With multiple trillions of wealth at stake, it should be no surprise that family offices are leaning more towards fixed income and “alternatives” than the typical S&P 500 allocation. After all, the mandate for most family offices is focused first on preservation of capital and then second on the benefits of compounding above inflation on such capital. Currently this means that inflation may be a headwind and a recession could be a problem, but since most family office clients can afford a contraction in the economy or headwinds from inflation, the big risk – according to the global clients at UBS – is the long-term geopolitical risk. Rationally speaking, this makes sense. While most everyone on the planet jabbers about 2-4 more increases in interest rates (equal to 50-100 Bps) by the U.S. Central Bank, the (super) ultra-wealthy are wise to simply “lock in” the increase in cash flow of 5% on their fixed income portfolio. They can then be positioned for a major drawdown in asset prices. Moreover, the plain truth of the matter is that few family office fiduciaries get blamed for playing it conservatively. No pain is their gain! This means that low priced beta, as is an investment in the S&P 500m, is not going to be enough of a draw to attract more money in 2023!

Family Office Fiduciary Secret

Talk one-on-one with a variety of family office executives and their “bankers,” and you will get multiple different outcomes, especially since it all depends upon what stage and geography their clients are in, and how their portfolio was positioned in 2022. Nevertheless, these surveys are interesting snap shots of the advice that is shared by different firms.

