With the first quarter of 2023 now in the rearview mirror, it’s interesting to see that amid all the jitters that marked market action – a banking crisis, stubborn inflation, rates and recession fears – the tally of “winners” for the quarter features a risk-on favorite: technology stocks.

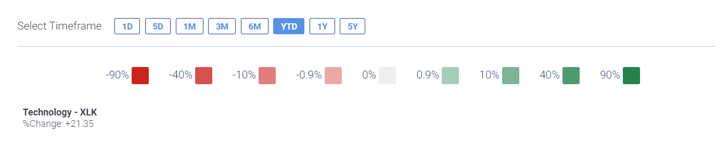

Among S&P 500 sectors, technology (as measured by XLK) led the pack, outpacing the broader index with roughly 3x the gains in the first quarter, and beating the Nasdaq-linked QQQ as well. Not only did tech as a sector do well, the majority of stocks within tech did well.

Tech Sector in Pictures

Here’s how tech stacked up relative to other sectors and the broader index, according to the SPDR Sector Tracker (YTD as of March 31):

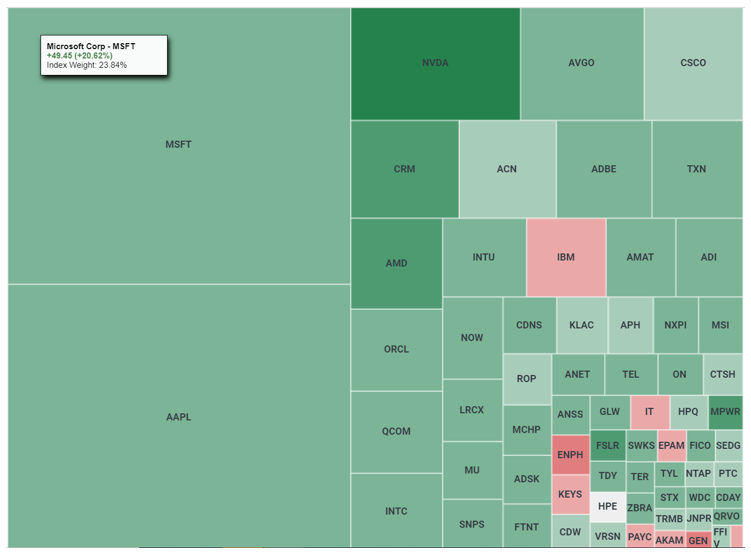

A more granular look shows that the first quarter was generous with its distribution of gains across the sector. There was an abundance of green – most tech stocks saw positive performance, with almost all delivering 10%+ in returns.

The largest 10 positions in S&P 500 technology included some jaw dropping results: Nvidia was up 90% so far this year (as of March 31), AMD +51%, Salesforce +50%, Apple + 26%.

Why such relative strength?

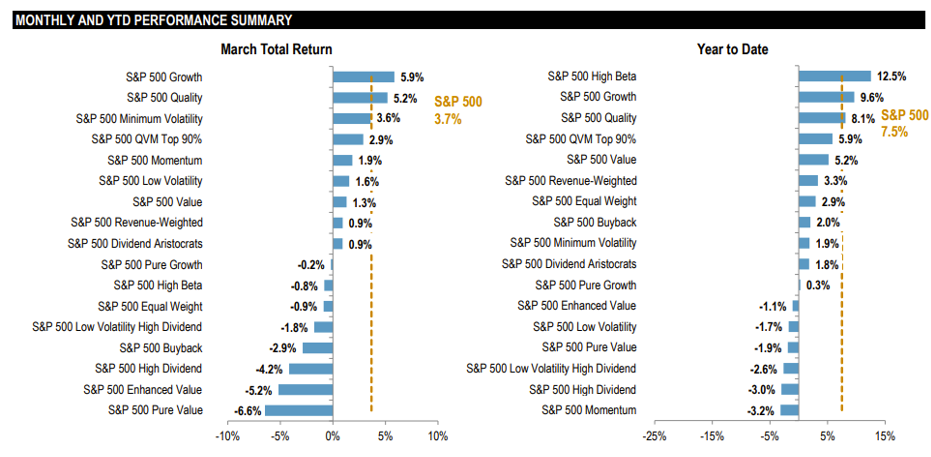

According to S&P Dow Jones, tech’s upward move was linked to a “flight to quality” seen across the market. “High Beta and Growth led among factors, while defensive strategies lagged,” S&P Dow said in its latest sector dashboard.

That flight to quality was anchored on rising valuations supported by rate pressure tied to expectations of a “more dovish Fed” ahead, according to J.P. Morgan’s market view.

“The bottomline is that performance in U.S. equity markets so far this year has been all about rates, a theme that should persist as earnings expectations gradually align with reality,” the firm said. “We seem to have temporarily returned to a world where large cap growth is the belle of the ball; the first quarter saw growth handily outperform value, and large caps meaningfully outperform small caps.”

So Now What?

As we enter the second quarter, the question is, can this relative strength persist or has it run its course?

Forecasting is folly. No one really knows what happens next. However, one of the prevailing “calls to action” across market commentaries as it relates to risk assets – tech and growth stocks included – is to proceed with caution. More specifically, beware that the market may be underappreciating real risks ahead.

“We do like information technology on a fundamental basis,” Gary Stringer, founder of Stringer Asset Management said. “These companies have resilient business models, and tech tends to do well during slow economic growth environments due to their persistent earnings growth and attractive profit margins.

“Valuations have gotten rich, however, especially if a recession looms,” Stringer added. As he sees it, the biggest risk ahead is not of an aggressive Fed, but one where the market “underappreciates the impact of the rate hikes already in place.”

“Changes in monetary policy can take a year or more to impact the real economy, and at these price levels, we do not think that the market fully appreciates the impact that the policy moves the Fed has already made will have on economic growth and corporate earnings over the coming quarters,” Stringer said.

BlackRock’s latest market outlook reinforces this notion. The firm is talking of underweighting U.S. (and developed market) equities, and favoring sectors such as energy and healthcare, because markets aren’t fully pricing in recession risk.

“Financial cracks are emerging from Fed rate hikes,” the firm said about its U.S. equity view. “We don’t think earnings expectations reflect the recession we see ahead.”

If the market is mispricing risk as earnings expectations deteriorate further, it could get tough for cyclical stocks and sectors. That said, this environment is also the one where calls for a focus on quality and “profitable growth names” with an eye on valuations (to quote J.P. Morgan’s outlook) find traction, and that, in some ways, sounds a lot like how we got here at the end of this quarter.

It turns out that it could work out well for tech and quality growth stocks ahead. It could also go south quickly if the market’s apparent underappreciation for risks proves true. Caution may be the only sensible thing to say at a point like this, but how do you implement it? All you can really do is make portfolio decisions – take on risk, diversify – that you can stomach in an asset allocation strategy that you can stick with during these uncertain times.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).