Every week we take stock of the ETF industry in our weekly ETF KPIs, and we’ve observed that the ratio between the number of ETF launches to ETF closures has dropped to roughly 2, indicating that for every 2 ETFs launched, 1 closes down.

Just a year ago, we were looking at a ratio that was flirting with 6. In recent weeks, the pace of closures has accelerated, while the rate of new ETF launches has slowed by almost 20% compared to a year ago.

ETF closures are almost always tied to lack of assets or the consolidation of a product lineup, but a slowdown in launches can stem from many factors, from market conditions, to concerns about asset growth, to an understanding of the benefits of launching an ETF.

Behind Market Conditions

In a very non-scientific, small-sample-size effort, we ran a quick poll on Twitter to find out if a challenging market was the main cause inhibiting ETF product launches. The answer was hardly a consensus. About half of folks considering launching an ETF would wait for a strong bull market, and about half said markets don’t matter.

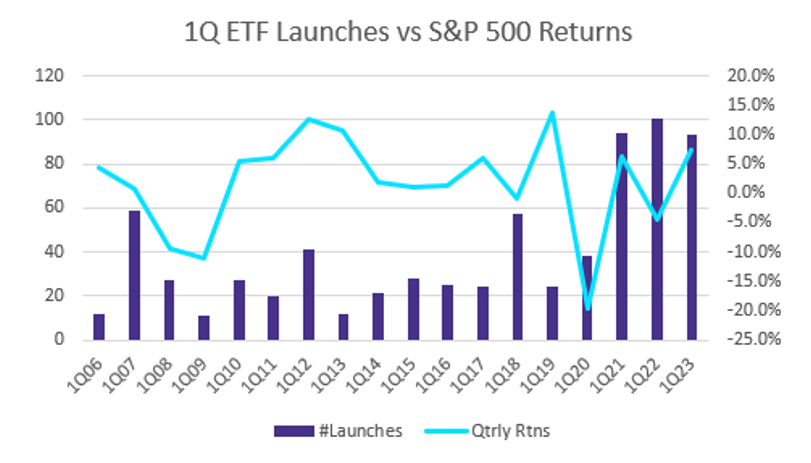

If you look at the number of ETFs launched in the first quarter of every calendar year since 2006 relative to the performance of the S&P 500 during that time, the correlation between launches and market performance isn’t consistent. It’s not always the case that bull markets lead to more launches vs. poorly performing markets, or vice versa.

Path To Asset Growth

If market conditions don’t fully explain the slowdown in launches, they still help inform the conversation about asset growth concerns – the other potential factor behind fewer launches.

The recent market performance has highlighted the fact that launching an ETF does not guarantee asset growth and there is no one-size-fits-all asset growth strategy that leads to success. No silver bullets. Even well-established product providers struggle with the asset gathering part of the business.

Consider Global X, for example, a firm that’s widely known as a powerhouse in thematic investing – a pioneer of the genre, if you will. In 2021, in a pandemic-fed thematic craze, the firm more than doubled its ETF asset footprint year-on-year, just to see fortunes reverse in 2022 when thematic investing gave way to a focus on fundamentals. That year, Global X’s, which is a top-12 issuer, saw assets drop some 17%.

In that same time frame – or same market environment – American Century, a firm known for its actively managed expertise, saw its assets more than double between 2021 and 2022 as the appeal of an active manager’s ability to navigate difficult waters grew. The firm crossed its first $1 billion in ETF assets in 2019, and today has nearly $23 billion.

Market conditions may or may not be a determining factor in providers’ decision to launch an ETF, but they can certainly impact their confidence in their ability to raise assets. We’ve all seen how a ripe market can turn a small or new-to-market ETF into an “overnight” blockbuster just as we’ve seen the erosive power of a market headwind. That inability to outline a definitive path to assets, in itself, may give some new issuers pause.

No one can take asset growth for granted. No one except perhaps for firms that choose to enter the ETF space via conversions of existing strategies or bespoke assets. Capital Group is a great example of what that looks like. They just entered the ETF market in 2022 through conversions and are already an $8 billion ETF provider. DFA, which came into ETFs in 2020, already boasts $87 billion in ETF assets.

The point is that assets – as in funding, as in initial seed – are a necessary condition for an ETF to be successful. And that’s partly because it takes money to run an ETF, but also because assets can help beget more assets.