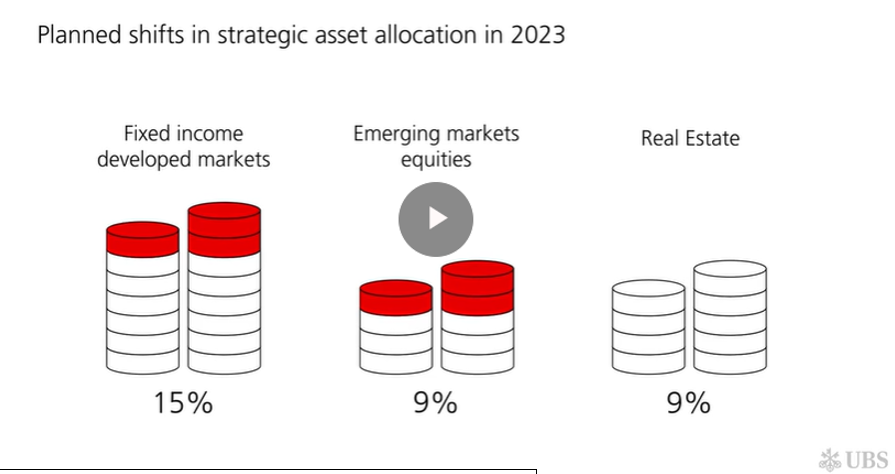

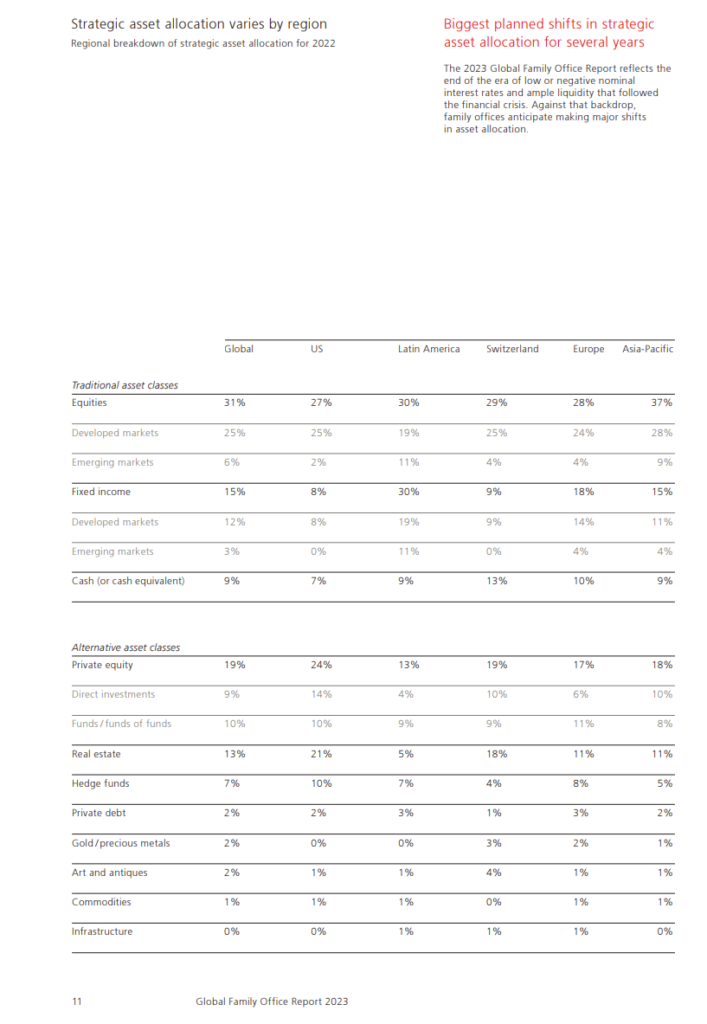

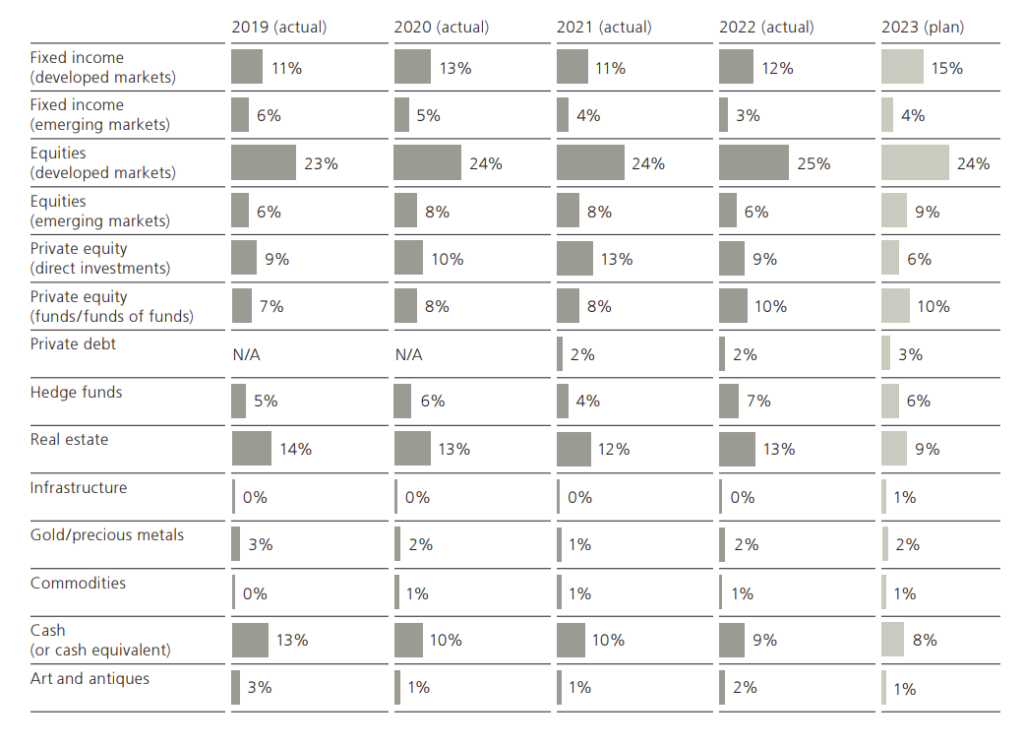

- According to the UBS Global Family Office Report, released May 31, 2023, the families of 230 single family offices worth about $500 billion in aggregate (avg $2.2 billion) intend to increase their fixed income exposure to 15% and lock in returns while reshuffling their private equity exposure. Specifically, the survey shows that this group plans to increase the broad category called “alternatives” to 45% from 43% through “refocusing private markets exposure by increasing holdings in private equity funds and reducing direct private equity and looking to increase allocation in private debt and infrastructure.” [i] Of course, beyond directly using cash to increase fixed income and trimming some equities, the question is whether these changes are more about this group anticipating an adjustment to prices on a market-to-market basis in some of these categories.

