The veteran in the space, the SPDR SHE, is the biggest ($211 million in assets) and best known thanks in part to its popular marketing campaign centered on the “Fearless Girl” statue. The fund offers access to companies who lead in their commitment to diversity. Top holdings include names like Amazon, Apple, and Microsoft in a portfolio that’s market-cap weighted but also takes into account a gender diversity score. It has delivered benchmark-like performance since inception.

- ImpactShares’ WOMN offers Russell 1000-like equity exposure, focusing on growing companies that support gender diversity and women empowerment, and it delivers on “impact investing” by donating net advisory profits from the fund’s management fee to the YWCA. The fund is the second oldest – and second largest ETF – in the segment, having outperformed the Russell 1000 since inception.

- BKWO, the newest women focused fund launched this past May, followed in WOMN’s footsteps, offering a growth-tilted portfolio that’s focused on companies that support women advancement. It, too, donates part of management fees to various charitable groups working to support women and girls.

- The Hypatia fund WCEO offers a narrower take on the theme by investing only in companies that have women CEOs, seeking to capture outperformance relative to a small cap benchmark overtime.

- And finally, the Fidelity FDWM is a non-transparent ETF focused on this theme in a portfolio that has its performance benchmarked to the Russell 3000 for comparison – an index it’s been outperforming in the past year.

The Future of the “Women Factor”

As we evaluate this investment theme and/or factor, we’d be remiss if we didn’t question its future. If women in leadership give companies an edge (on average) because they are a diversifier, what happens to this theme/factor if women are no longer a minority in the C-suite? Could gender parity at the C-suite and board room kill this opportunity?

So far, the data seems to suggest as much, even though it’s “hard to know it definitively,” Sandberg says. We do know that this edge or advantage is owed to the existing gender bias in companies. But only time will tell.

For now, gender parity is not imminent, but the march towards it has picked up significant pace in recent years.

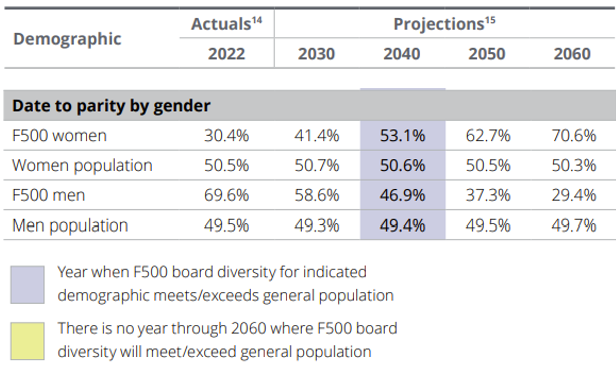

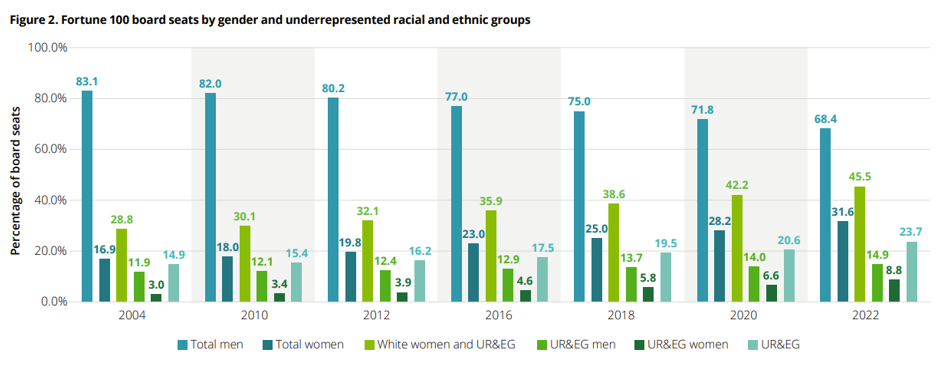

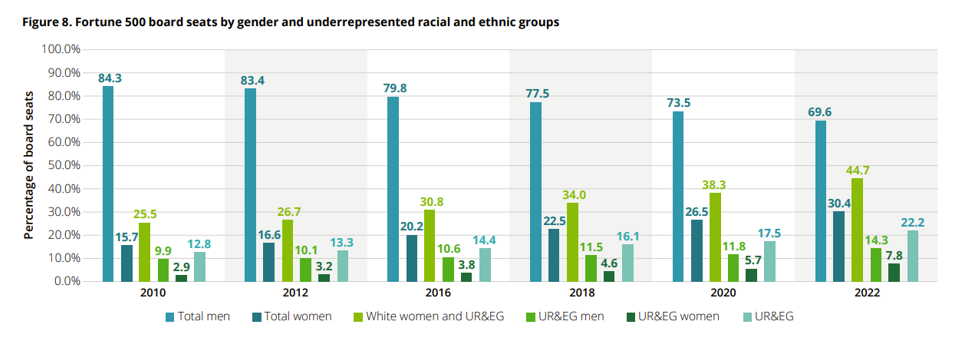

A Deloitte report titled “Missing Pieces” conducted with the Alliance for Board Diversity since 2004 has assessed the level of corporate board diversity within Fortune 100 and Fortune 500 companies, looking to understand the impact diversity has on effectiveness and results. Its latest edition, the 7th, shows that board diversity is expanding, having become a “tool” for companies to show they are doing the right thing.

According to the report:

- Fortune 100 corporate board representation overview, as of 2022: Women have nearly doubled their representation across board seats since 2004 (now representing about 31% of boards)

- Fortune 500 corporate board representation overview, as of 2022: Women have seen their share of board seats double since 2010 (now representing about 30% of boards)

The report forecasts that gender representation projections relative to social footprint will not line up until 2040 – that’s almost 20 years out.

Don’t Think Alone!

Women in leadership is an interesting investment theme and/or factor that we’ll keep tracking as more data and insights become available. As always, if we can help you explore a new investment idea or theme, or help with your ETF due diligence, don’t hesitate to reach out.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).