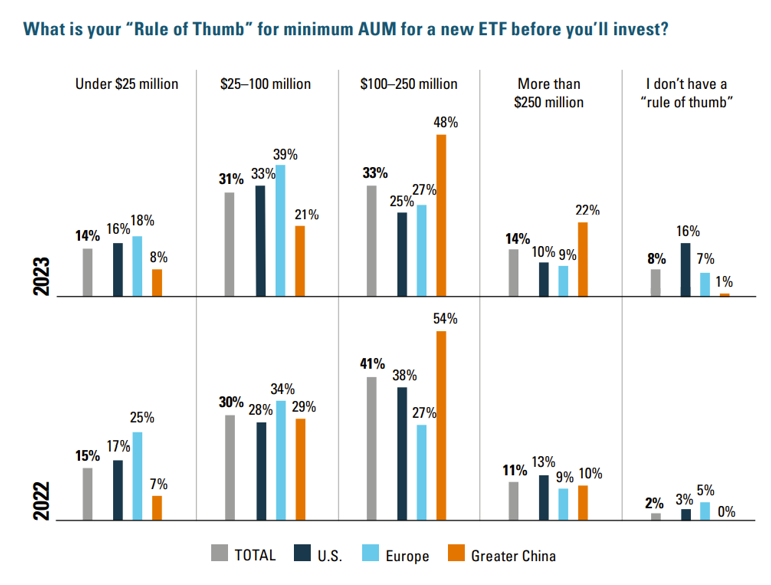

Brown Brothers Harriman’s latest Global ETF Investor Survey showed that almost 60% of U.S. investors look for ETFs that have anywhere from $25 million to $250 million in assets before they invest. Only 16% of them would consider an ETF with less than $25 million because many don’t want to be first in an ETF, or to have their book represent too big a slice in the overall strategy. Crossing through these asset milestones can unleash new waves of asset growth as other investors jump in.

So, Why Now?

Here’s what we know: No one can control market conditions. No one can predict the perfect time to launch an ETF. Market timing is a folly. We also know that there’s no easy path to asset growth outside of bespoke assets that seed a new ETF from day one.

So, deciding whether to launch an ETF or waiting for a “better” time centers on a simple question: Why are you launching it in the first place?

In some of our previous work on why launch an ETF and how to convert an existing strategy into an ETF, we’ve talked about the many benefits of the ETF structure for both product providers and investors, from operational efficiencies to access to tax efficiency and branding (you can read it detail here: Why launch an ETF and Why RIAs should invest in the ETF structure.)

To put it simply, let’s consider some key trends supporting ETFs.

- Market participants are bullish on the long-term outlook for ETFs.

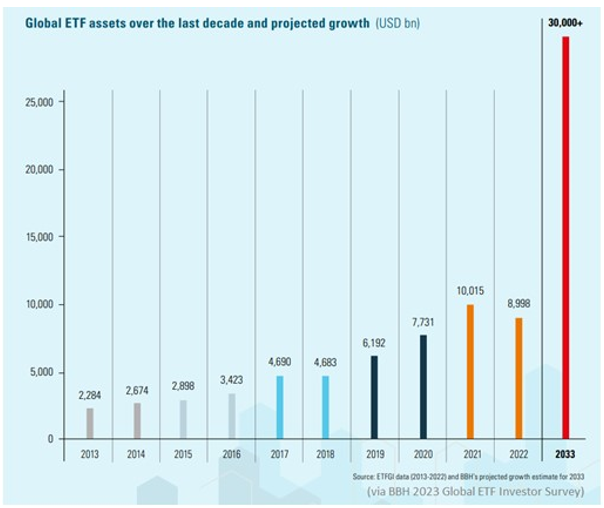

This is an industry in high growth mode, and pretty much everyone agrees on that. BBH, for instance, has projected that global ETF assets will reach $30 trillion within the next decade, which would represent a more than tripling of the current market size.

- Regulation has made it easier to enter the ETF market.

Recent regulatory changes have lowered the bar of entry into the ETF market, streamlining processes, reducing time and cost to launch, and opening the door for the implementation of complexity in ETFs (think the use of derivatives.) Launching an ETF today is easier, faster, and cheaper than it ever was.