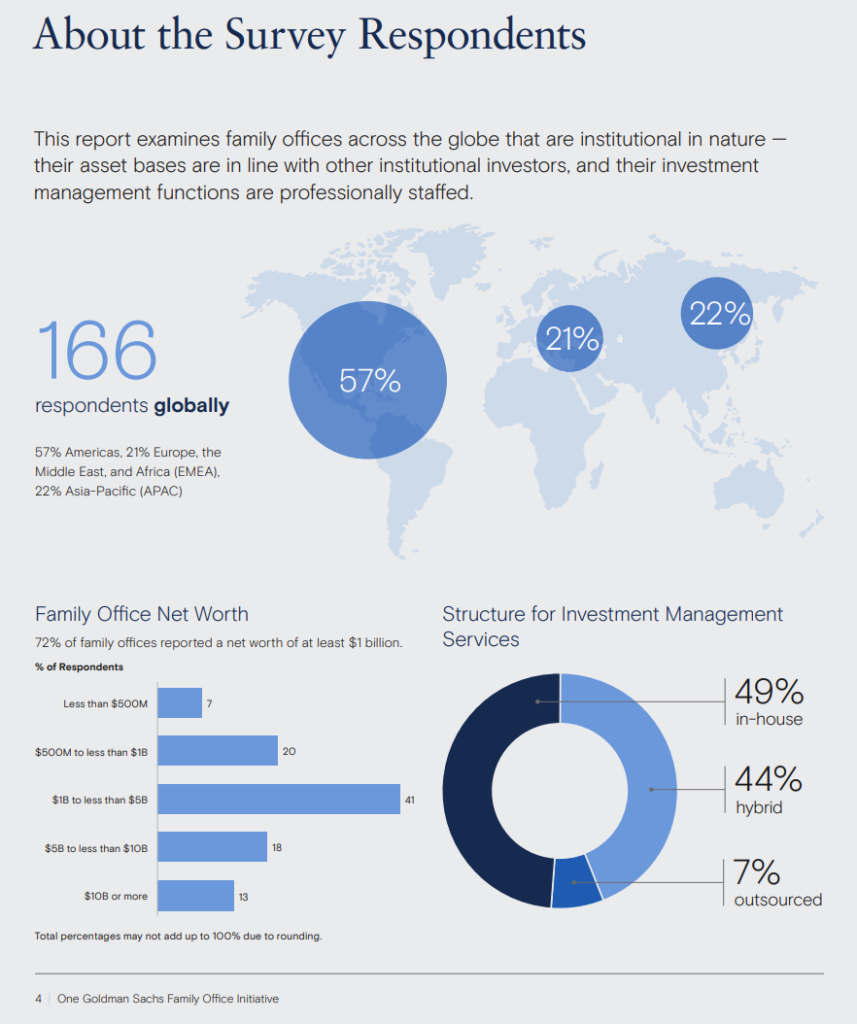

- The Goldman Sachs Eyes on the Horizon was released on May 18 and surveyed 166 family offices. Of the 166, 93% had a net worth of about $500 million, and 72% had at least $1 billion. According to the report, the family offices plan to increase their private markets exposure by 41%.[ii] This includes venture capital, so the definitions with UBS may not exactly match up, but we are glad that these families and their respective fiduciaries have a chance to see a real two-side market for secondary private equity investments. (We bet they are too! Let’s face it, most secondary private equity deals are probably viewed as distressed opportunities. Secret? How about you review my mistakes and I’ll review yours? Let’s make each other a bid!)

Common Trends Across the Two Surveys

- The appetite for risk in 2023 has moderated from 2021 and become more targeted.

- US equities are a source of funding, while on a selective basis, family offices are looking closely at increasing their exposure to the emerging markets, particularly on a selective basis to China and India. (Thinking long-term and on a selective basis given the potential upside of these countries on a long-term basis. Decisions by family offices in this area are probably also targeted by their own geographic location and home bias. A family office in the U.S. will view an allocation differently than one in APAC.)

- Both firms highlighted digital assets as a resonating asset class. This confirms the importance of the asset class despite its early stage of development in the context of wealth planning, and the ultra-wealthy’s vision of the future. Let’s face it – when you are talking trillions of wealth management dollars, a 1% allocation matters for a nascent asset class. How this evolves in the U.S. will depend upon the regulators, but as these survey members represent a global group, digital assets may have different visions of the value proposition.

- UBS = 56% of family offices have a marginal allocation to digital assets, and yet 75% of the family offices see digital assets as the investment theme that resonates the most with their family office. When it comes to investments based upon blockchain technology, family offices are growing their investments in a small way. Looking forward to the rest of 2023, 35% of the family offices that already invest in distributed ledger technologies plan to increase investments, with 27% looking to do so in cryptocurrencies more specifically and 25% in decentralized finance.”[iii]

- GS = “32% of family offices currently invest in digital assets, including cryptocurrencies, blockchain technology, stablecoins, non-fungible tokens (NFTS), decentralized finance (DEFI) and blockchain-focused funds.” [iv]

Surprise:

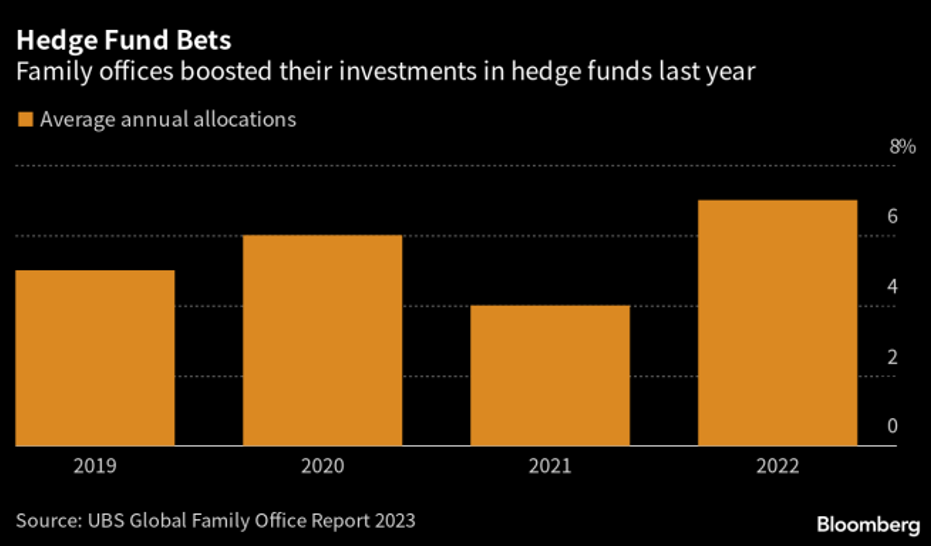

- According to the UBS survey, over 66% of family offices still believe that illiquidity boosts returns in the long-term, and they’re looking to further increase allocations to alternatives like hedge funds, private equity funds, and private debt to further diversify their private markets allocations. (We will be monitoring how this view is measured in 2024 after illiquidity shows a consequence.)

- Confidence in a select group of hedge funds remains surprisingly strong given their high fees, opaque nature, low returns, gates, and tax inefficiencies. Arguably, this is because of the promise of non-correlated returns, but what if those returns were provided with transparency, tax efficiency and reasonable fees? (This surprise will be one that we expect to write frequently about in 2024-2025!!)

- Family offices do not rebalance on a systematic basis. In fact, 89% of the family offices at UBS rebalance on a discretionary basis. (Perhaps this is because so much of the portfolio cannot be rebalanced because it is illiquid.)

Summary

We often write about the power of diversification in the ETF Think Tank. Non-traditional assets are an important wave in the ETF industry, and family offices over the upcoming years will begin to see the light given the ETF benefits of long-term diversification, tax efficiency, transparency, and LIQUIDITY. We also believe that ETFs can be tailored to match specific family office needs and goals at a very reasonable price. We may sound self-serving with this view given our ability to launch ETF, but regardless, it would seem inevitable that as fiduciaries this outcome is simply logical given the alignment of needs and the family office tilt away from traditional investments.

Mystery Poll

As we are highlighting two surveys and the statistics behind them, we thought we would have fun with this question. Who knows the source of this quote: “3 Kinds of lies: Lies, Damn lies, and statistics?” Please no ChatGPT!

- Samuel Clemens

- Mark Twain

- Prime Minister Benjamin Disraeli

- Sir Charles Dilke

[ii] Page 8, One Goldman Sachs Family Office Initiatives https://www.gsam.com/content/dam/pwm/direct-links/us/en/PDF/onegs_familyoffice_eyesonthehorizon.pdf?sa=n&rd=n

[iii] Page 24 ubs-gfo-report-2023.pdf

[iv] Page 13 https://www.gsam.com/content/dam/pwm/direct-links/us/en/PDF/onegs_familyoffice_eyesonthehorizon.pdf?sa=n&rd=n

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).