- Demand for ETFs is strong.

ETF adoption has grown steadily in the industry’s 30-year history, and that adoption only seems to grow as markets get more challenging. Time and time again we’ve seen investors put their money to work in ETFs, seeking to navigate markets with low cost, tax efficient, tradable, and transparent wrappers. In 2022, for example, as markets struggled – broad equity and bond benchmarks dropped double digits – some $600 billion of net new money went into in U.S.-listed ETFs, and more than $800 billion globally in one of the strongest years of inflows yet.

Meanwhile, outflows from mutual funds hit new record highs last year. As an anecdote, in their global annual report where institutional investors, advisors and fund managers were surveyed on their use and views on ETFs, BBH found that among active ETF adopters “46% of investors allocated from index mutual funds (2022 = 19%) and 42% allocated from active mutual funds (2022 = 19%).” In other words, ETFs are taking market share from mutual funds, and that trend accelerates when markets get tough because investors look for the opportunity to reallocate into a better vehicle.

The previous year, 2021, saw the ETF industry break all previous asset gathering records, nearing $1 trillion in inflows in the U.S. alone.

Should this demand continue? According to BBH’s survey, about 90% of investors plan to keep up or increase their use of ETFs this year, with that commitment to the wrapper coming from ETFs typically offering access at lower costs relative to other investment products and being very tax efficient relative to everything else.

As concluded in its survey by BBH: “Our findings this year suggest investors are focused on accessing new types of ETFs and investment strategies in an ETF wrapper and expanding their ETF product toolkit to drive outcomes for their clients.”

Room For Everyone

If you are a new provider – or considering entering the ETF market – here’s the not-so-good news: Market conditions can have an impact on investor confidence, which can dampen your confidence in your ability to grow assets in your ETF. Growth may come, but it may come slowly, or at least more slowly than you’d like. It is important to manage expectations because ETFs are an increasingly competitive landscape.

That said, the good news is that launching and growing an ETF is doable. Folks are doing it successfully every day.

Consider some industry statistics. The top 3 ETF issuers – iShares, Vanguard, and State Street Global Advisors – have long dominated the market, controlling most of the ETF assets. Today, they command about 76% of all U.S.-listed ETF assets, a number that’s high, but it used to be higher – above 90% in the past decade.

The top 5 issuers combined control about 85% of all ETF assets today, which leaves new and smaller players battling for a piece of a 15% market share. That slice looks small, but it has been expanding in recent years.

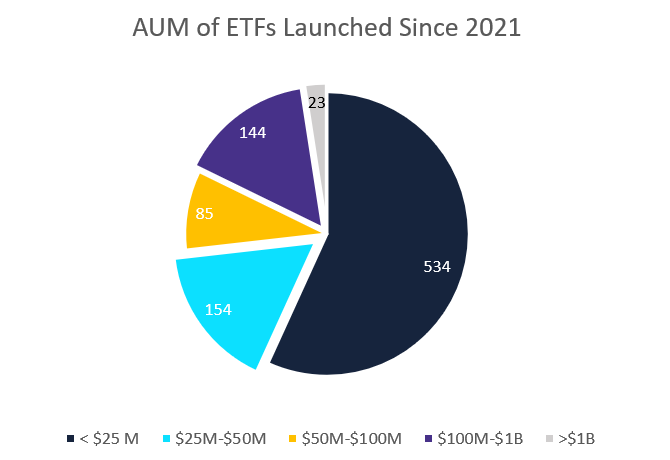

There’s no dancing around the fact that finding traction can be difficult. Among the new ETFs launched between January 2021 to date – about 940 in total – more than half have yet to hit $25 million in assets. The first couple of years can be challenging for many issuers.

On the flip side, roughly 2.5% of them are already in the billion-dollar-club, showing that success can come quickly.

While the pace of ETF launches may have slowed down recently, the demand trends remain strong, and the benefits of ETFs remain true for both providers and investors adopting the funds. None of that has changed as markets have moved.

We continue to see providers of all sizes putting their expertise to work in ETF wrappers, helping investors solve problems all the while streamlining their businesses for efficiency and growth. As ETF Nerds, it’s exciting to see this industry continue to expand in innovation and in reach.

If you are asking yourself why now, it’s because there is no going back. ETFs are here to stay.